A version of this article appeared on our website November 20, 2013. This article is for educational purposes only and does not reflect our current opinion on J.C. Penney. Please view the firm’s 16-page report for our updated take on the firm.

J.C. Penney’s (JCP) third-quarter 2013 results, released November 20, left much to be desired, despite the market’s positive reaction. In fact, the performance confirmed our greatest fear, and we are maintaining our significantly below-market fair value estimate of the firm. Investors should be cognizant, however, that we don’t expect a path directly to our below-market fair value estimate of J.C. Penney’s stock, but one that has fits and starts before an inevitable decline takes hold over the next couple years.

During the third quarter of 2013, J.C. Penney’s comparable store sales declined 4.8%, gross margins dropped 3 percentage points, and its operating loss totaled more than $400 million. Though we can hammer down just how poor its operating performance in the quarter was, the most informative assessment of J.C. Penney at this point is one that involves a cash-burn analysis.

The basic cash-burn analytical concept is that at some point the equity (stock) and debt markets will inevitably say “no” to giving J.C. Penney more capital once operating cash flow (and by extension, free cash flow) is negative for a prolonged period of time. Said differently, the longer that a firm burns cash, the less likely the capital markets will continue to fund its operations with fresh new capital, and the firm will then go into the hands of creditors under bankruptcy proceedings.

The starting point in such cash-burn analysis is the firm’s current liquidity position, which is subjective in its calculation. At J.C. Penney, cash and cash equivalents at the end of the third quarter of 2013 were $1.227 billion. Though the company has $1.71 billion in liquidity including its revolving credit facility (a corporate credit card), typically when things start to go bad for a firm, the banks pull the credit facility in a hurry to protect their own interests. The credit facility is often not available when companies really need it. As such, it is traditional to calculate the liquidity of weak credits such as J.C. Penney as only the sum of cash and cash-like equivalents that it currently has on its books, or $1.227 billion in J.C. Penney’s case (at the end of the third quarter of 2013).

The next step in the cash-burn analysis is to assess J.C. Penney’s debt repayment schedule. This area is equally subjective. For example, a company can roll its debt forward (refinance it) if creditors allow it, and there will not be a liquidity event (debt maturities keep getting pushed back). However, in the case of J.C. Penney, creditors appear to be demanding repayment of principle (the firm repaid $200 million from its revolving credit facility), so refinancing risk appears significantly elevated. Paying back debt in this case may not be a sign of J.C. Penney working to restore its financial health, but instead, it may be one that suggests the rope around the firm’s neck is tightening.

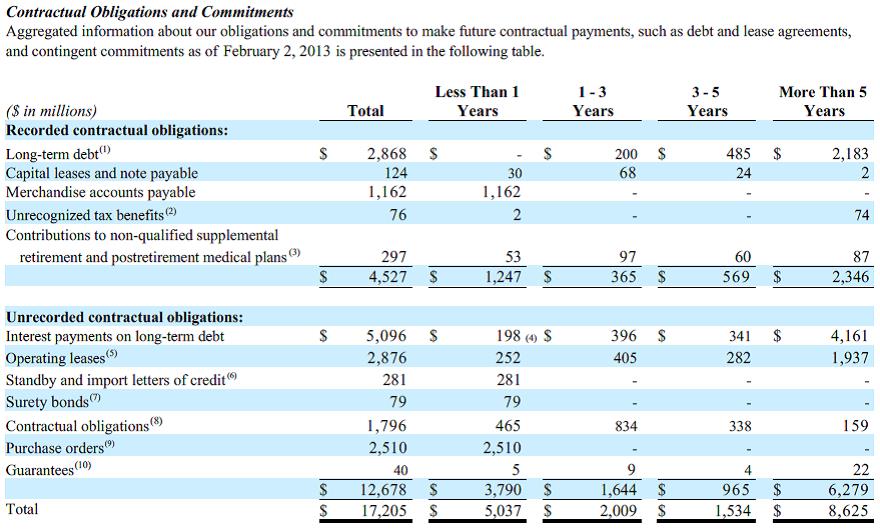

Below, please find J.C. Penney’s ‘Contractual Obligations and Commitments’ table, a disclosure found in the 10-K or 20-F (annual filings with the SEC). The primarily line to focus on in the table in the image below is the top one: ‘Long-term debt’. Though the weighted average maturity of J.C. Penney’s long-term debt was 24 years at the end of the last fiscal year (February 2013), there are some meaningful principle commitments coming due within the next 5 years (especially the $485 million obligation). In cash-burn analysis, the timing of debt maturities is critical to estimating a liquidity event.

Image Source: J.C. Penney’s 10-K (as of February 2, 2013)

Still, it may be traditional in credit analysis to give J.C. Penney the benefit of the doubt that creditors won’t come calling for full repayment at maturity. As in most cases, it is customary to assume the firm will be able to roll (refinance) its obligations forward (to a later maturity). We’ll assume that J.C. Penney will continue to be able to refinance its maturing debt, though we note that this is a big assumption illustrating the generousity of this particular cash-burn analysis. Other credit analysts may assume that J.C. Penney will not be able to refinance its maturing obligations.

