Leading technology company Microsoft (click ticker for report: ) reported much weaker than anticipated fourth quarter results Thursday afternoon. Revenue performance was disappointing, expanding only 3% year-over-year on a non-GAAP basis to $19.1 billion, falling short of consensus estimates by several hundred million dollars. Earnings per share fell 10% year-over-year to $0.66, which excludes the impact of an inventory charge for the Surface RT tablet. Not surprisingly, this number was below consensus expectations. Though down substantially from the prior year’s quarter, free cash flow during the fourth quarter was $4.1 billion—equal to approximately 22% of revenue. For the full-year, free cash flow came in at $24.6 billion, which equates to 31% of revenue (an excellent showing).

One of the material events coming out of fourth-quarter results was the $900 million inventory impairment for Surface RT tablets. CFO Amy Hood described the price reduction as follows:

“Hear what we did this quarter. We reduced the price of Surface RT by $150 to $349 per device. As a result of this price change as well as inventory adjustments for related parts and accessories we recorded a $900 million charge to our income statement. While this resulted in a negative $0.07 impact on earnings, we believe this pricing adjustment will accelerate Surface RT adoption and position us better for long term success.”

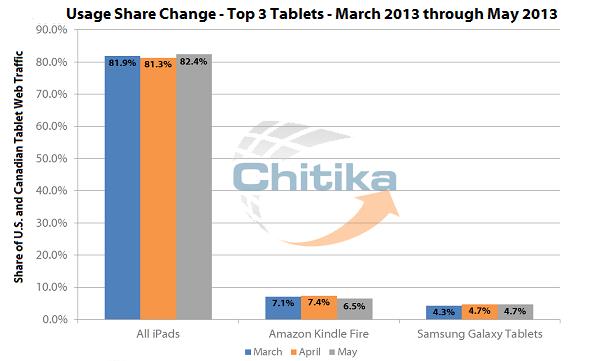

Anytime a company is forced by the market to reduce prices on its products indicates that demand is weak (and its competitive position with respect to that particular platform is waning). We think the Surface is simply hurting from the popularity of Apple’s iPad (click ticker for report: ), which stands head-and-shoulders above the competition (according to recent market share data).

Image Source: Chitika

That’s not to say the Surface is a bad product, but it is suffice to say Microsoft might have another Zune on its hands. The Zune was a capable and high-quality MP3 player, but it simply could not compare to Apple’s iPod, so it was eventually discontinued. We hope the Surface doesn’t suffer a similar fate, but if the firm cannot make money on the product, then there is really no reason to keep making them. We would like Microsoft to succeed in making ‘hardware’ products, but aside from Xbox, the firm has produced mainly ‘flops’.

