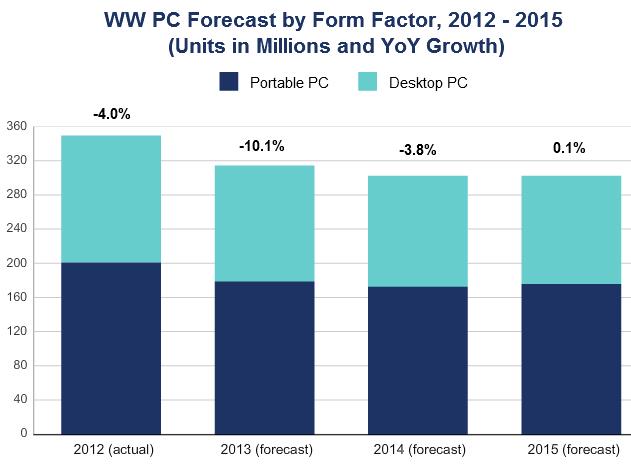

According to data released by the International Data Corporation (IDC) Worldwide Quarterly PC Tracker on December 2, personal computer (PC) shipments are now expected to drop more than 10% in 2013, slightly below the previous projection of -9.7%. Though 2013 will be the most severe yearly contraction on record, this news wasn’t the key takeaway. Instead, it was expectations for stabilizing demand by 2015 that provided a shot of optimism to the PC supply chain (see image below).

Image Source: IDC

The commentary provided by IDC was not terribly exciting, but market expectations are closer to the PC going the way of the dodo than stabilizing at just over 300 million units (roughly 2008 levels). We continue to believe that the PC is indispensable for complex tasks in the workplace environment, and corporations won’t be doing away with their desktops anytime soon. Increased smartphone (iPhone) and tablet (iPad) demand in the consumer market is being driven more by social-media proliferation where mobile interaction and consumption may make sense. We can’t see more complex tasks at the office being performed on the run, which is why the commercial market continues to hold up considerably better. IDC had the following to add:

Interest in PCs has remained limited, leading to little indication of positive growth beyond replacement of existing systems. Total shipments are expected to decline by an additional -3.8% in 2014 before turning slightly positive in the longer term. At these rates, total PC shipments will remain just above 300 million during the forecast – barely ahead of 2008 volumes. Even in emerging markets – a primary growth engine of the PC market – shipments are projected to decline in 2014 and recover by only a few percent during the forecast. The commercial market is faring notably better than the consumer market in 2013 with shipments declining by -5% year over year compared to nearly -15% for consumer. The relative stability is due to a mix of more stable PC investment planning, a smaller impact from tablets, and to replacements of Windows XP systems before the end of support planned for 2014. However, the long-term outlook for the two markets is not significantly different, with a small decline projected for both consumer and commercial segments in 2014 with near flat growth in the longer term.

Valuentum’s Take

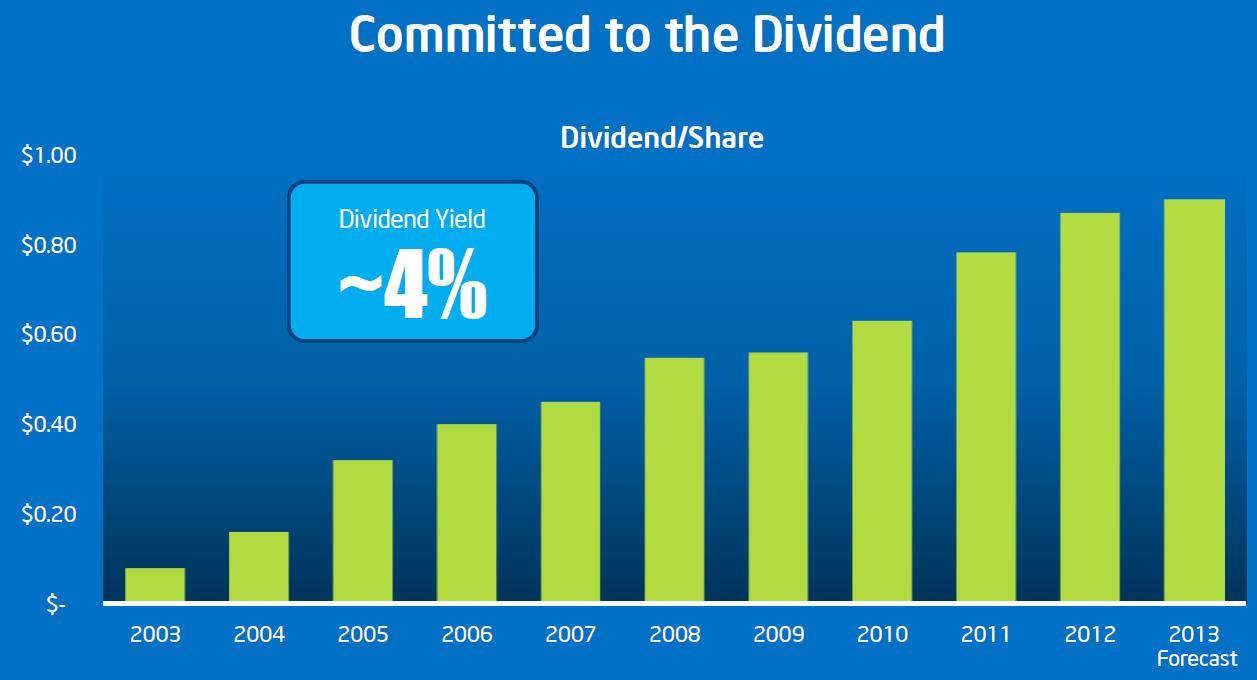

Though IDC has certainly kept its commentary muted, expectations for stabilization in the PC market is a big deal. The news has far-reaching implications on actively-managed portfolio holdings Apple (AAPL), Intel (INTC), and Microsoft (MSFT) and on firms from chip maker AMD (AMD) and GPU (graphic processing unit) maker Nvidia Corp (NVDA) to memory makers—Micron (MU), Seagate (STX), Western Digital (WDC)—and PC makers—Hewlett-Packard (HPQ) and Dell (DELL). Stabilization in PC demand by 2015 should be viewed as an upside surprise to the PC supply chain, and we view the news as particularly positive for Intel, offering further support behind the long-term growth and sustainability of its dividend.

Image Source: Intel