We hit a low on October 15 on the S&P 500 (SPY) of 181.92, which is ~9.9% off the highs that were set on September 19. A correction is defined as a 10% drop from the highs.

Because we never actually breached the 10% mark, we waited until today to ascertain whether the market had fully digested the correction, and given the bounce, we believe it has. We’re now paying close attention to next week, with this correction having come and gone. That being said, we’re still very cautious on the markets and do not believe that we’ve established the lows that will be set over the next 12-18 months. Please keep your guard up.

The newsletter portfolios, however, are now very cash heavy, and in the Best Ideas portfolio, we’ll be looking to add to the existing positions in Alibaba (BABA) and Gilead Sciences (GILD) in the next couple weeks, and perhaps as early as next week. In the Dividend Growth portfolio, we’ll be looking to initiate a position in Kinder Morgan (KMI) to replace Kinder Morgan Energy Partners (KMP), which was removed from the portfolio a few months ago and will cease trading following the completion of Kinder Morgan’s re-consolidation. Our newsletter portfolios are managed to achieve the portfolio goals, so adding to positions in a bear market may make sense at times. The portfolios, after the additions are completed, will still be relatively cash-heavy. This market correction appears to be over, but we’ll be looking to see next week whether a defined downtrend (and perhaps the beginning of a bear market) has been established.

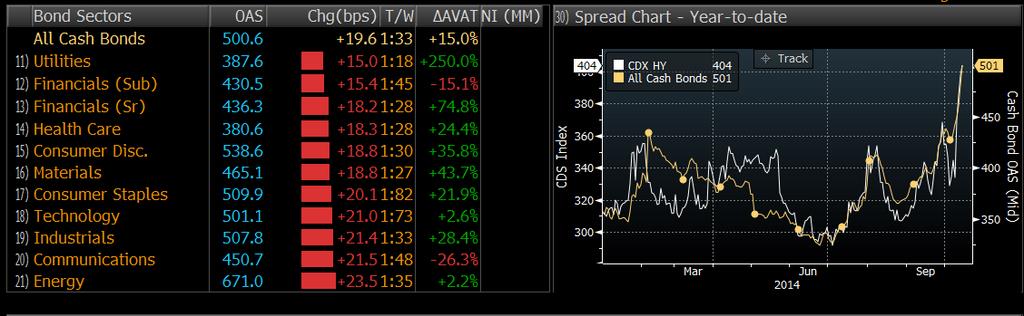

We’re still quite nervous, if only for one new reason: junk spreads have widened considerably – meaning the price of issuing new debt for BB+ credit-rated entities and lower has become considerably more expensive. What this means is that the ability for smaller-cap or more leveraged entities to borrow for future investment has become more difficult and incremental projects may now have a higher hurdle rate (and some may be shelved). In light of a) the poor economic situation in Europe, b) concerns across many sectors of the US economy (chips and telecom), c) declining crude oil prices (and the impact on Big Oil’s profits), d) the fear that Ebola is causing across much of the airline, lodging and leisure industries, a credit squeeze among smaller caps is not something that should be taken lightly.

According to Seeking Alpha, here is a snapshot of the move in junk spreads, as of earlier this week:

Image Source: Seeking Alpha

Credit analysts have always been viewed as smarter than equity analysts, and this development should not be taken lightly, even as many investment shops from UBS to Blackrock have started to buy the dip in junk bonds. We’re monitoring the situation closely.

Related ETFs: HYG, JNK