Pharmaceutical firm Amgen (click ticker for report: ) announced strong second quarter results Tuesday afternoon. Revenue increased 5% year-over-year to $4.7 billion, modestly exceeding consensus estimates. Adjusted for certain items, earnings-per-share climbed 3% year-over-year to $1.89, a figure well above consensus expectations. Free cash flow was terrific at $1.4 billion, equal to 30% of total revenue.

Amgen’s white-blood-cell-growth drugs designed to prevent infections during chemotherapy, Neulasta and Neupogen, saw combined sales growth of 7% year-over-year to $1.4 billion as Neulasta becomes the drug of choice.

Amgen’s other billion-dollar treatment Enbrel, a rheumatoid arthritis and plaque psoriasis drug similar to AbbVie’s Humira (click ticker for report: ) and Johnson & Johnson’s Remicade (click ticker for report: ), posted 9% revenue growth. We were relatively pleased with Enbrel’s sales expansion, especially after Humira sales surged 12% globally. Competition remains fierce, but Executive Vice President Tony Hooper expressed confidence regarding Enbrel’s market position, saying on the conference call:

“Enbrel continues to hold share while in dermatology we saw a slight decrease in share due to increasing competitor activity. Our direct to consumer advertising continues to emphasis the benefits of using Enbrel. Enbrel consistently leads to total brand awareness in the rheumatology segment. Additionally, physicians continue to augment over 90% of Enbrel patient requests. With Enbrel we remain the value share leader in both rheumatology and dermatology segments and I am confident in its further growth potential.”

Although the same drug marketed differently (denosumab), osteoporosis treatment Prolia and bone tumor drug Xgeva posted revenue growth of 57% and 39% year-over-year, respectively. Combined sales totaled $437 million (up 46% year-over-year), and we think the drug is exhibiting blockbuster potential after achieving over $1 billion in sales during fiscal year 2012.

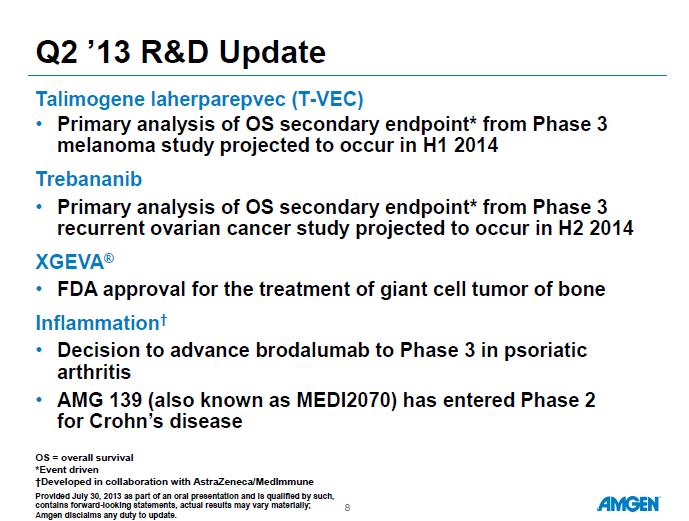

Image Source: AMGN 2Q 2013 Investor Slides

We heard plenty about Amgen’s immunotherapy treatments at ASCO in early June, but management added some color on Xgeva as well as its inflammation treatment pipeline (shown above). Management also added some positive commentary on genetic treatments. Executive Vice President Sean Harper added:

“Around six months into it, we are finding our scientific integration with deCODE Genetics to be even more productive and tactful than we had hoped. We now have multiple cases in which advanced human genetic analysis have allowed us to establish programs against new novel disease targets as well as to prioritize the existing targets within our early and new stage pipeline.”

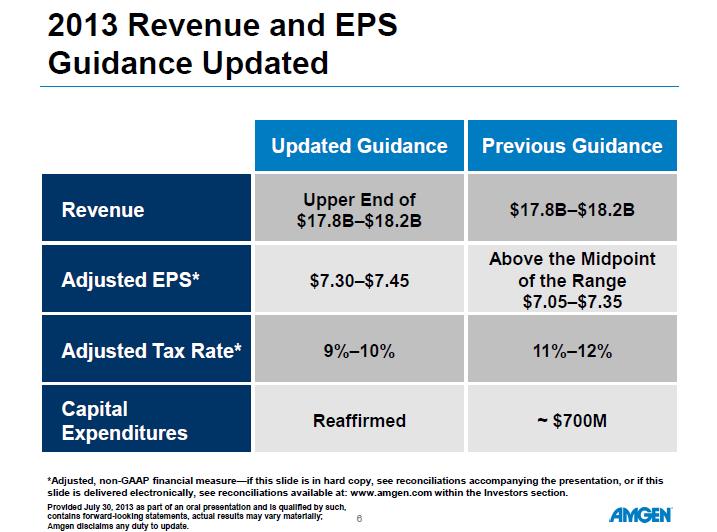

Image Source: AMGN 2Q 2013 Investor Slides

Looking ahead, Amgen increased its outlook for fiscal year 2013, boosting its earnings per share guidance to $7.30-$7.45 (was $7.05-$7.35) thanks to the solid revenue performance and a lower tax rate. Revenue is expected to be at the upper-end of the firm’s previous sales guidance of $17.8-$18.2 billon.

Valuentum’s Take

Amgen continues to mold itself into one of the larger pharmaceutical companies in the world, stocked with a promising pipeline and solid stable of drugs. While we will make some tweaks to our valuation model, we think shares look fairly valued at this time; thus, we will not be establishing a position in the portfolio of our Best Ideas Newsletter.