“Focusing on your investment process, and not the outcome, should be your goal. Here is the payoff: Over the long term, a good process delivers highly-desirable results, and generates better and more reliable outcomes.” – source below

“Focusing on your investment process, and not the outcome, should be your goal. Here is the payoff: Over the long term, a good process delivers highly-desirable results, and generates better and more reliable outcomes.” – source below

We came across an excellent article that hits the nail on the head of what we do at Valuentum — we focus on the process that leads to better and more reliable outcomes. The performance in the actively-managed portfolios has been great, but it wouldn’t mean much if we didn’t use a repeatable and measurable process like the Valuentum Buying Index. In another example, the prediction of dividend cuts by the Valuentum Dividend Cushion wouldn’t have any value to members, if the Dividend Cushion itself wasn’t a systematic and measurable process. We strive to deliver great performance in all areas, but focusing on the process is much more important so that the desired outcome has the best chance of being repeated in the future. A good outcome with a defined process is much more reliable:

Process…is a specific methodology. It is a repeatable approach to any challenge or endeavor, be it construction or medicine or investing.

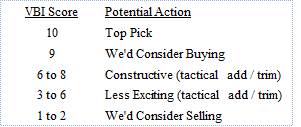

Our process, the Valuentum Buying Index, is a relatively straightforward methodology, even if the three underlying pillars are robust in their transparent forms (as shown in the stock reports): a discounted cash-flow analysis, a relative valuation analysis, and a technical/momentum analysis. The Valuentum Buying Index uncovers underpriced stocks on the basis of their discounted cash-flow value and their relative value versus industry peers and couples this evaluation with a timeliness assessment to achieve outperformance. Without a repeatable and measureable methodology, the future returns of a stock or a portfolio could be considered luck (to a very large degree).

The dividend process, the Valuentum Dividend Cushion, utilizes our advanced free cash flow infrastructure to compare future cash dividend payments to a company’s future free cash flow stream. It also considers the firm’s balance sheet structure in the analysis. What we’ve found both academically and empirically is that firms that have a Valuentum Dividend Cushion score below 1, and especially ones that have scores below 0, tend to be at a high risk for a dividend cut. The Dividend Cushion makes for an excellent tool in this regard as it steers financial advisors and individual investors away from firms that could damage an income portfolio.

The outcome is always going to catch your eye as an investor. But the process is much more important to analyze such that future performance can be more reliable. All of this said, we’d like to finally direct you to the source of the quote and further reading below. It’s a great piece.

—————

“The reason investors and the investment industry rely on performance is because it’s simple, objective and easy to measure. But more importantly, performance goals, performance reviews and performance measurement are so common in business, in sports, in education, in investing — almost everywhere — that not using them feels uncomfortable.” — Marshall Jaffe, Think Advisor

Has this ever happened to you?

Article tickerized for actively-managed portfolio holdings.