The next step in the cash-burn analysis is to focus on J.C. Penney’s free cash flow, which is a function of its cash flow generated from operations and its capital expenditures. Creditors would love for the company to keep raising equity (the stockholders are funding payments to the bond holders with such activity), but shareholders are only willing to throw so much good money after bad. J.C. Penney already had a fairly significant equity raise in September 2013, and the likelihood of equity investors engaging in another round is remote. Creditors are already set to take ownership of the firm under bankruptcy protection (should it file), so floating more debt may not change the outcome or return profile for creditors.

J.C. Penney’s operating cash flow was a use of $737 million (negative $737 million) in the third quarter of 2013, reflecting net operating losses and an increase of $592 million in inventory (an increase in an operating asset is a use of cash). The inventory increase is nearly 60% greater than the increase in last year’s quarter, so it appears that management is staking almost everything on the holiday 2013 quarter, which will inevitably be more promotional than those of years past (given that there are 6 fewer shopping days between Thanksgiving and Christmas).

Management noted that it had stopped the same-store sales declines in October 2013 (during the month, same-store sales advanced 0.9%). However, it is important to note that merely stemming sales declines does nothing to change the level of sales the firm currently has–and, by extension, the pace of the current cash burn. The same-store sales in the month of October suggests that perhaps the pace of the cash-burn analysis won’t accelerate in future periods—not that it has stopped. This is an important distinction.

Note: Forecasts in this case study reflect opinions as of November 2013.

For the 12 months ending February 2015, we’re forecasting a net loss of $565 million, cash flow from operations of $159 million, and capital expenditures of $686 million, resulting in negative free cash flow of $527 million (a cash burn of $527 million). Importantly, our forecast of a $565 million net loss in the 12 months ending February 2015 is materially better than the $985 million loss the company posted in the 12 months ending February 2013 and much better than the massive $1.42 billion loss the company has put up during the past nine months ending February 2013.

Our cash flow from operations forecast for the 12 months ending February 2015 includes a reasonable and offsetting impact to the net loss thanks to non-cash depreciation and amortization (+$538 million) and a contributing positive cash-flow factor from merchandise accounts payable (+$239 million). Our capital expenditures forecast is also in-line with what we think to be bare-bone capital spending levels of about $150-$175 million per quarter, a range that bounds the firm’s $161 million capital spending in the most recently-reported third quarter (as well as its expectations for $175 million during the fourth quarter of this year).

During the fourth quarter of 2013, management expects to end 2013 with more than $2 billion in total available liquidity, which will be a $290 million improvement from the $1.71 billion measure at the end of the third quarter. This implies that cash and cash equivalents will be $1.51 billion at the end of the fiscal year, if everything goes as planned during the holiday season (which is a very optimistic statement given expected promotional activity).

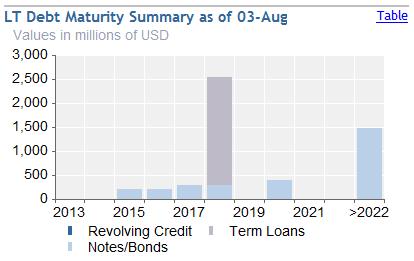

Under a base-case scenario, which extend our forecasts for $527 million in cash burn during the 12 months ending February 2015 for the next couple years, J.C. Penney can last about three years with current cash on hand, assuming creditors don’t call the $685 million in long-term debt coming due within the next 3-5 years. There is $200 million coming due in both 2015 and 2016 and $285 million coming due in 2017. In 2018, the company has $2.25 billion coming due. If creditors demand repayment at maturity, we think it’s likely the firm will enter bankruptcy proceedings before February 2016.

Image Source: FactSet

Under more aggressive scenarios, including extrapolating the current cash-burn rate of $3 billion through the nine months ending November 2013 ($2.197 billion in cash used from operations less $814 million in capital expenditures) or about $1 billion per quarter, J.C. Penney may be seeking bankruptcy protection much earlier. A lot will depend on how cash flow performs in the coming months, measures that will inform how long the company will be able to survive.

There can always be a white knight to come to the rescue of J.C. Penney with gobs and gobs of cash to throw at the endeavor’s turnaround (or someone might come along to scoop up its real estate), but it’s more likely the firm will wither away to bankruptcy. Forecasts aren’t made to be precise, and it may take a few years before J.C. Penney eventually falters. Still, cash-burn analysis such as this can be a valuable tool for any investors’ tool chest to not only assess bankruptcy risk (the likelihood of one’s investment being completely wiped out), but also to evaluate the option value associated with the time for a company to turn things around.

Importantly, investors active on the long side of J.C. Penney’s shares may be forgetting the inevitable economic cycles of retail. Once the next economic downturn happens (not if, but when–the timing of which is uncertain), J.C. Penney may be among the first in retail to fold. Still, with great risk comes great reward: if J.C. Penney is able to turn things around permanently (no matter how remote the possibility), the equity portion of its capital structure is much more valuable than it is today.

This article is for educational purposes only and does not reflect our current opinion on J.C. Penney. Please view the firm’s 16-page report for our updated take on the firm.