High-flying restaurant peers, Panera (PNRA) and Chipotle (CMG), reported divergent performance in their respective third-quarter results. Though one is a bakery and the other a high-end burrito maker, their comparable growth trajectories make them relevant peers for discussion.

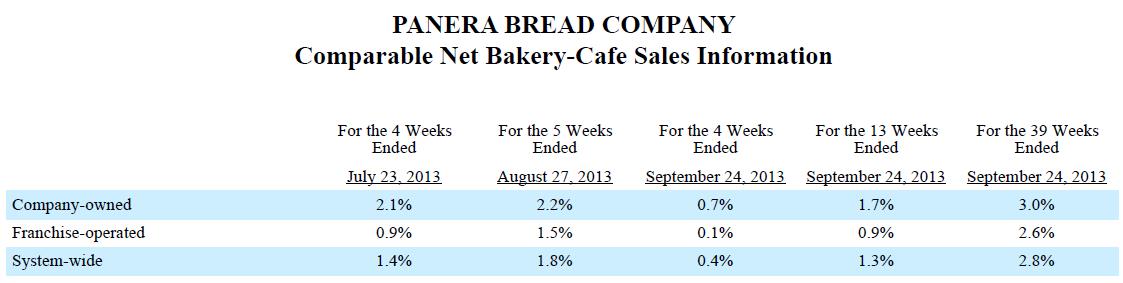

Panera’s third-quarter report, released Tuesday, showed relatively strong top-line and bottom-line expansion of 8% and 17%, respectively, but the real issue was with the firm’s fourth-quarter outlook. For starters, the bakery-café cut its fourth-quarter comparable sales growth expectations for company-owned restaurants to the range of flat-to-up-2% versus 3-5% previously. Panera also cut its fourth-quarter earnings-per-share guidance to $1.91-$1.97 per share from $2.05-$2.11 previously on expected margin contraction of more than 100 basis points on a year-over-year basis. Though the new bottom-line outlook implies a 9%-13% increase over the comparable period in fiscal 2012, the ratcheting down of the target is a black-eye for management and a classic no-no for an above-market-multiple equity like Panera’s. The firm’s earnings growth appears to be decelerating, and we think expansion in the 9%-13% range is likely more achievable in 2014 than the low-end of its long-term growth target of 15%-20% (as it stated in the release). We’re certainly watching developments at Panera closely, and we fully expect a downward revision to our fair value estimate on the basis of our lower expected growth trajectory.

Image Source: Panera

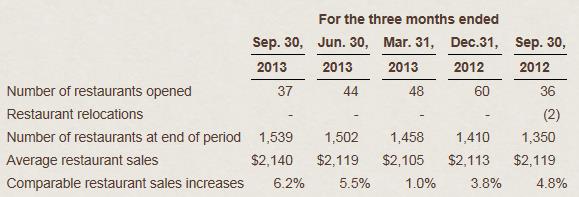

On the other hand, Chipotle continues to defy all odds. The company’s third-quarter report, released last Thursday, revealed accelerated comparable restaurant sales growth of 6.2% thanks to increased traffic (see image below), which helped drive revenue 18% higher from the same period a year ago. Though restaurant level operating margins faced some pressure in the period, net income still leapt more than 15%. Diluted earnings per share came in at $2.66 for the quarter, an increase of 17.2%. The firm’s outlook was no less impressive. The firm’s fourth-quarter comp is now expected to be similar or slightly better than the third-quarter mark. For 2014, management plans to open more restaurants than it did in 2013 (180-195 versus 165-180) and anticipates potential upside in its full-year guidance calling for ‘low-single-digit’ comp increases (should menu price initiatives be pursued). We love when restaurants talk about price increases – nothing improves margins (or mitigates cost pressure) and bolsters earnings better than hiking menu prices.

Image Source: Chipotle

Valuentum’s Take

The divergent fundamental performance of Panera and Chipotle will likely continue into the fourth quarter of 2013, given weakening comparable sales trends of the former and accelerating comparable sales trends of the latter. We also love the pricing power that is seemingly creeping back into Chipotle’s business given the improved traffic trends. Still, we’re not interested in establishing a position in either restaurant at this time on the basis of valuation. Instead, we point to Buffalo Wild Wings (BWLD) as our favorite idea in the restaurant space, and we think there’s upside to nearly $140 per share in the restaurant that’s focused on “beer, wings, and sports.”