Thursday brought a plethora of news from the e-commerce space.

First, Bloomberg reported that Amazon (AMZN) is raising prices on Prime from $79 per year to $99 per year. The company was quick to note that the Prime Fresh membership fee will remain unchanged at $299, as it continues to test pricing thresholds in the marketplace. We don’t expect much customer defection as a result of the price hike—and especially nothing like that which happened to Netflix (NFLX), which lost hundreds of thousands of customers when it raised prices in 2011.

Amazon’s price increase at Prime was necessary, in our view, as it faces rising content (movies) and shipping costs. With more than 20 million US Prime members, the pricing action should bring in more than $400 million in incremental revenue, helping to defray the heightened expense profile. We continue to believe Amazon is laser-focused on expanding its position as the largest Internet retailer at the expense of bottom-line performance, and accepting higher-priced membership fees for Prime will allow it to invest in more warehouses and drone delivery to further expand sales.

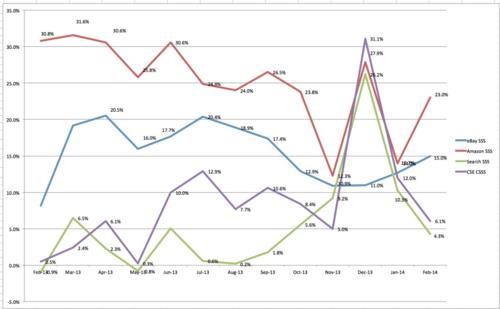

Also topping the news was ChannelAdvisor data. The report, released Thursday, indicated that Amazon’s same-store sales growth in February came in at 23% compared to January’s 14% increase, a significant sequential ramp, while eBay’s (EBAY) February same-store sales growth came in at 15%, up from a 12.7% increase in January. ChannelAdvisor noted that the increases were caused by the winter snow storms subsiding and delivery times returning back to normal. Amazon continues to expand at a greater pace, but eBay’s growth (blue line) is much more consistent (as shown below):

Image Source: ChannelAdvisor

Valuentum’s Take

You’ll have a difficult time prying eBay out of the Best Ideas portfolio. The company is significantly underpriced, in our view, and we believe Carl Icahn is the catalyst to open up the market to evaluating the firm’s free cash flow potential more appropriately. Amazon is a company with far too much risk for our taste. Though we can justify significant equity value in our discounted cash-flow process, much of the company’s intrinsic worth is based on its normalized operating margin. Our analysts estimate that for every 1 percentage point of operating margin expansion (higher than our mid-cycle expectations), Amazon is worth as much as $50 per share more. The company simply has significant operating leverage, and this cuts both ways. We prefer eBay over Amazon and think the former’s shares are worth nearly $80 each. The strong e-commerce performance also bodes well for credit-card giant Visa (V) and related peers. We don’t expect to make any changes to our actively-managed portfolios at this juncture.

Related firms: DFS, MA, GRPN, OSTK, NILE