For starters, if you haven’t yet read through our piece on General Electric’s (GE) third-quarter earnings, it’s a must-read. The step-up in backlog and order trends at the industrial behemoth are quite remarkable, and we think GE’s performance bodes well for the sector as a whole. Still, let’s drill down on a few themes across the industrial space and how our Best Ideas portfolio is well-positioned to capture the strength of underlying trends.

Danaher (DHR)

Danaher reported third-quarter results Thursday that showed revenue expansion of 5.5% and diluted net earnings per share growth of 9%. The company generated 30 basis points of operating-margin improvement and generated more than $800 million in free cash flow, or about 17.8% of revenue (a very strong number). ‘Test & Measurement’ revenues faced modest pressure, ‘Environmental’ sales leapt 10% (4.5% core), ‘Life Sciences & Diagnostics’ revenue jumped 10.5% (6% core), ‘Dental’ sales advanced 4.5% (3.5% core), and revenue from ‘Industrial Technologies’ increased 1% (-1% core).

The firm’s ‘Life Sciences & Diagnostics’ segment—which houses Beckman Coulter, Leica, and Radiometer—revealed the greatest absolute increase in revenue expansion and the best operating profit margin improvement (+250 basis points) of any of Danaher’s business lines. The segment’s gem Beckman Coulter, which Danaher acquired in early 2011, makes devices that automate biomedical testing (blood, immunoassay, chemical), and its systems are found in hospitals around the world. The firm bumps heads with firms such as Becton, Dickinson (BDX), Johnson & Johnson (JNJ), Siemens (SI), Roche and Abbott (ABT). We’re viewing Danaher’s strong performance in this area as support for our holding the Health Care Select SPDR (XLV) in the portfolio of our Best Ideas Newsletter.

Dover (DOV)

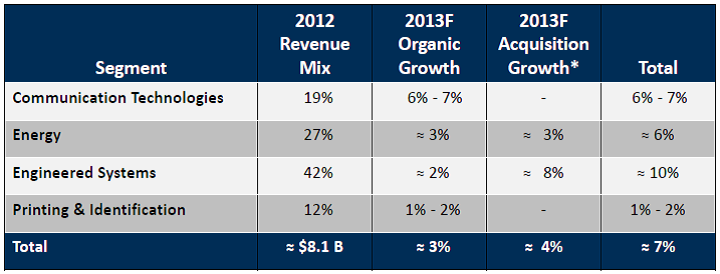

Dividend Aristocrat Dover reported third-quarter results Thursday that revealed 7% revenue growth and 20% earnings expansion. Bookings jumped 9%, segment margins improved 100 basis points, and free cash flow jumped 30% to $283 million (about 12% of revenue). Though the company noted bookings expansion was broad-based, the firm’s overall book-to-bill was 0.96 (we’d prefer this to be greater than 1). Still, we’re not reading too much into the slight shortfall in replacing revenue with new orders. The strongest performing segment on an organic basis continues to be its ‘Communication Technologies’ operations.

Image Source: Dover

The company’s ‘Communication Technologies’ segment serves the consumer electronics market in design and assembly of micro-acoustic audio equipment for use in personal mobile handsets. Dover noted that it experienced solid growth in this division thanks to new smartphone product launches. We believe we’re adequately exposed to this strength via our position in Apple (AAPL) in the portfolio of our Best Ideas Newsletter.

