On Thursday, Intel (INTC) reported what we would characterize as a nice fourth quarter. On a year over year basis, the period revealed that revenue advanced 3%, gross margin improved 4 percentage points, operating income leapt 12%, and both net income and earnings per share increased 6%, the latter to $0.51 (roughly in-line with expectations). The quarterly performance showed a nice stabilization of fundamentals in a year that still witnessed year-over-year revenue declines and lower profits. We’re viewing the quarter as a distinct positive.

Image Source: Intel

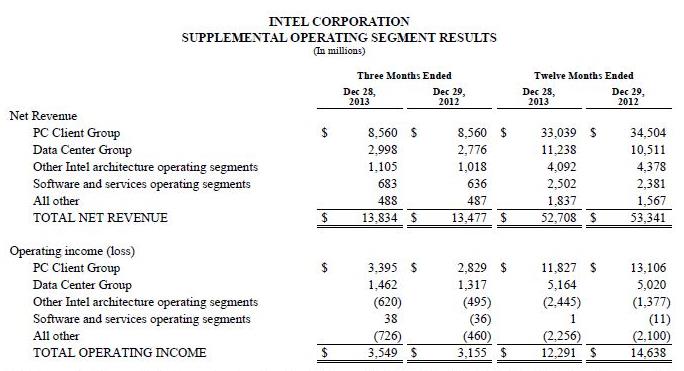

Though we had prognosticated that PC demand would start to stabilize in coming periods, it was very encouraging to see the year-over-year performance in the fourth quarter of Intel’s PC Client Group. The division’s revenue was flat (a very good sign), while operating income in the segment leapt an impressive 20%, to $3.4 billion. Revenue and operating income in the Data Center Group continued its steady advance higher, while other divisions also showed revenue increases. The chip maker generated $6.2 billion in cash from operations during the quarter and registered $2.9 billion in capital spending, resulting in free cash flow of roughly $3.3 billion, or about 24% of quarterly revenue. Intel’s strong free cash flow generation speaks volumes about its ability to keep raising its dividend payout in the years ahead (the company paid dividends of $1.1 billion in the quarter).

Looking ahead, Intel provided a conservative outlook for 2014. Revenue is expected to be approximately flat, but given performance in the most recently-reported fourth quarter, a marginal increase is most likely, which is in-line with consensus expectations. Intel’s gross margin is expected to be approximately 60% for 2014, plus or minus a few percentage points, while full-year capital spending will be $11 billion, plus or minus $500 million. Though the mid-point of the gross margin guidance for 2014 is only 20 basis points higher than 2013 levels, we point to lower factory start-up costs and lower platform unit costs that may bolster gross margins to the higher end of the targeted range for the year. Higher platform write-offs related to its Broadwell chips should be expected in the first quarter of 2014, however. The capital spending guidance is approximately flat compared to 2013.

Valuentum’s Take

Intel is clearly a cash-generating machine. For all of 2013, cash flow from operations was approximately $20.9 billion and capital spending came in at $10.7 billion, resulting in free cash flow of $10.2 billion (or roughly 19% of revenue). Total cash investments ended the year at $20.1 billion ($11.65 billion in cash and short-term investments and $8.44 billion in trading assets – marketable debt securities), up $1.9 billion from 2012 (see CFO comments). Long-term debt stood at $13.2 billion at the end of the year. Strong free cash flow, a healthy balance sheet, stabilizing demand in its largest segment, continued momentum across other areas of its business, and the prospects for further dividend growth offer investors a number of positives to chew on. The company remains a holding in our actively-managed portfolios.