Key Takeaways

· Cost cuts helped Rio Tinto stomach weak commodity end markets.

· Production increases buffered weak iron ore prices.

· China remains a key driver of growth. Country data flow continues to contradict.

· We continue to hold Rio Tinto in our Best Ideas Newsletter portfolio…but we think it could be a wild ride.

Best Ideas Newsletter portfolio holding Rio Tinto (click ticker for report: ) announced weak, but better-than-expected, financial performance for the first half of 2013 Thursday. Earnings per share declined 71% year-over-year to $0.93, though revenue declined only 3% year-over-year to $24.5 billion as production increases were able to partially offset commodity price weakness. Underlying earnings per share, which is adjusted for one-time charges, exchange rates, and write-downs, declined just 18% year-over-year to $2.29.

Headline results were relatively poor, but cash flow held up well during the first half. Operating cash flow increased 1% year-over-year to $8 billion, and the firm reduced capital spending to $6.9 billion. Thus, Rio Tinto generated nearly $1.1 billion in free cash flow, nearly three times higher than what it generated in the first half of 2012 and equal to 5% of total revenue. As a result, Rio was able to increase its interim dividend 15% year-over-year to $0.835 per share.

Given the weakness of commodity prices, the improvement in cash flow may seem somewhat surprising. However, CEO Sam Walsh has done a fantastic job blunting lower prices with cost reductions. Year-to-date, Rio reduced total costs by $1.5 billion through a combination of operational savings ($977 million) and lower spending on exploration and evaluation ($483 million).

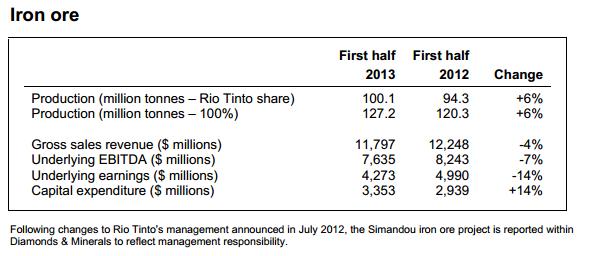

Image Source: RIO 1H 2013

A great deal of Rio’s strength came from a boost in iron ore production, which was up 6% year-over-year thanks largely to record production from Pilbara (96 million tonnes attributable to Rio). The mine currently has annual production capacity of 237 million tonnes, but Rio is investing in the mine to boost capacity to 290 million tonnes, and that is just the first phase of the expansion. Walsh is confident the firm can boost incremental production by another 70 million tonnes to 360 million tonnes if necessary. Full-year production is estimated at 265 million tonnes.

Iron Ore Growth Flies in the Face of the Pace of Manufacturing Expansion in China

For much of 2013 (and even late 2012), iron ore demand has been a hotly-debated issue. However, iron ore imports in China during July jumped 26% over the same period a year ago to a record 73.1 million tonnes, which was also 17% higher than June. This flies in the face of the contracting HSBC/Markit Manufacturing Purchasing Managers’ Index (PMI) we’ve seen in China in June. Walsh noted that growth in China was slowing, but reminded us that it is slowing off a larger base. In fact, Rio sounds relatively confident about China, with Walsh saying on the conference call:

“In China, the economy will evolve as it transforms to a consumption led growth. Sentiment will continue to be influenced by these global structural shifts creating volatility in our markets. This is likely to persist making it harder to predict overall growth. But importantly our long-term view of the Chinese economy remains unchanged. We expect to see continued robust growth in absolute demand for commodities.”

The CEO brings up an excellent point that often gets lost upon investors with attention fixated on growth—iron ore doesn’t necessarily need to grow at the same velocity for the absolute demand for iron ore to remain robust.

China’s Services Sector and Industry Production Show Resiliency

China’s manufacturing segment may be struggling, but we’ve witnessed some resiliency from the HSBC/Markit Services PMI, which held steady at 51.3 in June and July (a reading above 50 suggests month-over-month expansion). Although a measure of 51.3 doesn’t suggest robust growth by any means, the reading does reveal Chinese consumers are still increasing spending. Further, the services sector is likely fundamentally healthier than manufacturing as it is immune from cheap foreign competitors. During the last century, manufacturing has centered on where producers can get the best “bang for the buck,” so declines in China’s manufacturing dominance should be expected. Industrial production rose 9.7% year-over-year in the country in July, and we continue to receive a flurry of conflicting data on the underlying trajectory of the Chinese economy.

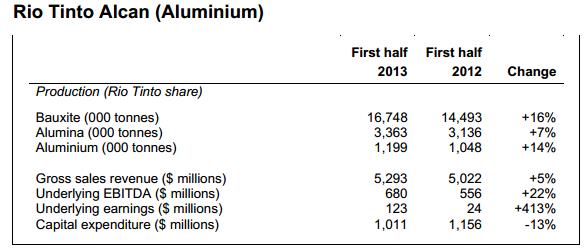

Alcan performed materially better than it did during the prior-year period, with underlying earnings up over 400% to $123 million and production increases in bauxite, alumina, and aluminum. This increase in profitability came in spite of an 8% drag from declining market prices. Rio received post-tax cost-savings of $95 million and had increased production at its Alma smelter.

