On Wednesday, Dividend Growth portfolio holding Kinder Morgan Energy Partners (KMP) increased its quarterly cash distribution per common unit to $1.35 ($5.40 annualized). The increase represents a 7% jump over the payout during last year’s quarter and a three penny bump from the second quarter of this year. We continue to be huge fans of the consistency of distribution increases at Kinder Morgan Energy Partners, where existing management has increased the distribution 49 times since early 1997.

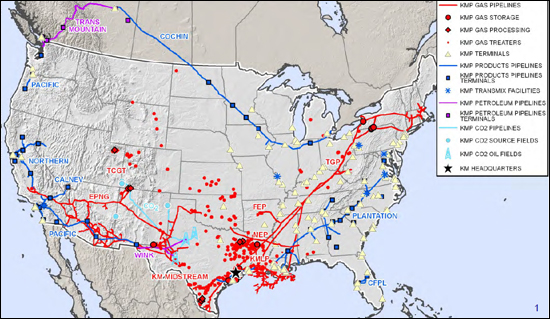

We expect to update our dividend report on the pipeline transportation master limited partnership shortly and continue to believe Kinder Morgan Energy Partners represents a core position in the portfolio of our Dividend Growth Newsletter. Though we note that the MLP is significantly dependent on the healthy functioning of the capital markets (it has accessed them for roughly $37 billion since inception), its focus on stable fee-based cash flow (more than 80% of its business) mitigates this risk to a degree. The MLP’s asset footprint is unmatched, with its natural gas network connected to every important US natural gas resource play, including Eagle Ford, Marcellus, Utica, Uinta, Haynesville, Fayetteville, and Barnett. It remains one of our favorite income ideas.

Source: http://www.kindermorgan.com/investor/kmp_overview.cfm