Yesterday, a core holding in the Dividend Growth portfolio, Johnson & Johnson (JNJ), reported fantastic third-quarter results. Sales of $18.5 billion advanced more than 5% compared to the third quarter of 2013. Domestic sales leapt 11.6%, while international sales were roughly flat, off less than 1%. The results were muddied by the divestiture of its Ortho-Clinical Diagnostics business. Worldwide, domestic and international operational sales growth, adjusted for the divestiture, came in at 8.4%, 14.8% and 3.1%, respectively. Net earnings, excluding special items, were $4.3 billion and $1.50 per share in the quarter, up 9.5% and 10.3% on a year-over-year basis, respectively. These are fantastic growth rates for a company of Johnson & Johnson’s size.

The biggest driver behind the company’s strong performance continues to be its pharmaceutical business. J&J’s worldwide pharmaceutical sales leapt more than 18% versus the prior year with operational growth approaching 19%. Domestic sales advanced a whopping 33%! J&J’s pharmaceutical portfolio is in growing demand and remains one of the fastest-growing across the healthcare sector (XLV). Here’s a quick excerpt from the press release on key drivers:

The strong sales results were driven by new products and the strength of our core products. New products include OLYSIO®/SOVRIAD® (simeprevir), for combination treatment of chronic hepatitis C in adult patients; XARELTO® (rivaroxaban), an oral anticoagulant; INVOKANA® (canagliflozin), for the treatment of adults with type 2 diabetes; ZYTIGA® (abiraterone acetate), an oral, once-daily medication for use in combination with prednisone for the treatment of metastatic, castration-resistant prostate cancer; and IMBRUVICA® (ibrutinib), a kinase inhibitor for the treatment of mantle cell lymphoma (MCL), chronic lymphocytic leukemia (CLL) in patients who have had at least one prior therapy and CLL patients with 17p deletion, a genetic mutation that occurs when part of chromosome 17 has been lost.

Additional contributors to operational sales growth were STELARA® (ustekinumab), a biologic approved for the treatment of moderate to severe plaque psoriasis and psoriatic arthritis; REMICADE® (infliximab), a biologic approved for the treatment of a number of immune-mediated inflammatory diseases; and INVEGA® SUSTENNA®/XEPLION® (paliperidone palmitate), a once-monthly, long-acting, injectable atypical antipsychotic for the treatment of schizophrenia in adults.

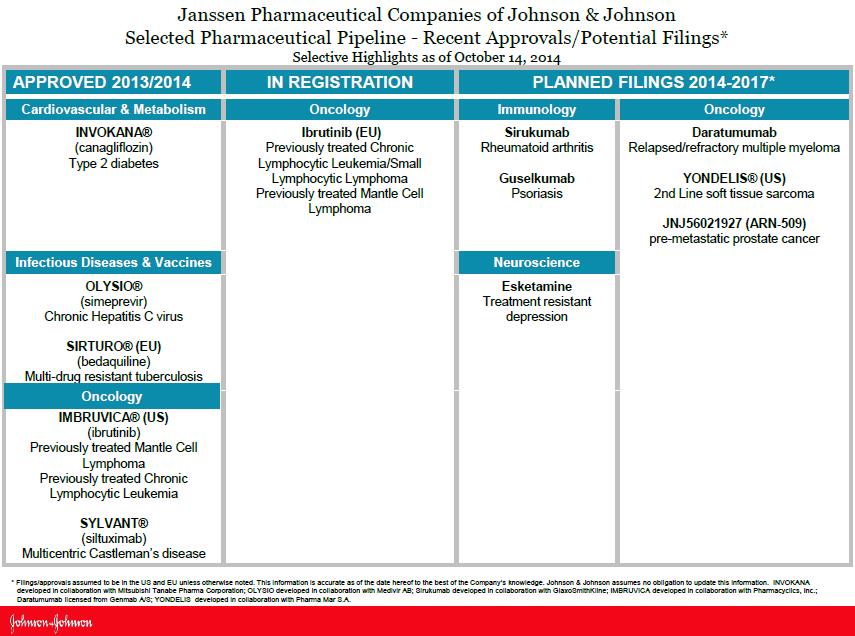

We previously outlined Johnson & Johnson’s fantastic patent expiration profile here, and we continue to like execution across its existing marketed drugs as well as its pipeline. We’ve pasted below J&J’s robust late stage US and EU pipeline.

(select image to download pdf)

Image Source: Johnson & Johnson

Image Source: Johnson & Johnson

Looking ahead, Johnson & Johnson raised its earnings guidance for full-year 2014, to $5.92-$5.97 per share, up from the $5.85-$5.92 range issued in the second quarter, which itself was up from the range of $5.80-$5.90. The company’s earnings momentum is apparent, and we have no plans to remove the position from the Dividend Growth portfolio anytime soon.