Rio has spent time exploring ways to rid itself of its underperforming aluminum business, but management remarked that it has yet to receive an acceptable price. As we’ve stated before, several large miners would love to sell underperforming assets, but therein lies the problem: several assets are for sale. We’re satisfied with management’s decision to fix cost and production issues at this point.

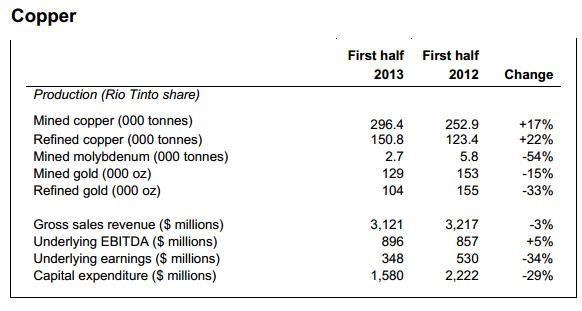

Copper production increased 17% year-over-year during the first half, with refined copper production also up 22%. Large production increases were able to offset copper prices that were materially lower than a year ago; thus, total sales declined only 3% year-over-year to $3.1 billion. Copper contributed just $348 million in underlying earnings, and the segment is far less material to Rio Tinto’s operations than iron ore.

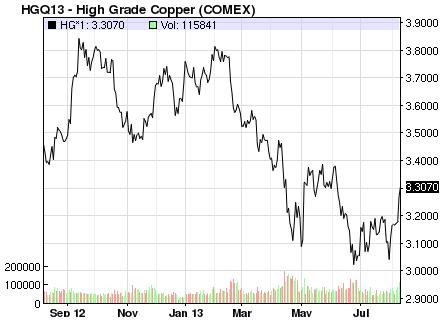

Image Source: NASDAQ

Assuming emerging-market demand returns, copper could be on its way for a stronger second half. We’ve seen copper prices recover somewhat in August; however, comparisons will be difficult considering prices remained mostly above $3.50 per pound in the year-ago period. Another incremental positive came from the company selling 80% of its Northparkes mine, which generated $820 million, while the firm also sold its interest in Eagle nickel for $315 million.

Energy production was mostly higher during the first half of 2013, even though revenue declined 11% year-over-year to $2.6 billion. Underlying earnings in the segment turned negative, but underlying EBITDA held up relatively well, more than doubling if we adjust for one-time gains from exploration sales.

Thermal coal prices have actually strengthened during the first half of 2013, while met coal prices have fallen off of their high in February. We heard relatively little detail about coal on the conference call, to the effect that it was only mentioned once.

We believe coal will face a number of challenges going forward as a result of the abundance of natural gas and the US exporting more coal (putting pressure on import prices). We remain cautious on this segment going forward, but as with everything not named iron ore at Rio Tinto, its performance likely won’t make or break the company.

Valuentum’s Take

Although we acknowledged that the impact of declining iron ore prices on Rio’s profitability wouldn’t be completely devastating, we think results held up better than we could have hoped for. Walsh’s focus on costs and boosting returns for shareholders has certainly improved Rio Tinto’s cash flow thus far.

We’re very encouraged by first half results and trust that management will continue to appropriately manage Rio’s balance sheet by selectively reducing debt and increasing dividends. But at the end of the day, much of Rio’s performance will continue to be tied to the volatile behavior of iron ore prices. We plan to hold on to our small Rio Tinto position in the portfolio of our Best Ideas Newsletter, but we think it will continue to be a wild ride.

Metals & Mining – Diversified: BHP, CLF, FCX, MLM, RIO, SCCO, VALE, VMC

Related ETFs: FTSE China 25 Index Fund (FXI), Australian Dollar Trust (FXA)

Other China Equity ETFs: SPDR S&P China (GXC), PowerShares Golden Dragon China (PGJ), Guggenheim China All-Cap (YAO), iShares FTSE China (FCHI), Market Vectors China ETF (PEK), Morgan Stanley China A Share Fu (CAF), ProShares Short FTSE China 25 (YXI), ProShares Ultra FTSE China 25 (XPP), ProShares UltraShort FTSE China 25 (FXP), iShares MSCI China Index (MCHI), Direxion Daily China Bull 3X Shares (YINN), Direxion Daily China Bear 3X Shares (YANG), RBS China Trendpilot ETN (TCHI), Wisdom Tree China Dividend ex-Financials (CHXF), KraneShares CSI China Five Year Plan ETF (KFYP).