Notes

-

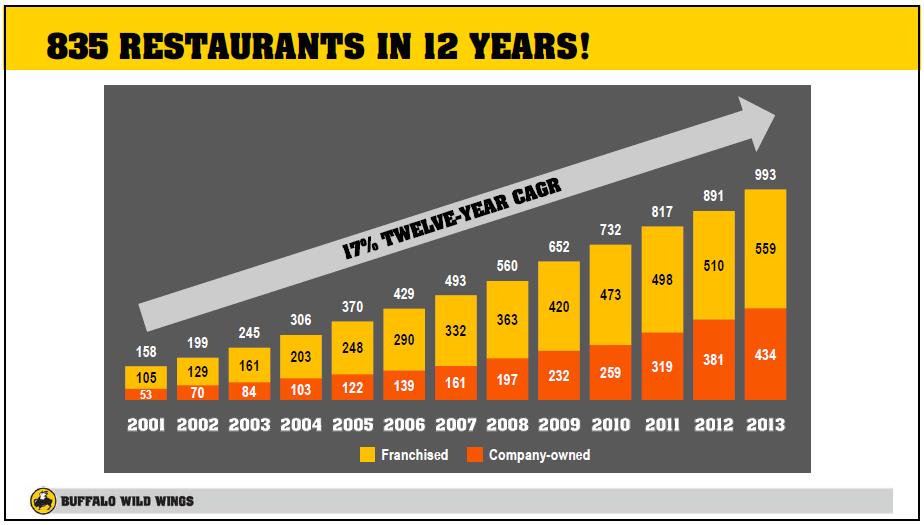

Buffalo Wild Wings (BWLD) has been a great growth story. (1)

