Dividend Growth Newsletter portfolio holding Phillips 66 (click ticker for report: ) announced slightly weaker than anticipated second quarter earnings Wednesday morning, which isn’t too surprising after the insight we received from peer Valero (click ticker for report: ). Revenue declined 8% year-over-year to $43.9 billion, which was actually above estimates but not materially important for Phillips 66. Earnings per share declined 33% to $1.50 per share, falling well short of consensus expectations. Free cash flow remained relatively strong at $597 million during the quarter, and year-to-date, it stands at $2.4 billion.

Image Source: PSX 2Q 2013 Investor Presentation

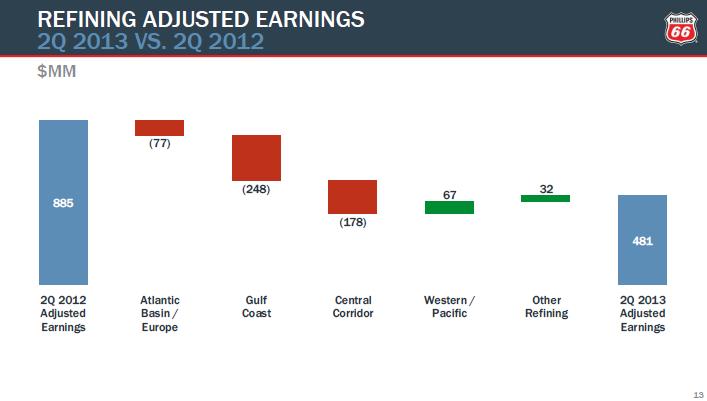

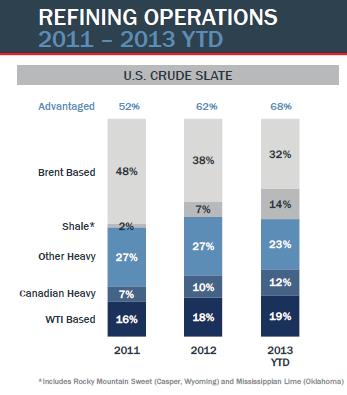

Where did Phillips 66 earnings weakness come from? Without question, it was the firm’s refining margin. Advantaged crude remained flat as a percentage of the mix sequentially, but the spread of the advantaged crude mix has fallen considerably, so the firm isn’t receiving the sharp discount from Bakken supplies that it did in the first quarter. Still, based on the rising supplies of shale oil in the US and Canada, we think Phillips 66 will be able to increase its advantaged crude slate and receive discounts if/when excess supply occurs.

Where did Phillips 66 earnings weakness come from? Without question, it was the firm’s refining margin. Advantaged crude remained flat as a percentage of the mix sequentially, but the spread of the advantaged crude mix has fallen considerably, so the firm isn’t receiving the sharp discount from Bakken supplies that it did in the first quarter. Still, based on the rising supplies of shale oil in the US and Canada, we think Phillips 66 will be able to increase its advantaged crude slate and receive discounts if/when excess supply occurs.

Further, Philips 66 recently launched its midstream MLP, Phillips 66 Partners (PSXP) in order to bolster the firm’s midstream business. This includes transporting crude to Phillips 66 refineries, giving the firm the opportunity to capture more value along the supply chain.

A dreadful power outage also damaged second quarter earnings. Though the problem was not caused internally, CFO Greg Maxwell was not happy about the event, saying:

”… the biggest disappointment in the quarter was having a second power outage at Sweeny, which by the way impacts all the way across our businesses, so we had the refinery down, all the ethylene units were down, the frac was down. So it impacted all three business platforms that we had, and so we’ll absolutely get that one fixed.”

Earnings in Phillips 66’s other businesses weren’t nearly as volatile. Midstream earnings fell 5% year-over-year to $90 million, which management blamed largely on declining NGL earnings.

Image Source: PSX 2Q 2013 Investor Presentation

Chemical earnings declined 25% year-over-year to $181 million thanks to the aforementioned power outage and a 91 day turnaround at its Port Arthur facilities that cost the firm 540 million pounds of production. This would have added another 14% of olefin and polyolefin production, and given the low marginal costs, would have likely boosted earnings significantly.

Adjusted earnings in the firm’s marketing and specialties segment increased 8% year-over-year to $309 million. It appears some of this may have to do with RINs (Renewable Identification Numbers) being sold at premiums rather than improved performance, but overall, we’re pleased with the segment’s performance.

Looking ahead, the firm predicts it will have refinery utilization in the mid-90% range and capital expenditures of approximately $1.9 billion. We would have been concerned by this spending when Philips 66 went public given its debt load, but management has been prudent about eliminating debt, retiring another $500 million this quarter.

Valuentum’s Take

On the surface, Phillip 66’s quarter didn’t look great, as profitability fell in two of its most important segments. But under further examination, the second quarter looks more like an aberration than the norm. We like the company’s decision to expand its midstream business to improve value capture, even if the firm doesn’t receive the same large discounts from the Bakken that it did earlier in the year. We continue to hold the name in the portfolio of our Dividend Growth Newsletter.