After the market closed Tuesday, the top holding in the Dividend Growth portfolio Microsoft (MSFT) raised its dividend 11%, to $0.31 per share on a quarterly basis. Though we try to be as modest as possible, we think it’s not an exaggeration to say that ‘we hit the ball out of the park’ with the call on Microsoft — not only in making the controversial decision to add it to the Dividend Growth portfolio (when the consensus was convinced it was ‘dead money’) but also in retaining the stock as the portfolio’s largest weighting for the past several months.

Microsoft was added to the Dividend Growth portfolio at $25.96 per share at the beginning of 2012, and shares closed yesterday at nearly $47 each! This is an incredible move higher for such a large company and represents an excellent example of the efficacy of combining the rigorous valuation and “let-winners-run” dynamics of the Valuentum Buying Index with the cash-flow-derived nature of the Valuentum Dividend Cushion, a forward-looking ratio of dividend growth and safety.

We continue to believe that Microsoft is a Dividend-Aristocrat-to-be, and we’re expecting continued dividend expansion for many years to come. The firm’s cash flow strength and balance sheet are as strong as any other firm out there. Shares currently yield about 2.6%. We know you know we’re working hard, and we trust you are very pleased with this development!

Please expect an updated dividend report on Microsoft shortly.

Update (9/17/2014 9:58AM CST): As a member to our independent research firm, please work to uncover biases in sell side research and in writings on other websites. For example, Goldman Sachs released a note today saying the dividend increase was less than expected in order to support its sell rating. Only the board knows the precise amount that the firm will raise the dividend. A double-digit increase is fantastic and in-line with our estimates. Sell-side analysts will do anything to try to get trading activity in the direction of their call. Driving trading commissions through their desk is in part their job. Please work to uncover conflicts of interest.

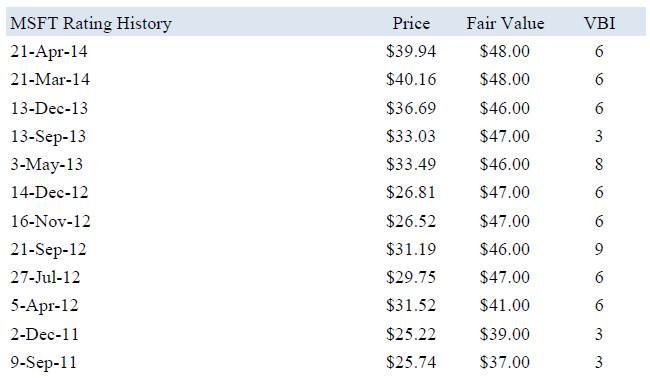

Update (9/17/2014 9:58AM CST): Appendix: Historical Valuentum Buying Index ratings for Microsoft

Microsoft’s 16-page Report