-

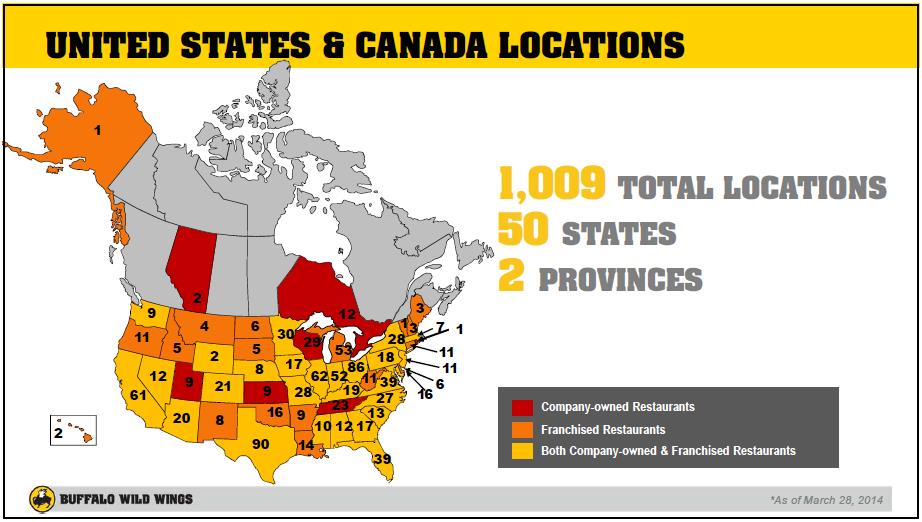

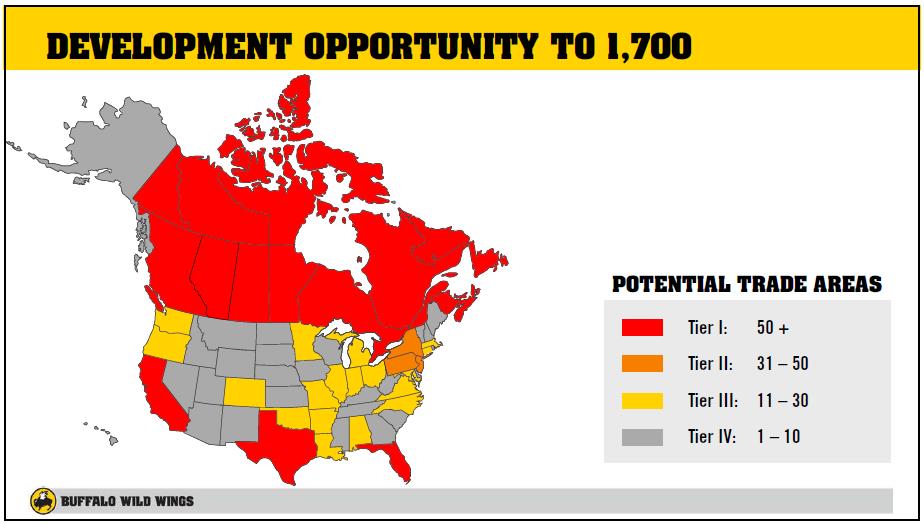

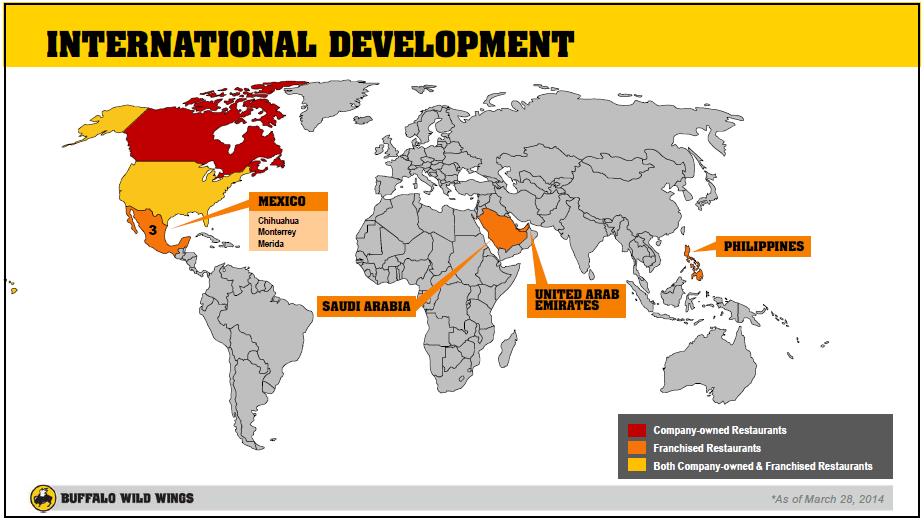

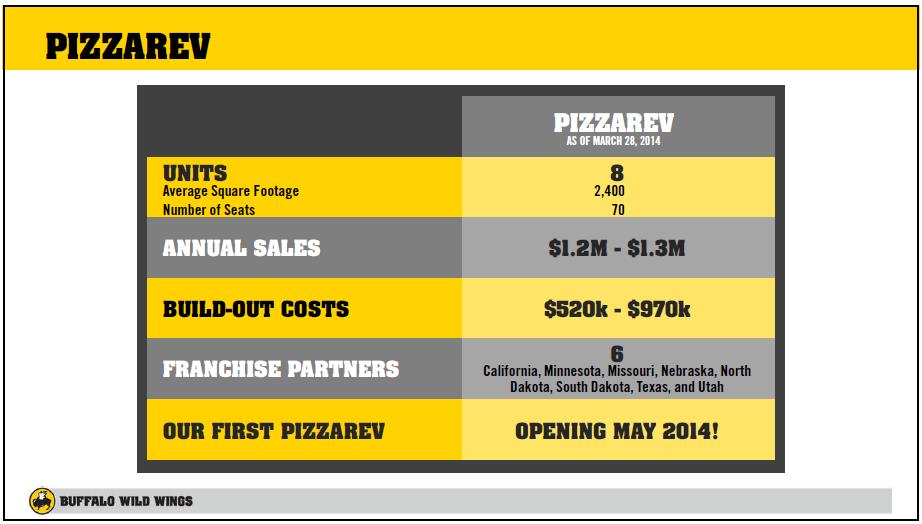

Substantial unit growth opportunities remain across the US and Canada. The company’s vision is to be a growth enterprise of restaurant brands, with more than 3,000 restaurants worldwide. The firm’s growth strategy includes creating the ultimate guest experience in the US and Canada, growing Buffalo Wild Wings into an international, globally-connected brand, and building an enduring, diversified portfolio of brands, including PizzaRev. (2)

