Wednesday after the market close, Best Ideas Newsletter portfolio holding Visa (click ticker for report: ) reported wonderful results for its fiscal year 2013 third quarter. Revenue surged 17% year-over-year to $3 billion, easily exceeding consensus estimates. Earnings-per-share growth was even better, jumping 20% year-over-year to $1.88, well above consensus expectations. Excluding accrued litigation expenses, free cash flow is running at about $5 billion year-to-date, equivalent to an amazing 57% of revenue. Few companies are able to match Visa in terms of converting revenue into cash for shareholders.

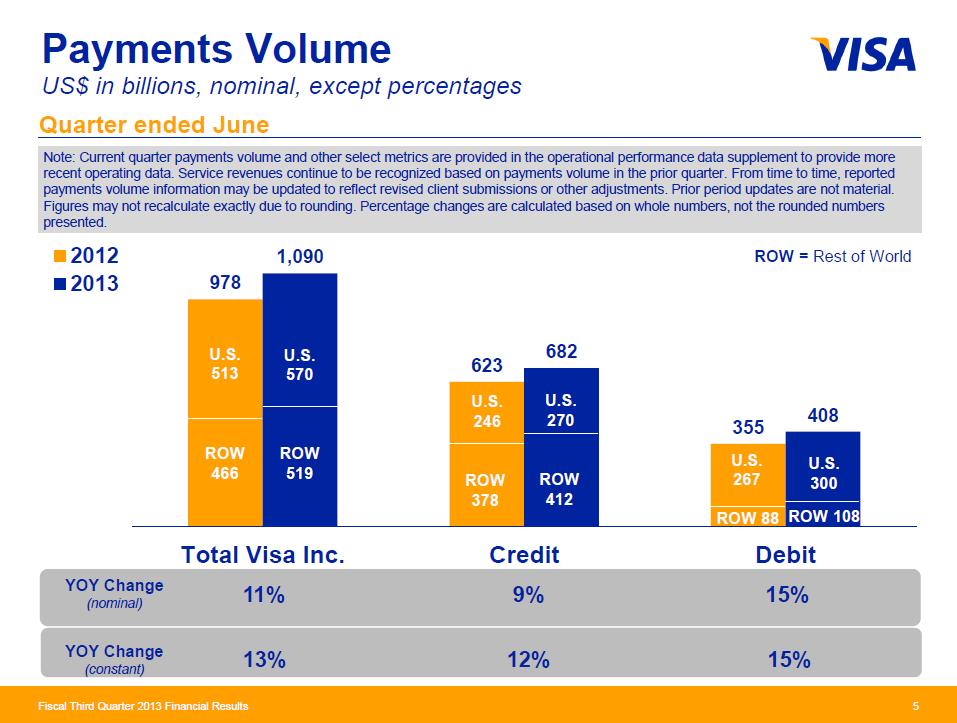

Image Source: V 3Q FY2013 Investor Presentation

Visa continues to ride the secular trend in credit payments to strong payment volume growth. Total payments processed increased 11% year-over-year to $1.09 trillion, driven by strong credit payment volume growth of 9% and debit volume payment growth of 15%. The infamous Durbin Amendment began in April 2012, so Visa faced relatively easy comparisons with respect to US debit payment volumes (debit volume was down 54% year-over-year in the third quarter of fiscal year 2012). Still, we think the company has found its bottom in debit processing, and we should see continued growth going forward.

