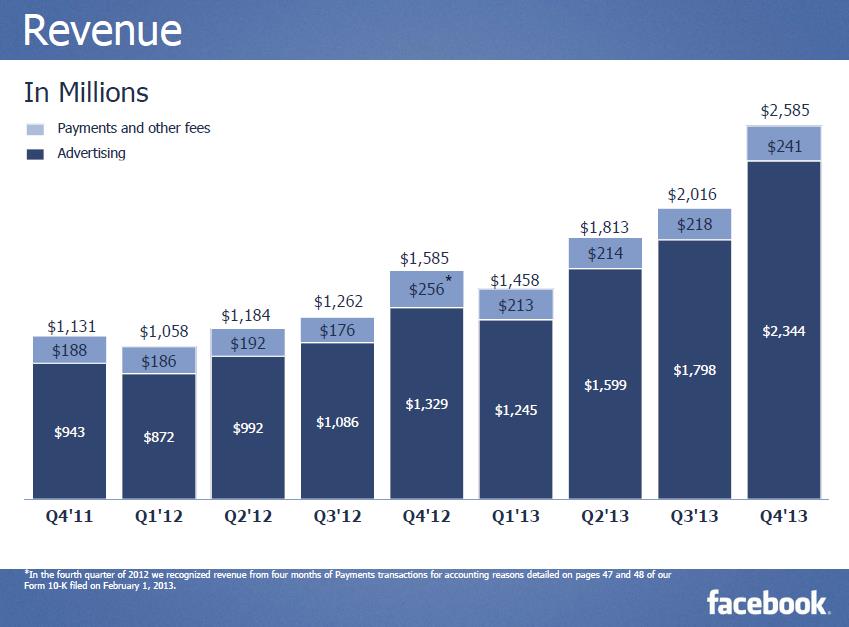

On January 29, Facebook (FB) kept the fundamental momentum going in its operations. The social media giant announced impressive fourth-quarter results, revealing that revenue jumped 63% (see image below) thanks to a 76% increase in revenue from advertising. Facebook indicated that mobile advertising revenue now represents more than half of advertising revenue compared to less than 25% in the same period a year ago. Income from operations nearly doubled in the period, to $1.13 billion, as the firm’s GAAP operating margin leapt 11 percentage points, to 44%. GAAP net income advanced to $523 million, compared to $64 million in the fourth quarter of 2012. Diluted earnings per share came in at $0.20 per share in the quarter, up from $0.03 in the prior-year quarter. For all of 2013, net cash from operations totaled $4.22 billion and capital expenditures were $1.36 billion, resulting in free cash flow of $2.86 billion (or 36.3% of revenue). The company’s free cash flow conversion is among the best in the market today. At the end of 2013, cash and marketable securities stood at $11.45 billion.

Image Source: Facebook

Click to dig into more of Facebook’s numbers.

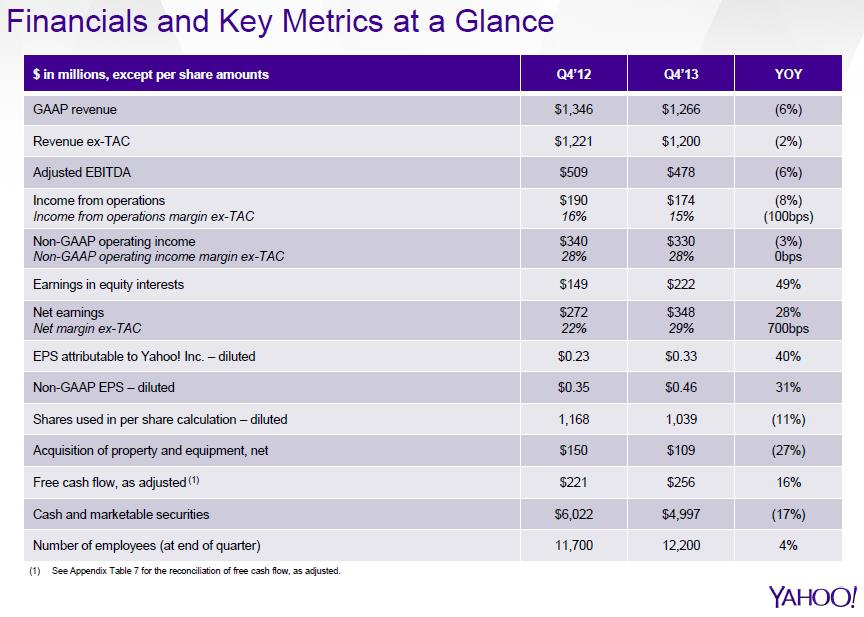

On the other hand, Yahoo (YHOO) continues to struggle mightily. In its fourth quarter, results released January 28, the firm’s GAAP revenue fell 6%, revenue (ex-TAC) dropped 2%, adjusted EBITDA dropped 6%, and income from operations fell 8%. As shown in the image below, Yahoo’s only growth engine is ‘earnings in equity’ interests—its ownership stake in Alibaba and Yahoo Japan (see here how we value Alibaba and Yahoo Japan). In its core business, Yahoo continues to head towards irrelevancy. We expect Yahoo to continue to sell off its non-core international assets to continue to fund its core business turnaround, the success of which cannot be guaranteed. For all of 2013, adjusted free cash flow was $786 million, or about 16.7% of revenue—less than half of the pace of revenue conversion than Facebook. Yahoo’s cash and marketable securities finished 17% lower ($5 billion) than the mark in the same period a year ago ($6 billion). The company may have to use much more than its current cash balance to right the ship, either through internal improvements or a large acquisition.

Image Source: Yahoo

Click to dig into more of Yahoo’s numbers.

Valuentum’s Take

There’s probably no better dichotomy today than a comparison of the fundamentals of new tech (Facebook) and old tech (Yahoo). Facebook continues to execute well and put up solid numbers, while Yahoo continues to wane as it points to its dependency on non-core asset performance for survival. We’re not interested in shares of Yahoo at current levels and believe the firm is more appropriately valued under $34 per share. Our intrinsic value estimate of Facebook is $80 per share, and we maintain our view that shares could fetch a price far greater than that in coming years. The likelihood of a single-stock bubble in Facebook is equal to or perhaps even greater than that of InfoSpace during the dot-com era. In the latter, InfoSpace was expected to become a monopoly in emerging wireless technologies, bringing the Internet to everyone’s cell phone (making it the first trillion-dollar company). If the talk of Facebook possibly becoming the new Internet starts to expand across social media, the trajectory of InfoSpace’s price increase may look minor to what Facebook could experience. We think our call-option position on Facebook in the Best Ideas portfolio supports this view.

Internet Content & Services: AKAM, BIDU, FB, GOOG, LNKD, SOHU, TCEHY, TWTR, TZOO, ULTI, WBMD, YHOO