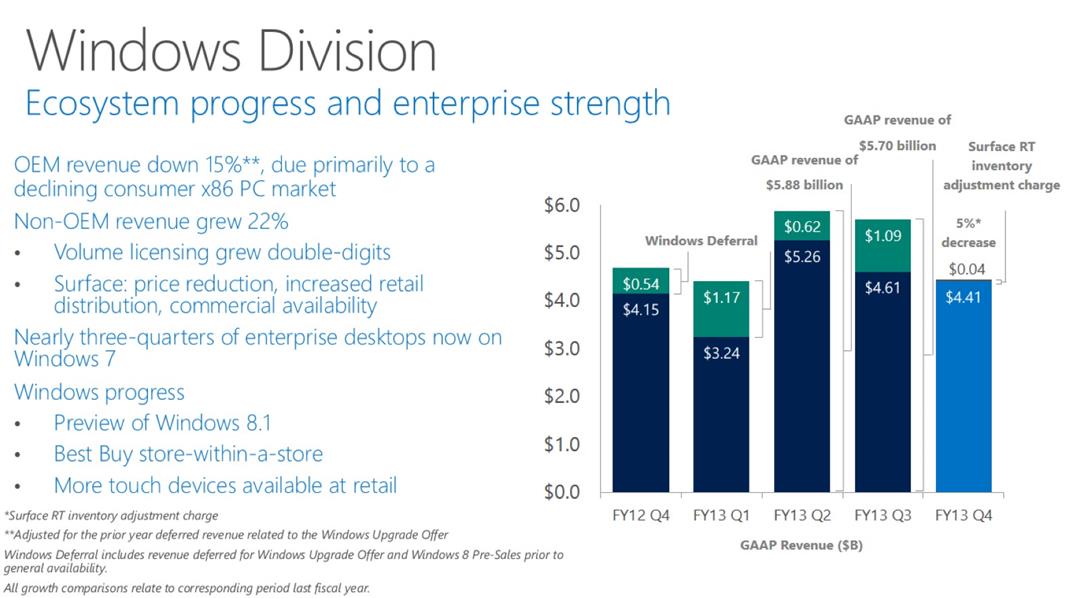

Image Source: MSFT Q4 FY2013 Earnings Presentation

Slightly more concerning, in our view, was the decline in its ‘Windows Division,’ with OEM revenue declining 15% year-over-year. As with Intel (click ticker for report: ), we don’t think this issue is as much Microsoft as it is the secular decline in personal computer (PC) demand. Still, the PC market may be finding a bottom, at least in the US (shipments only fell 1.4% of the second quarter of 2013). Perhaps Windows 8.1 will help a bit, but we are growing less and less optimistic on the latest update to Microsoft’s flagship product.

On the bright side, Windows continues to win OEM customers in the mobile market, and Windows phones can now be purchased at every major US carrier. We’ve previously asserted that we think Windows can become a strong player in the mobile phone space, particularly on the low end if Apple continues to ignore the market (and consumers have inconsistent experiences with Android phones). Windows’ mobile offering has a very nice opportunity globally, in our view.

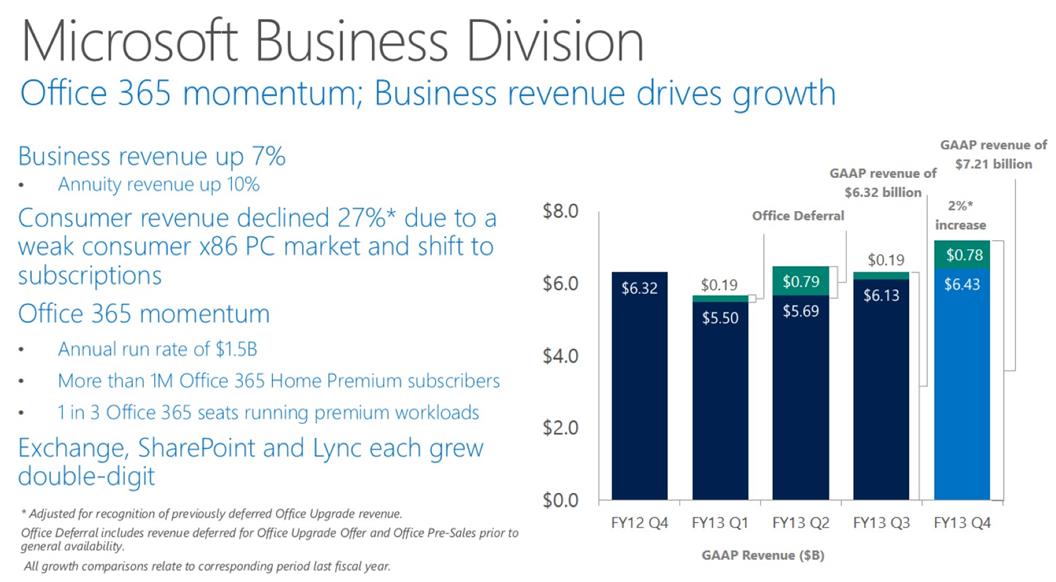

Image Source: MSFT Q4 FY2013 Earnings Presentation

On the enterprise side of the business, Microsoft continues to do a fantastic job. We loved the recent shift to Office 365, a subscription/cloud based version of Office that provides a robust long-term revenue stream. The product’s annual revenue run-rate now exceeds $1.5 billion. Microsoft’s ‘Business Division’ revenue advanced 2%, and this was mostly attributable to the shift to a subscription-based business model. Annuity revenue was up 10% year-over-year.

Its ‘Servers & Tools Division’ experienced solid growth, with revenue jumping 9% year-over-year to $5.5 billion. The firm is seeing very strong datacenter growth, as System Center revenue increased 14% year-over-year. SQL Server revenue surged 16% year-over-year, and the segment continues to be a growth powerhouse inside the tech giant. We believe Microsoft’s enterprise software business is among the best in class.

