2014 is over in ~75 days. Most companies should have a good idea about what their 2014 numbers look like. On Friday, we may have seen the last strong push from industrials, with General Electric (GE), Honeywell (HON) and Textron (TXT) saying 2014 numbers still look pretty good. But remember: it’s all about 2015 this time of year as analysts will be rolling forward their earnings-based price targets soon. We expect management teams to be cautious heading into 2015 (and when issuing guidance for the year), mostly due to the myriad factors that drove the recent equity market correction. In any case, the industrial conglomerates are executing nicely in the current uncertain environment, and order strength (which is a precursor to revenue and earnings recognition) is undeniable.

General Electric perhaps has had the best third quarter out of the three. All key metrics are moving in the right direction at the industrial powerhouse. Industrial segment organic revenue jumped 4%, driving industrial segment profit 9% higher. Third-quarter operating earnings per share leapt 6%, to $0.38 per share, slightly higher than expectations, thanks in part to better than anticipated margins (+90 basis points on a year-over-year basis). The industrial giant continues to make good progress with its simplification goals and is on track to remove $1 billion in structural costs from operations this year. Management mentioned on the call that 2014 was hindered by restructuring investments, and that a decline in corporate expenses will be a “real tailwind in 2015.” GE expects industrial organic revenue growth for 2014 to be at the higher end of the 4%-7% guided range thanks in part to the strong third-quarter performance.

During the quarter, GE spun off its North American Retail Finance Business, Synchrony Financial (SYF), and sold its Appliances business to Electrolux (ELUXY). The firm’s acquisition of Alstom’s Power and Grid businesses continues to proceed through the approval process and is targeted to close in 2015. The deal will add $0.06-$0.09 per share in earnings in 2016, but the impact in 2017 and beyond should be much greater. General Electric expects to completely exit Synchrony Financial through a split-off event in late 2015. By 2016, roughly 75% of GE’s earnings will come from its industrial operations, a much safer operating environment than financials (the firm’s dividend was dented as a result of the Financial Crisis a number of years ago). There’s little that can threaten GE or its dividend anymore, especially with the new business mix: the firm’s industrial free cash flow is top notch, and it holds $90 billion of consolidated cash and cash equivalents.

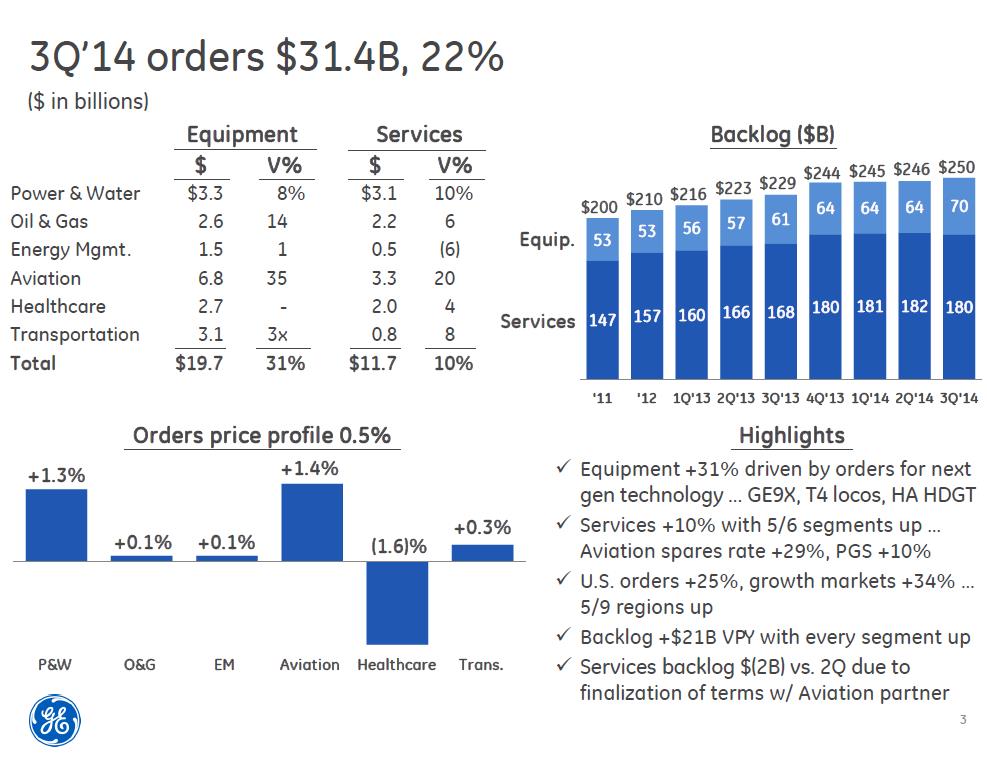

Though there was a lot to like in GE’s third quarter, its order strength was the standout: 3Q orders +22%, growth market orders +34%, U.S. orders +25%. Importantly, GE’s backlog of unfilled orders jumped to $250 billion. GE is a bellwether for the industrial economy, and the trajectory of its backlog is watched closely by analysts across the industrial sector. This multi-year upswing has been strong for GE, but we’ll be waiting anxiously for its investor meeting December 16. The remainder of 2014 may be solid for GE, but we’re not sure to ring the “all-clear” bell for the global economy into 2015. GE’s shares remain a key position in both the Best Ideas portfolio and Dividend Growth portfolio (this is saying a lot).

Image Source: General Electric

Honeywell’s and Textron’s third-quarter performances were also solid.

Honeywell beat on both the top and bottom lines in its third quarter and lifted its full-year outlook. During the period, sales jumped 5%, operating margins improved 100 basis points, and earnings per share leapt 19%. Cash flow from operations strengthened 15%, while free cash flow increased 12%. Honeywell raised the low-end of its proforma revenue and earnings-per-share guidance to the ranges of $40.3-$40.4 billion (was $40.2-$40.4 billion) and $5.50-$5.55 per share (was $5.45-$5.55). The firm, however, echoed some of our concerns about the economic environment for 2015: “Looking ahead to 2015, we’re once again planning for a slow growth macro environment, but expect to continue delivering strong earnings growth.” We’ll be waiting for how the market reacts to 2015 guidance from industrial entities, as most analysts are baking in robust expansion for the year, perhaps setting the table for a disappointment.

Textron, the maker of Bell helicopters, also put up a better-than-expected third quarter. Thanks in part to its acquisition of Beechcraft, total revenues leapt 18.1%, while income from operations jumped 60%+. Sales at Textron Aviation, Industrial and Bell advanced during the period, and operationally, the company achieved significant margin expansion at Textron Aviation and Bell. Looking ahead, “Textron increased its 2014 earnings per share from continuing operations guidance to a range of $2.05 to $2.15 and increased its expectation for cash flow from continuing operations of the manufacturing group before pension contributions to a range of $700 million to $800 million.” 2014 has been a solid year for Textron.

Though General Electric, Honeywell, and Textron will finish 2014 on a strong note, we’re anxiously awaiting the impact that cautious 2015 guidance may have on their equity prices. In any case, GE’s backlog and margin-improvement potential coupled with its focus on growing its cash-rich industrial operations (and shrinking its riskier financial operations) make it a top idea within our coverage universe. GE yields 3.6% at present. We value shares north of $30 each, with the completion of Alstom and earnings leverage key catalysts over the next 12-18 months.