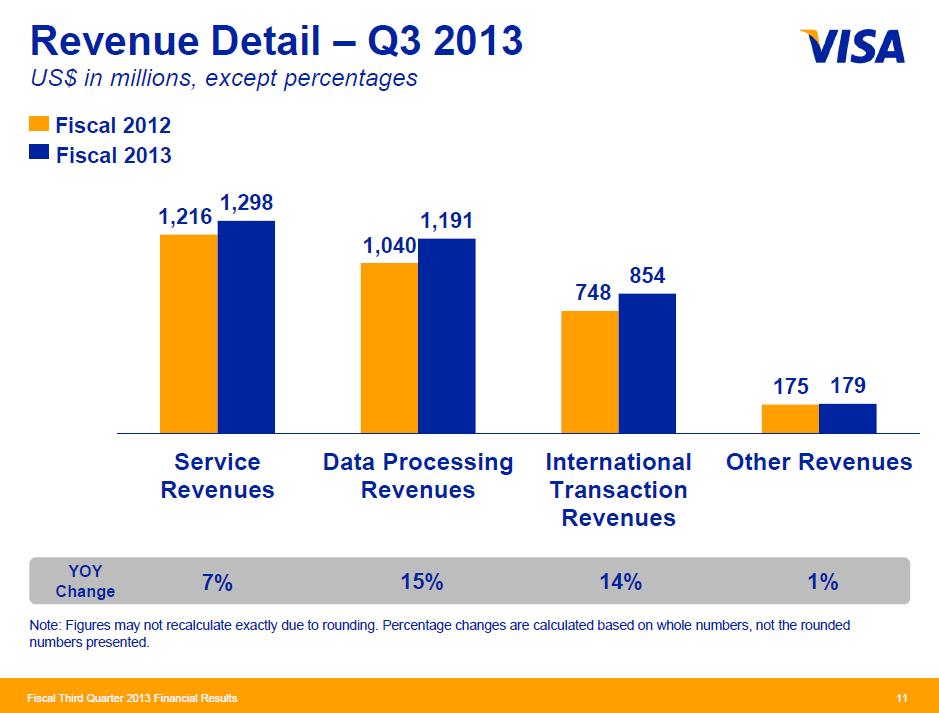

Image Source: V 3Q FY2013 Investor Presentation

Visa experienced a substantial decline in incentive volume related to the timing of its payment processing agreement with JP Morgan Chase (click ticker for report: ), but revenue performance was still solid. In fact, we’re seeing strong top-line expansion from ‘International Transaction’ revenue (up 14%) as well as ‘Data Processing’ revenue, which increased 15% year-over-year. Interestingly, Visa’s results refute concerns about weak consumer spending in the US, where total payment volume increased 11% year-over-year. CEO Charlie Scharf had some interesting commentary on what Visa is seeing in its payments volume, saying on the conference call:

“So the affluent part of our portfolio really has been the driver of the credit spend that we have been recording over the past year. In the last quarter or two, we are starting to see some participation from the next income cohort down but it is not yet significant and therefore it’s not a material driver in our results today.

As we look out into the coming year, when I describe the economic — underlying economic growth as sluggish, if I would relate that to the U.S., creating 200,000 jobs a month, which is kind of the minimum to make any progress against unemployment. We would describe that as non-anemic but as sluggish growth. And — but it is creating new jobs and those new jobs ultimately translate into spend.”

Essentially Visa sees the high-end consumer coming back strong, though the lower- and middle-tiers have yet to recover. Rates of economic growth above current expectations could provide some solid payment upside for Visa going forward.

Once again, revenue growth outpaced expense growth at Visa, even as the company invests heavily in CyberSource and V.me. Operating margins were 280 basis points higher than a year ago at 60.9% of revenue.

If there was anything negative to take away from the earnings call, it is that V.me growth hasn’t really taken off yet. V.me is Visa’s attempt to take on firmly-entrenched PayPal (click ticker for report: ) in the realm of online payments. Scharf described the situation perfectly, noting:

“Right, it’s the chicken and the egg which is, you know, merchants aren’t going to want to spend the time and the effort and the money to establish V.me on their site unless they think there is a real need for it. And the issuers are going to be careful about marketing it to their clients until there is a meaningful amount of acceptance.”

We could see the company invest more heavily in client incentives to gain traction going forward. Given Visa’s superb operational success over the duration of its publicly-traded life, we’re confident that management will make the correct decisions in order to improve V.me.

Guidance for the rest of fiscal year 2013 implies total free cash flow of $6 billion, earnings per share growth in the low-20% range, and 13% revenue growth. Fiscal year 2014 also looks strong, as the firm anticipates revenue growing at a low-double-digit rate to drive earnings-per-share expansion in the mid-teens (and free cash flow of approximately $5 billion).

Valuentum’s Take

Taking on credit risk is what differentiates American Express (click ticker for report: ) and Discover (click ticker for report: ) from Visa and Mastercard (click ticker for repot: ). This dynamic is why we prefer Visa’s business model; the firm simply collects a fee every time a card is swiped without risking credit defaults.

Visa continues to be among the best managed public companies in the world, as management remains laser-focused on generating long-term value for shareholders. We’re excited to continue holding the firm in the portfolio of our Best Ideas Newsletter.