Honeywell (HON)

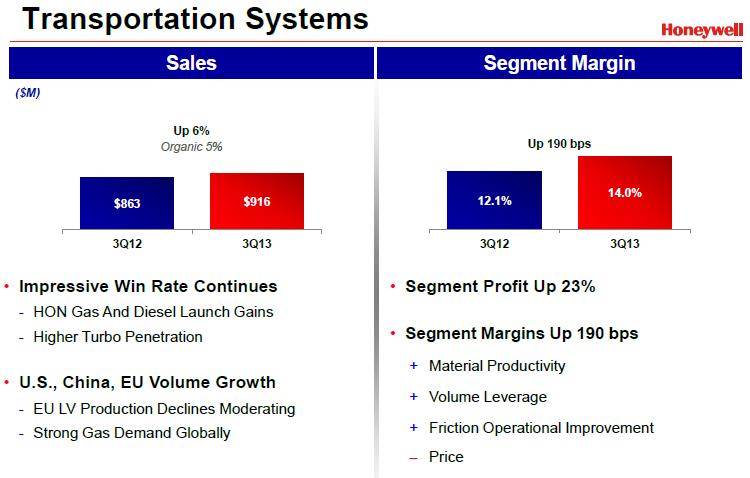

Honeywell’s third-quarter results, released Friday, weren’t as strong as we would have liked, but they weren’t bad either. Revenue advanced 1% on an organic basis and net income nudged 4% higher on 90 basis-points of improvement in operating margin. Free cash flow came in at $937 million or about 9.7% of sales in the period. On an organic basis, the firm’s ‘Transportation Systems’ segment showed the most promise, jumping 5% from the year-ago quarter (its ‘Aerospace’ division was weighed down by defense and space shipment delays and DoD challenges).

Image Source: Honeywell

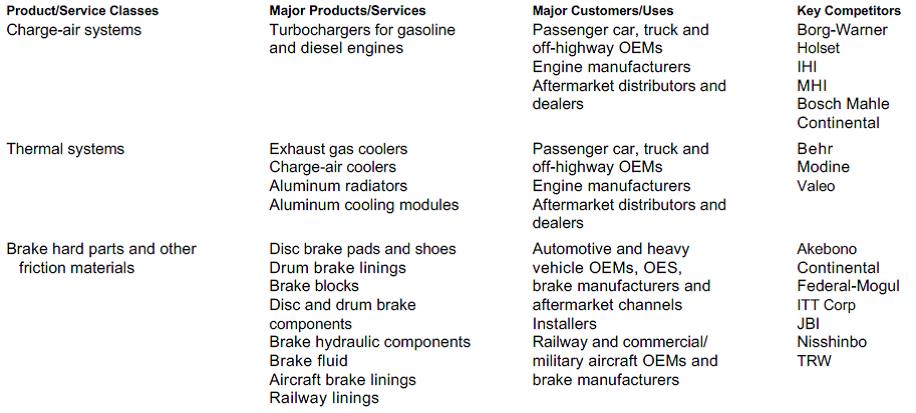

The firm’s ‘Transportation Systems’ division makes engine-boosting systems for passenger cars and commercial vehicles. It is also a leading provider of braking products, as shown below.

Image Source: Honeywell

We were pleased to see the strength in this division of Honeywell and welcomed management’s comments on the call suggesting that European light vehicle production declines are moderating. We think this bodes well for Best Ideas portfolio holding Ford (F).

Ingersoll-Rand (IR)

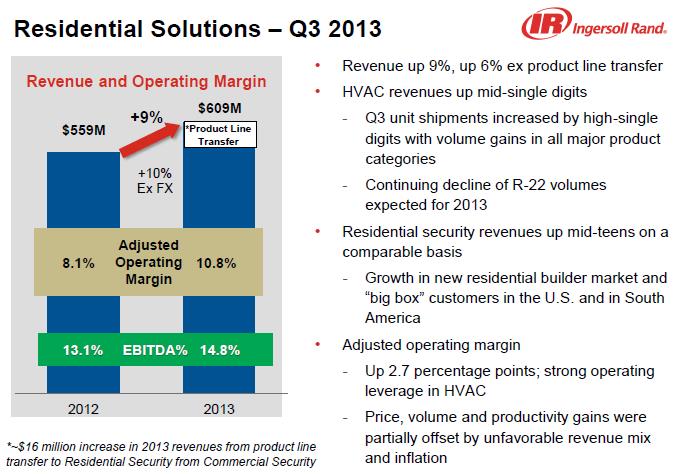

Ingersoll-Rand issued third-quarter results Friday that showed revenue growth of 4% and better-than-expected adjusted earnings per share from continuing operations. The company noted that bookings advanced 7% and that its adjusted operating margin increased 140 basis points to 14% from 12.6%. Ingersoll-Rand’s ‘Residential’ segment led the charge with adjusted segment revenue improvement of 6%.

