On Tuesday, mining giant BHP Billiton (BHP) reported solid financial results for the December 2013 half year, with underlying EBIT advancing by 15%, to $12.4 billion, and underlying attributable profit jumping by 31%, to $7.8 billion. The company noted that substantial improvements in productivity and volume from lower-risk projects drove a material improvement in its underlying EBIT margin and underlying return on capital for the period. BHP Billiton’s net operating cash flow increased 65% and investing cash outflows dropped 25%, resulting in a $7.8 billion increase in free cash flow from the comparable six-month period last year. We like that both measures are moving in the correct direction to drive free cash flow expansion. The firm is wisely using its expected strong free cash flow to pay down its debt load to $25 billion by the end of the 2014 financial year (from $27.1 billion).

Image Source: BHP

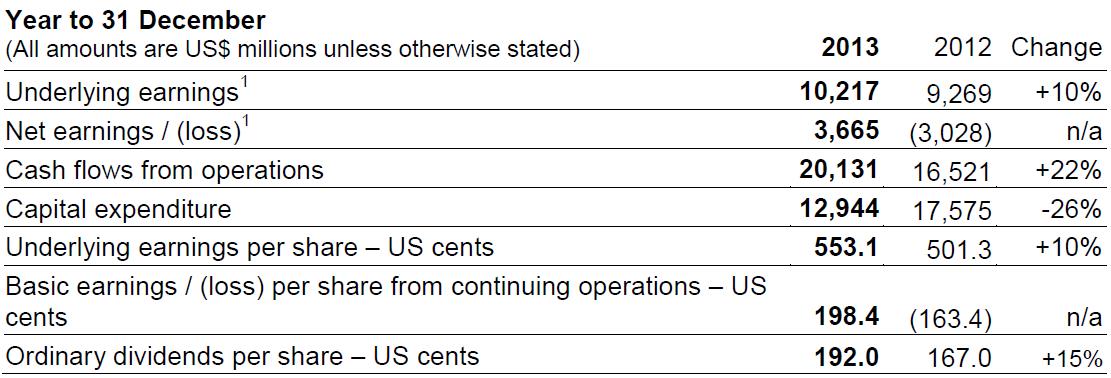

Rio Tinto’s (RIO) full-year 2013 results, released February 13, were also solid. The mining firm revealed a 10% increase in underlying earnings in 2013, to $10.2 billion, and announced that it exceeded cost-reduction targets while setting production records for iron ore, bauxite and thermal coal during the year. The prudent measures taken by Rio Tinto led to enhanced cash-flow generation and an improved net debt position. Cash flows from operations of $20.1 billion advanced 22%, while capital expenditures fell 26% to $12.9 billion. As with BHP Billiton, both measures at Rio Tinto are moving in the correct direction to drive strong free cash flow expansion. Net debt fell to $18.1 billion at the end of the year, down $4 billion from the half year and $1.1 billion on the previous year end.

Image Source: Rio Tinto

Valuentum’s Take

The diversified mining industry is highly cyclical and almost entirely commoditized, with little differentiation from one firm to the next. Rising input costs can only be passed on to consumers if industry-wide prices increase. Exploration and development require large capital investments, which could pressure cash flows during weak economic times. A miner’s position on the cost curve for each respective resource is a critical investment consideration, given the volatility of commodity prices. Though participants boast hefty operating margins, the industry experiences fairly significant profit swings.

That said, we continue to be huge fans of the largest miners’ decisions to strengthen their respective balance sheets by enhancing cash flows and reducing capital spending. A focus on debt repayment is also welcome, particularly as concerns about global growth (especially China) remain. Though Best Ideas portfolio holding Rio Tinto has come a long way to close its undervaluation gap relative to our fair value estimate (a good thing), the high end of its estimated fair value range suggests more upside potential is yet to come. We’re not making any changes to the firm’s weighting in the Best Ideas portfolio and may add to the position on any material price pullback. Rio Tinto is our favorite idea in the basic materials sector.

Metals & Mining – Diversified: BHP, CLF, FCX, RIO, SCCO, SLW, VALE