Microsoft’s web search engine Bing continues to subtly capture market share, increasing its share of online search 280 basis points year-over-year to 17.9%. This increase in market share helped revenue in the Online Services segment grow 9% year-over-year to $800 million. The division remains unprofitable at this time, but we’ve seen the loss shrink nicely during the past year. The segment is simply too small to push the needle one way or the other at Microsoft.

The company’s ‘Entertainment & Devices’ segment posted an 8% increase in revenue, coming in at $1.9 billion. Xbox console sales still totaled 1 million units even though a product refresh is coming shortly. The Xbox Live Marketplace witnessed 20% transactional growth, exemplifying the power of a great network that delivers consumers useful products. We think the next-generation product will provide greater incentive to make purchases in the Xbox Live Marketplace, and it could be an underrated source of revenue growth going forward.

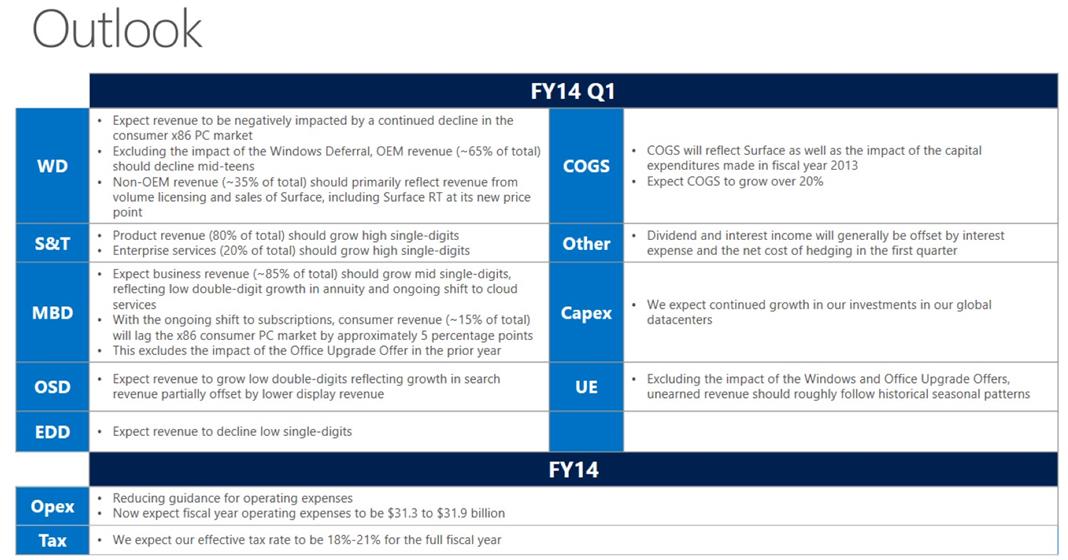

Image Source: MSFT Q4 FY2013 Earnings Presentation

Microsoft’s outlook seems to suggest a relatively weak first quarter with cost of goods sold (COGS) increasing, Windows revenue lagging, and revenue in its ‘Entertainment Devices Division’ looking lackluster. Capital expenditures may increase slightly, but we doubt the firm will get ahead of itself. For the full-year, the company expects operating expenses of $31.3-$31.9 billion and an effective tax rate of 18%-21%. Needless to say, the Street was looking for stronger first-quarter guidance—particularly with respect to ‘Windows Division’ revenue.

Valuentum’s Take

Microsoft’s fourth quarter was a flat-out disappointment, but we still do not think the sell-off is justified. Earnings per share, and to a lesser extent, revenue move around a bit at Microsoft, but the software behemoth is generating plenty of cash, even if it is down slightly from fiscal year 2012. The recent reorg announcement could also be a catalyst for change, though we are taking a wait and see approach.

Xbox One should provide a nice catalyst in fiscal year 2014, and we think the company’s Windows 8.1 refresh will be a bit better for classic Microsoft customers. should remain fantastic, and we think shares still present a compelling risk/reward opportunity for long-term investors. Thus, we intend to continue to hold the company in the portfolio of our Dividend Growth Newsletter.