Best Ideas Newsletter portfolio option position Facebook (FB) once again flexed its advertising muscle when it reported fantastic third-quarter results Wednesday. Revenue swelled 60% year-over-year to $2 billion, soaring past consensus estimates, while non-GAAP earnings per share rose 108% year-over-year to $0.25, also above consensus estimates. Year-to-date, free cash flow is phenomenal at $2.1 billion, equal to 40% of total revenue.

The Words that Clouded the Quarter

“Our best synopsis on youth engagement in the U.S. reveals that usage of Facebook among U.S. teens overall was stable from Q2 to Q3. So we did see a decrease in daily users specifically among younger teens.”

– CFO David Ebersman

In spite of overwhelmingly positive financial results and a few anecdotes that match up with our long-term vision of the company, the consensus reaction seems fixated on this small quote. We applaud Ebersman for being honest–there was no need to disclose this information. We also see why this might make investors nervous: young teens have the greatest amount of free time to spend on Facebook and are the customers of tomorrow.

However, we don’t think this information is cause to panic. Young teens are a fickle bunch (see teen retail), and the social network could experience a recovery in daily active users in the fourth quarter. Further, young teens specifically don’t have much buying power, and they do not fall into the sweet spot of an 18-35 year-old demographic that advertisers desire. This information is not worth losing sleep over.

Daily Active Users Continue to Impress

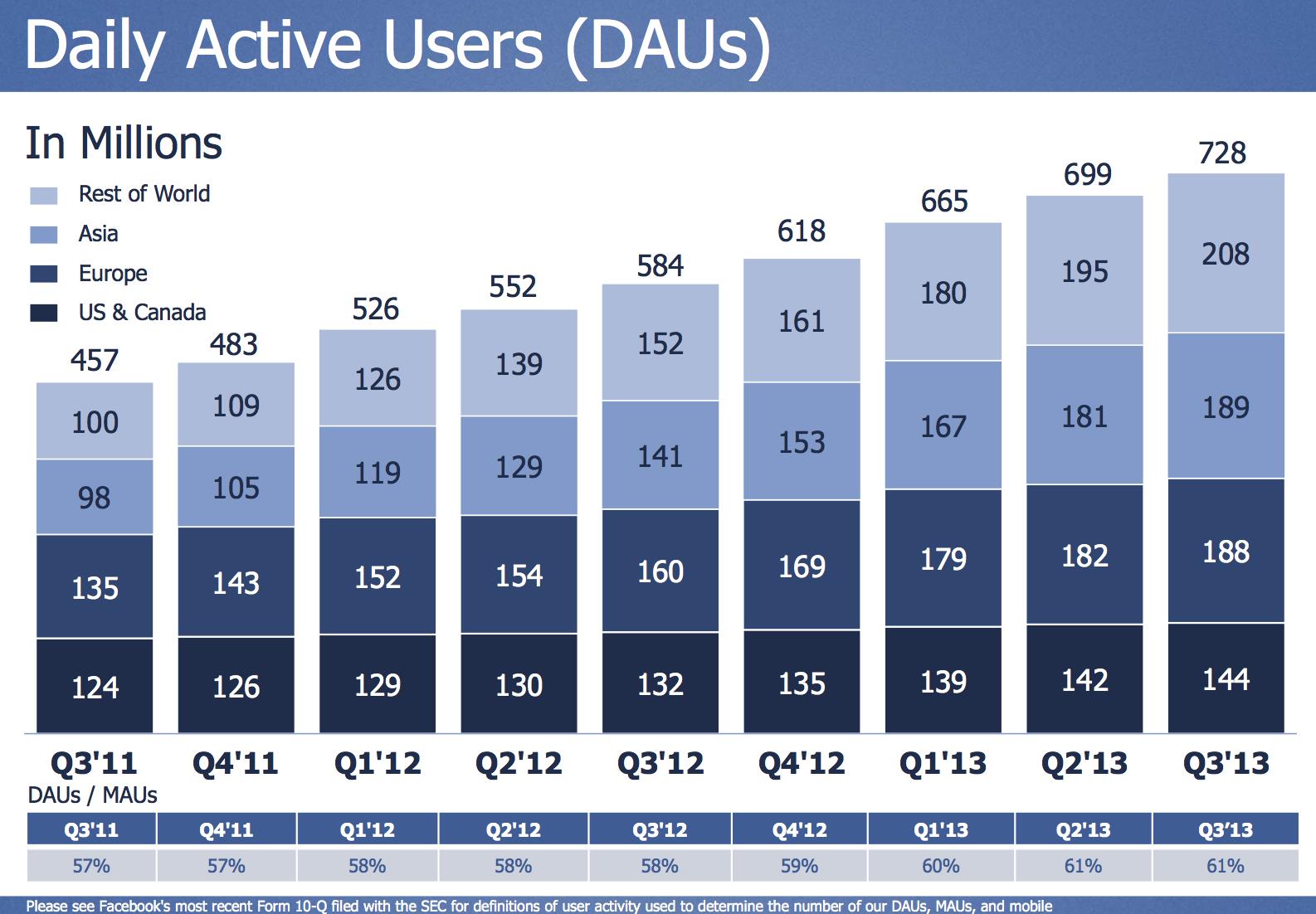

Image Source: FB 3Q13 Slides

Just when it seemed like Facebook couldn’t get any bigger, the number of Daily Active Users (DAUs) grew 25% year-over-year to 728 million, with most of the growth coming outside the US. With notifications sent directly to smartphones and Facebook’s mobile usage on the rise, we expect this figure to continue to grow going forward. The potent combination of DAUs growth and advertising efficacy should allow the company to command higher premiums for ad space.

A Search Revolution

“In the last quarter, we started testing what we call host search, (which) allows you to search all the unstructured text and posts that people have ever made on Facebook. About 1.2 trillion more posts. The folks on the team who have worked on web search engines in the past tell me that the Graph Search corpus is bigger than any other web search index out there. It’s still early for Graph Search, because it’s still in beta, only in English and we haven’t launched our mobile version yet, but it’s something I am really excited about.”

– CEO Mark Zuckerberg

Zuckerberg made it crystal clear, in our view, what the future holds for Facebook. It will not be a place where people come to have content pushed to them, but rather a place where people discover content, ideas, video, and products. Essentially, Facebook plans to reinvent search to go toe-to-toe with the likes of Google (GOOG) and Twitter (TWTR).

We can’t stress enough how important this is to our Facebook thesis: it underscores that Facebook can become anything. According to Zuckerberg (on the conference call):

“…Facebook and Instagram have more mobile time spent than many of the next largest services including YouTube, Pandora, Yahoo, Twitter, Pinterest, Tumblr, AOL, Snapchat and LinkedIn combined.”

Mobile devices will likely surpass desktops in terms of overall Internet consumption, and Facebook is the unquestioned leader in the space. Reviews, e-commerce, payments, games, you name it—the possibilities for Facebook are endless.

Valuentum’s Take

Facebook showed its prowess in mobile advertising during the quarter, as it grew 34% sequentially and now accounts for 49% of all ad sales. More importantly, Zuckerberg hinted at the future of Facebook as a connector of all sorts of areas—not just people. Our fair value estimate and the call option exposure (number of contracts) in the portfolio of our Best Ideas Newsletter remains unchanged.