Tuesday brought a couple of interesting developments that showed sometimes in-line performance is good enough.

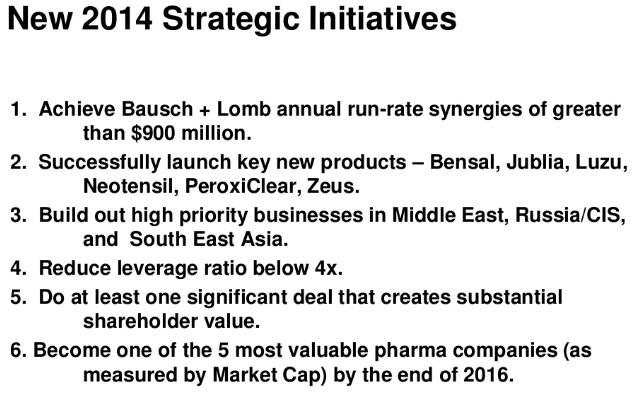

Valeant Pharma (VRX)—fact sheet download here—surged more than 10% in trading Tuesday as it spoke favorably about its long-term ambitions. Though fourth-quarter financial guidance in the presentation was in-line with expectations, the company’s outlook for 2014 and its intermediate-term goal to become one of the world’s top five pharma companies (by market capitalization) by the end of 2016 caught investor’s attention. We don’t think saying such a noble goal is a reason for its stock price to appreciate, but the company’s other strategic priorities are worth noting.

We think the “one significant deal” highlighted below may potentially refer to a future purchase of or a future “merger of equals” with generic pharma giant Teva (TEVA), a transaction that we view as having a relatively high likelihood of occurring, especially given that Valeant’s 2014 priorities also include launching more than 300 branded generics. If this deal doesn’t go through, it will certainly be evaluated (or is currently being evaluated) by both parties.

Image Source: Valeant

In other news, leading supercomputer provider Cray (CRAY)—fact sheet here—soared nearly 15% Tuesday as investors felt a sense of relief following the reiteration of its 2013 outlook:

Based on initial indications, the company completed the system acceptances necessary to achieve its previously provided 2013 guidance of revenue in the range of $520 million for the year. As a result, the company expects to be profitable on both a GAAP and non-GAAP basis for 2013.

It doesn’t sound like much, but Cray’s disappointing third-quarter results, released mid-October, were enough to set expectations below management’s issued guidance for the fourth quarter. Its third-quarter report released months ago also mentioned that “a wide range of results remains possible for 2013”, as “a significant portion of (its) expected fourth quarter revenue is dependent on several large systems which are currently anticipated to be accepted late in the fourth quarter.” It appears Cray has it its revenue mark for 2013, despite the complex work and the compressed timelines due to the US government shutdown. Still, the company’s commentary about 2014 leaves open the likelihood of another quarterly miss next year given similar terminology (bolded):

For 2014, while a wide range of results remains possible, the company is maintaining the outlook provided in its most recent quarterly earnings release, which included expecting revenue to be in the range of $600 million for the year.

Valuentum’s Take

We’re excited about Valeant Pharma’s initiatives and, while we fall short of speculating on merger activity, we think a Valeant-Teva tie-up makes a lot of sense. Even if Valeant offered Teva shareholders a hefty premium to today’s prices, the firm would be getting a great deal (despite Copaxone patent expiration). In our view, Valeant can pay as much as $50 per share for Teva (our estimate of its intrinsic value at the time of this writing) and still create economic value for shareholders, as this estimate doesn’t include potential synergies or cost take-outs associated with the transaction.

On the other hand, Cray’s move today pushes its shares to the high end of our fair value range (see its 16-page report), and we’d look to other opportunities in the hardware space. For one, we continue to expect material upside in Apple’s (AAPL) shares. Our best ideas are included in the Best Ideas portfolio and Dividend Growth portfolio.