-

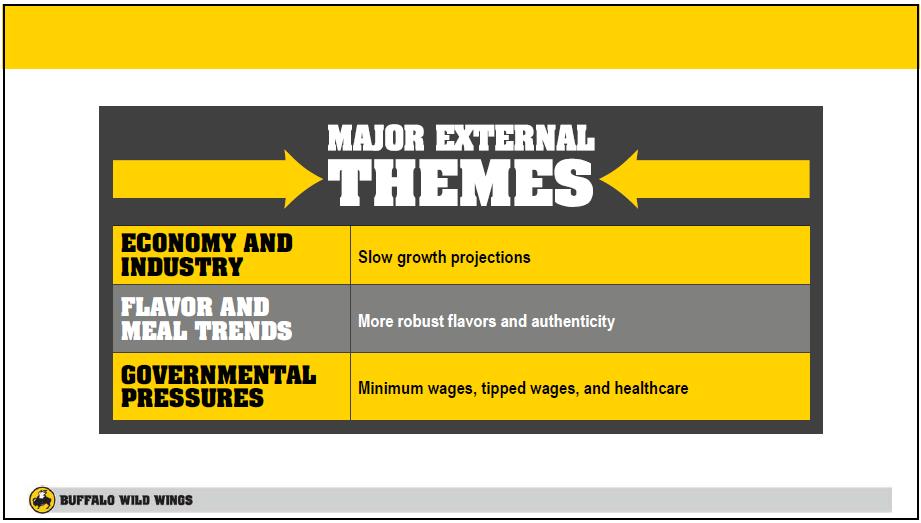

Challenges: slow economic growth projections, consumer demands for more robust flavors and authenticity, and governmental pressures (minimum wages, tipped wages, and healthcare). (3)

-

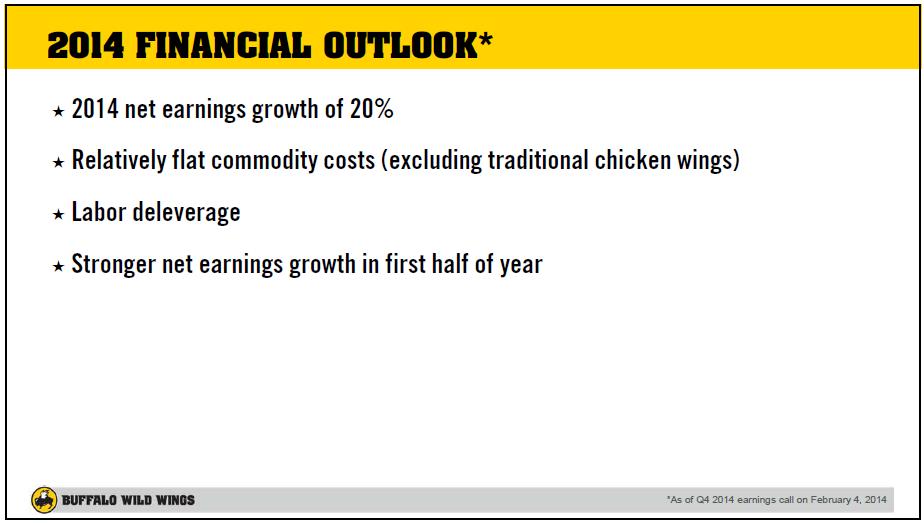

2014 financial outlook: 2014 net earnings growth of 20%; relatively flat commodity costs (excluding traditional chicken wings); labor deleveraging, strong net earnings growth in first half of 2014. (4)

