On Thursday morning, International Paper (IP) posted record third quarter operating earnings driven by solid margin expansion. Revenue increased 5% year-over-year to $7.4 billion, slightly below consensus expectations. Operating earnings per share of $1.05 per share were in-line with consensus estimates and 30% higher than the year ago period. Year-to-date, free cash flow stands at $1.2 billion, down slightly compared to the same period a year ago, but still equal to 5.6% of total revenue.

Robust Industrial Packaging

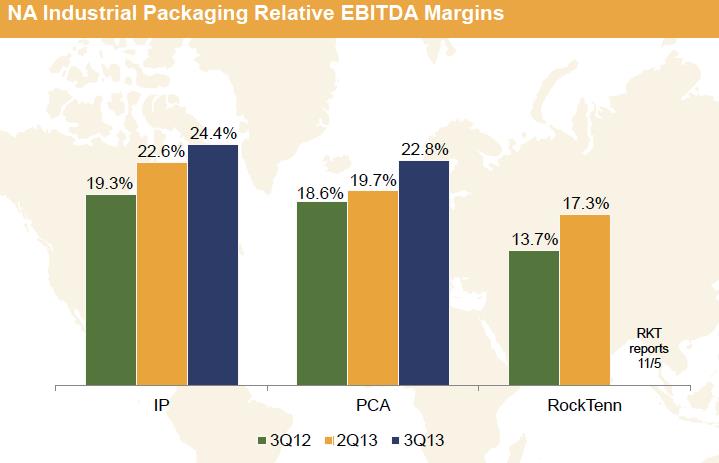

Image Source: IP 3Q13 Slides

North American Industrial Packaging was a standout performer for International Paper during the third quarter. As shown in the above chart, the segment’s EBITDA margins easily eclipse peers and increased 510 basis points year-over-year to 24.4%. Although wood and fiber input costs were higher than anticipated and volume fell because of the inclusion of one less day during the quarter, the firm was able to realize strong gains in box and containerboard pricing to drive an improvement in earnings.

Looking ahead to the fourth quarter, management sees continued strength in box pricing though some of the pricing gains will be offset by higher wood costs. Nevertheless, positive pricing in North America coupled with continued strength from the firm’s joint venture with IIlim and the potential for margin reflation in the firm’s Europe, Middle East, and Asia (EMEA) segment should provide the foundation for solid industrial packaging growth going forward.

Consumer Packaging Opportunity

Earnings in IP’s Consumer Packaging Segment jumped 8.9% year-over-year to $73 million thanks to stronger pricing and demand. More importantly, the firm revealed an interesting tidbit about its opportunity in food service. CFO Carol Roberts noted on the conference call:

“McDonald’s announced their plan to convert to paper hot cups in all of their 14,000 plus locations in the U.S. A McDonald’s representative cited customers’ changing preferences and increased recyclability as the driver for this change, and they expect a multiyear transition that will extend probably through 2016.

In the case of Dunkin, they moved to paper in their Brookline Mass. stores in response to anti-foam legislation. And they stated, they’re looking for a solution to replace foam that meets the goals for cost performance and recyclability. These 2 opportunities alone would result in 3 billion to 4 billion cups in increased demand, and that would translate to roughly 80,000 tons of paper cup stocks, which is great for us, as we’re very well positioned to benefit from this development.”

Simply put, a backlash against foam usage could provide a great source of revenue growth for International Paper going forward.

Fourth Quarter Outlook

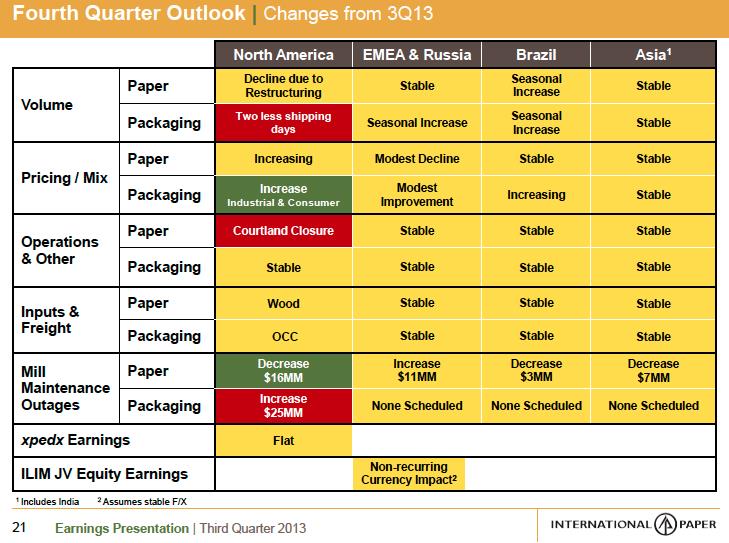

Image Source: IP 3Q13 Slides

Looking into the fourth quarter, International Paper provided solid guidance, noting that its businesses are fairly stable across all geographies. The company will have some normal fluctuations due to maintenance outages, but these normal occurrences for International Paper will not have an impact on our fair value estimate.

Valuentum’s Take

Although revenue was a tad lighter than expected, we believe International Paper’s third quarter results were satisfactory. The company should continue to thrive on strong containerboard and box pricing, and it has a compelling opportunity in consumer products as fast food restaurants leave foam in favor of the more environmentally friendly paper. Industry consolidation also bodes well for future profitability. All-in, however, we think shares look fairly valued at current levels; thus, we’re not rushing to add them to the portfolio of our Best Ideas Newsletter.