Image Source: Ingersoll-Rand

The firm’s ‘Residential’ segment provides customers with a broad range of products and services including mechanical and electronic locks and energy-efficient HVAC systems. This segment houses well-known brands such as American Standard, Schlage and Trane. Management noted that “orders were up double digits in commercial HVAC units,” a positive sign for the US construction markets and for peers Lennox (LII) and Johnson Controls (JCI). Though we think many firms are ultimately levered to the health of the US construction markets (and we remain cognizant of the negative impact rising interest rates may cause), we continue to be exposed to the housing recovery via diversified banking ETFs, the Financial Select SPDR (XLF) and SPDR S&P Bank ETF (KBE). We’re not looking to increase our exposure to the housing or banking sector at this time.

Parker-Hannifin (PH)

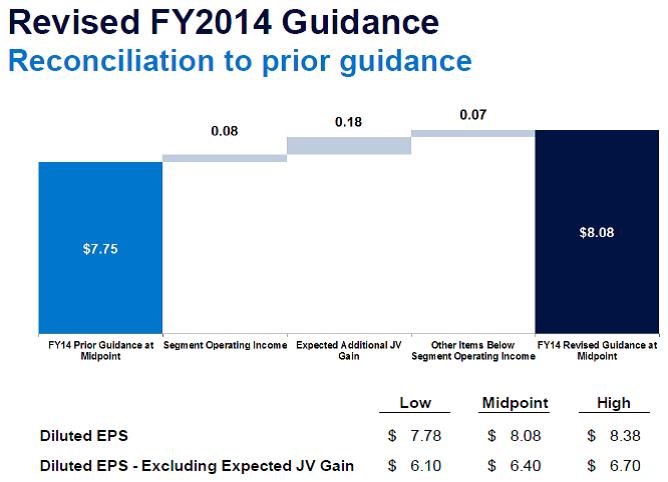

Parker-Hannifin’s fiscal 2014 first-quarter (calendar 2013 third-quarter) results, released Friday, were relatively mediocre, but the firm’s fiscal year 2014 guidance stole the show.

Though we’re not exactly comfortable with the wide earnings outlook range, the company did note that order rates turned positive in the period. The aerospace segment was a relatively sore spot for Honeywell given its defense exposure, but Parker-Hannifin noted that orders jumped 11% in its ‘Aerospace Systems’ segment. On the call, the firm noted that its commercial aerospace aftermarket and commercial aerospace OEM markets remain positive and that its aerospace backlog is at an “all-time high.” Our favorite idea in the aerospace industry continues to be Best Ideas portfolio holding Precision Castparts (PCP).

Valuentum’s Take

We like what we’re seeing in the industrial sector. General Electric’s performance provided a nice backdrop for the future outlook, and underlying trends in the calendar third-quarter results of Danaher, Dover, Honeywell, Ingersoll-Rand, and Parker-Hannifin play into the hands of the exposure we currently have in the portfolio of our Best Ideas Newsletter. This is not by accident.

Strength in Danaher’s Beckman Coulter division supports our healthcare exposure, while smartphone proliferation shown in Dover’s quarter showcases the market strength behind Best Ideas portfolio holding Apple. Honeywell’s ‘Transportation Systems’ business is encouraging for Ford, while resilience in the construction markets revealed in Ingersoll-Rand’s third-quarter indirectly supports underlying banking strength in the US (and our diversified exposure there). And finally, Parker-Hannifin’s aerospace order growth and backlog speak to our well-documented exposure to the aerospace end market and our current position in Precision Castparts.