Late last week, HCP (click ticker for report: ) terminated CEO, Chairman, and President Jay Flaherty III after 10 years of leadership. Flaherty led the firm admirably throughout the Great Recession, never reducing the dividend and achieving share appreciation of 112% versus 80% for the S&P 500 over the same time frame. Flaherty also raised the quarterly dividend from $0.415 per share to $0.515 (a 27% increase) during this tenure (dividend history). In short, HCP performed quite well through Flaherty’s reign.

Image Source: Glassdoor

Non-Executive Chairman Mike McKee noted that the firing had nothing to do with underlying financial performance or operational issues. Without much board transparency, it’s difficult to ascertain exactly what happened; however, employer review website Glassdoor has 3 of 6 reviewers disapproving of Flaherty while 2 have no opinion and only 1 reviewer supports the ousted executive. Perhaps the board did not like the culture that had developed at HCP over the past ten years during which the company has had 4 different CFOs. Or maybe the well-compensated Flaherty began expressing less interest in running the company.

Regardless, Flaherty will remain on the board of directors, and the attention now turns to another board member, Lauralee Martin, who leaves Chicago-based commercial real estate firm Jones Lang LaSalle (JLL) to become CEO and President of HCP. Martin has spent years learning the real estate industry at GE (click ticker for report: ) and Heller Financial before joining Jones Lang LaSalle where she became CFO in 2002 and COO in 2005. Shares of her former company rose over 300% during her tenure, though we think it is a stretch to attribute share performance exclusively to Martin. Further, she moved into the role of CEO of Americas at Jones earlier this year to manage the company’s fastest-growing business.

In our view, Martin is a proven leader, though some question her experience in the healthcare business. Some have also suggested that her reign may be temporary, in which case HCP will be left with another leadership scramble. For the meantime, we believe she will focus on improving the corporate culture and perhaps executing some deals of her own. Martin has been on the board of directors for 5 years so she isn’t a complete novice in the healthcare industry.

Valuentum’s Take

Shares of HCP have fallen substantially after peaking in the mid-$50 range in May, and the current market price values the company at the low-end of our fair value range. Still, a management shakeup that some assert will cost the firm $50 million may reveal that all is not well at HCP.

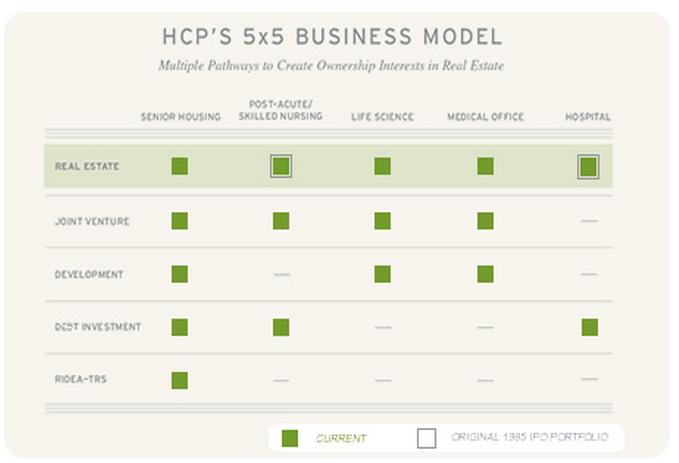

Image Source: HCP

At current levels, HCP sports a compelling dividend yield (5.3%) and interesting valuation. Still, we’d like a little more clarity on the management change before becoming comfortable with the firm. Considering Flaherty spent 10 years as CEO and only now has been replaced sounds a bit strange, in our view. At this time, the management shakeup has no impact on our fair value estimate or opinion of the firm’s 5 X 5 business model (shown above). We continue to monitor developments closely.