Though it has already sold nearly $3 billion in assets since 2012, Brazilian mining giant Vale (click ticker for report: ) is mulling additional asset sales. CEO Murilo Ferreira admitted Tuesday that the firm was considering selling its 40% stake in aluminum producer Norsk Hydro ASA as well as some of its oil and gas assets.

Vale joins rivals Rio Tinto (click ticker for report: ), Anglo American, and BHP (click ticker for report: ) in the effort to focus on the best operations while selling off underperforming assets. As we’ve previously noted, this situation becomes difficult when every party is also interested in selling weak assets, as would-be buyers can seek out bargains and demand hefty discounts.

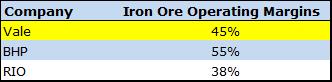

The fundamental reasoning behind Vale’s decision is sound, as we believe there is no reason to invest in poor assets just for the sake of diversity. This is particularly true given Vale’s robust iron ore operating margins (shown below).

Image Source: Company Filings, most recent fiscal year

Valuentum’s Take

Vale’s decision is far from revolutionary, as virtually every miner is scrambling to sell underproductive assets. We think shares of Vale and BHP look fairly valued, and Rio Tinto remains our favorite of the major iron ore miners and a holding in our Best Ideas Newsletter portfolio.

Metals & Mining – Diversified: BHP, CLF, FCX, RIO, SCCO, SLW, VALE