On Friday, Best Ideas Newsletter portfolio holding Teva Pharma (click ticker for report: ) announced that its generic version of AbbVie’s (click ticker for report: ) Niaspan would hit the US market this week. The news is particularly noteworthy because Teva was the first-to-file, making the product eligible for 180 days of marketing exclusivity (a large windfall for the company).

To learn more about the generic industry and the significant benefits of marketing exclusivity, please consult our initiation report on the generics industry here.

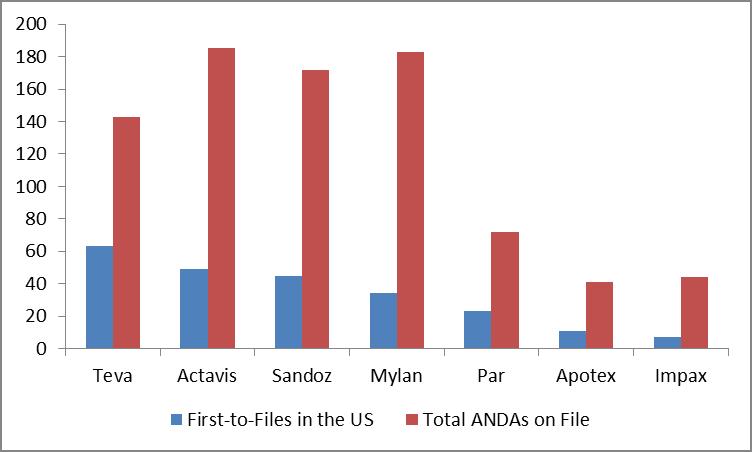

Niaspan is a cholesterol drug used to reduce elevated TC, LDL-C (bad cholesterol), Apo B and TG levels, and to raise HDL-C cholesterol (the good variety). Niaspan had annual sales of more than $1.1 billion in the US, according to IMS data. Sales of Niaspan have advanced in the first half of fiscal year 2013, growing 4% year-over-year. Niaspan is one of the top 15 drug patent losses for 2013, and we continue to view Teva’s first-to-file opportunities as the best among peers (blue bar below).

Source: Actavis, Valuentum (January 2013)

Valuentum’s Take

Teva’s huge opportunity remains in its NTE (new therapeutic entity) pipeline, which the company believes is a multibillion-dollar opportunity. We’re also encouraged by the odds of incremental revenue growth from the firm’s niacin generic (and other opportunities in its best-in-class first-to-file pipeline). We continue to hold shares of Teva in the portfolio of our Best Ideas Newsletter.

<< Teva Announces Favorable Court Ruling in AZILECT® Patent Infringement Litigation Against Mylan