On Thursday, Verizon (VZ) reported better than expected top- and bottom-line performance in its third quarter, which showed impressive subscriber additions and healthy iPhone sales. We continue to evaluate Verizon for addition to the portfolio of our Dividend Growth Newsletter, though we note its pursuit of Verizon Wireless has complicated matters quite a bit (given the outsize debt load it will take on). We’d like to see how the financials shake-out post-transaction, as there are quite a few moving parts that will negatively impact the firm’s Valuentum Dividend Cushion score (and potentially challenge its investment-grade rating).

Verizon added 1.1 million net retail wireless connections and 927,000 net retail postpaid connections in the period, leading to quarter-end marks of 101.2 million total retail connections and 95.2 million total retail postpaid connections. Wireless service revenue advanced 8.4%, and the company’s wireless operating and EBITDA margins were wonderful, coming in at 22.8% and 51.1% in the period, respectively. The firm noted that Apple’s (AAPL) iPhone accounted for 51% of activations in the period (up from 43% in the second quarter and 46% in the year-ago period), suggesting the smartphone maker is picking up share in the US market. The firm’s wireline business saw a 1% drop in total revenue, though segment EBITDA did nudge higher from the same quarter last year. All-in, Verizon’s consolidated revenue advanced 4.4%, driving adjusted earnings per share to $0.77, roughly a 20% increase compared with adjusted earnings per share of $0.64 in the prior-year period.

Valuentum’s Take

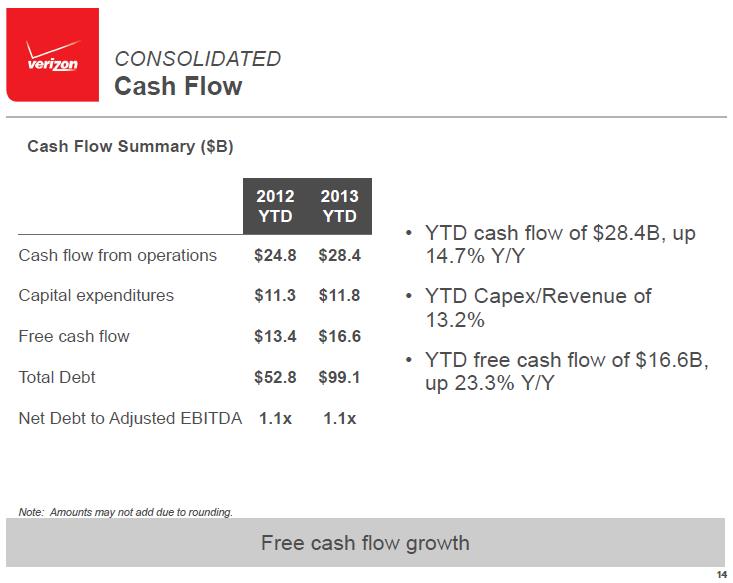

Image Source: Verizon

Verizon cash-flow metrics are absolutely phenomenal (at present) – one of the reasons that turned our heads with respect to the firm’s dividend growth promise. However, Verizon will be taking on a massive amount of debt to fund its acquisition of 45% interest in Verizon Wireless. Though the firm anticipates a steady de-leveraging and return to pre-transaction credit ratings, $117 billion in pro forma debt is NOT small potatoes.

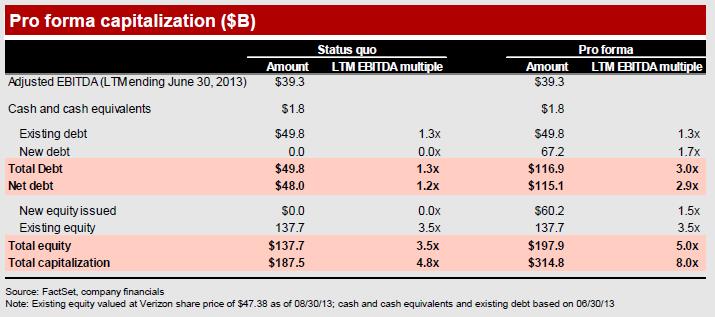

Image Source: Verizon

For example, after the transaction is completed, Verizon’s debt/EBITDA (a common leverage metric used in credit analysis) will triple to roughly 3x from just over 1x. Any slip up in EBITDA that may happen as a result of execution or the occurrence of a cyclical trough more severe than “normal” could see the firm’s investment-grade credit rating pulled by the rating agencies.

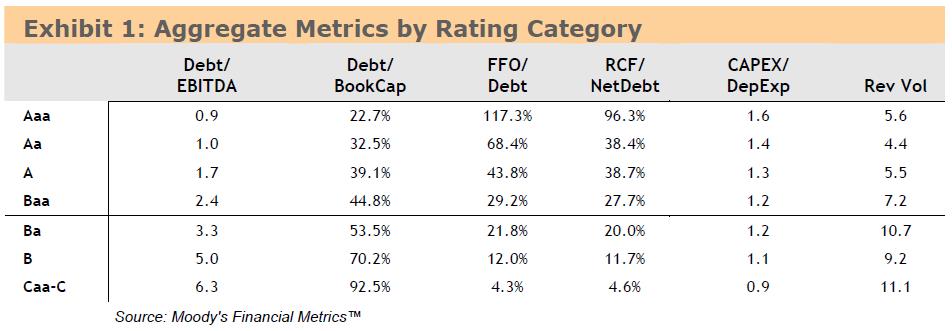

For example, the first column on the left (debt/EBITDA) reveals that companies at the bottom rung of investment grade (Baa) have average debt/EBITDA ratios of about 2.4. Those at the top rung of non-investment grade (junk, or a rating of Ba or below) have average debt/EBITDA ratios of 3.3. Though there are many other factors that go into rating credits, at a pro forma debt/EBITDA mark of 3x, Verizon is walking a fine line.

Image Source: http://business.illinois.edu/j-gentry/workshop/exhibit-06.pdf

All things considered, we liked Verizon’s third-quarter performance, but we’re still on the sidelines with respect to adding it to the portfolio of our Dividend Growth Newsletter. If all doesn’t go perfectly at Verizon, its investment-grade credit rating may be challenged at the trough of the economic cycle. We don’t want to be holders of its equity if that happens.

Telecom Services: BCE, CLWR, CTL, DCM, EQIX, FTE, FTR, PT, S, T, TWTC, VOD, VZ, WIN