-

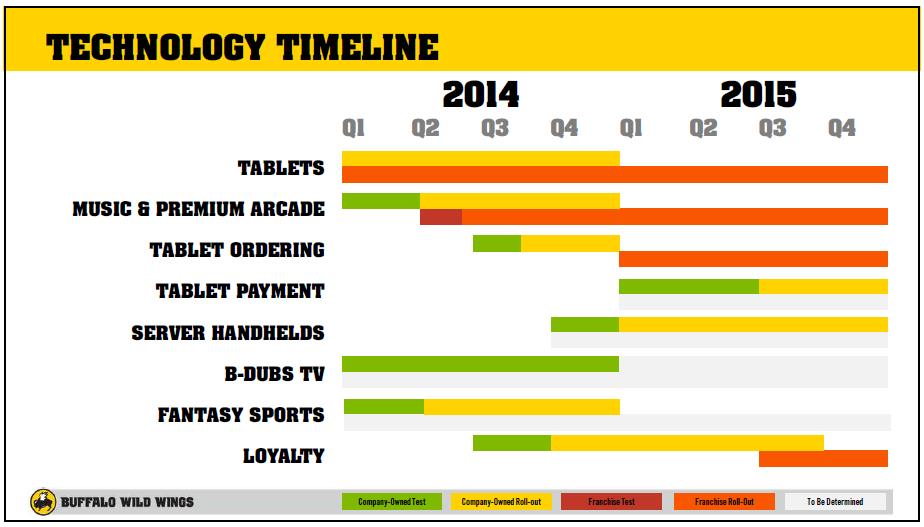

Buffalo Wild Wings continues to invest in technology to improve the guest experience and attract new demographics: tablets, music & premium arcade, tablet ordering and payment, server handhelds, B-Dubs TV, fantasy sports, loyalty. (5)

-

The firm’s strategic advantages remain apparent: culture evolution, capitalizing on guest insights and research, continued brand development, real estate site selection improvements, vendor partnership optimization, operational efficiency initiatives, franchise development, and national expansion. (6)

Valuentum’s Take

Buffalo Wild Wings is not a dividend growth gem and not an idea for the risk-averse investor. However, we think the company serves a valuable slot in the Best Ideas portfolio and has been one of the best-performing ideas since the portfolio’s inception. Though we would be cautious in allocating new money at these levels to Buffalo Wild Wings, we are comfortable holding it until it registers a 1 or a 2 on the Valuentum Buying Index. We generally add firms to the Best Ideas portfolio when they register a high rating on the Valuentum Buying Index and hold them until they register a 1 or 2. We may tactically add to or trim positions in the portfolio if they register a rating between a 3 and an 8, depending on a variety of considerations (from technical, economic, diversification, etc.).

All-in, we continue to like Buffalo Wild Wings’ long-term opportunities with respect to its store growth potential (both with its namesake and with PizzaRev). The company’s ability to execute in the face of myriad challenges (commodity and labor cost uncertainty) is also noteworthy and speaks to a talented management team and staff. We don’t expect to make any changes to the weighting of Buffalo Wild Wings in the Best Ideas portfolio in light of the company’s 2014 analyst day. On a fundamental level, the firm is one of our favorite ideas in the restaurant space.

(1)

Image Source: Buffalo Wild Wings

(2)

Image Source: Buffalo Wild Wings

Image Source: Buffalo Wild Wings

Image Source: Buffalo Wild Wings

Image Source: Buffalo Wild Wings

Image Source: Buffalo Wild Wings

(3)

Image Source: Buffalo Wild Wings

(4)

Image Source: Buffalo Wild Wings

(5)

Image Source: Buffalo Wild Wings

(6)

Image Source: Buffalo Wild Wings