Famed investor Benjamin Graham, author of Security Analysis and the Intelligent Investor, made a fortune out of what he liked to call “cigar butts.” These stocks were often poor operating businesses selling for less than liquidation value. Graham would purchase said stocks with the hope that there was one last “puff” of profit left. Not all of them worked out positively, but Graham would bet on dozens of stocks trading at less than book value and hope for the best.

RadioShack (click ticker for report: ) looks like a cigar butt. The firm’s core operating business is rapidly deteriorating, the firm is generating negative free cash flow, and recent rumors suggest the company is hiring advisors to help shore up its balance sheet (which some extended as the beginnings of a pre-packaged bankruptcy). Of course, the company refuted such an idea, saying it was nothing more than routine discussions. The firm had $820 million worth of liquidity at the end of the first quarter.

Learn more about how the Valuentum Buying Index steered investors away from the collapse in RadioShack’s stock: Part X: Why Value Investing Alone Doesn’t Work

Obviously, few, if any, businesses will come clean and admit whole-heartedly that its core business is failing and liquidity has become an issue. Still, RadioShack’s story is an all too familiar situation. The company’s business model is certainly in question as to whether or not it even needs to exist. Further, operating cash flow is falling off a cliff, causing the company to invest less in stores, making stores even less appealing to consumers and perpetuating the operating cash flow problem.

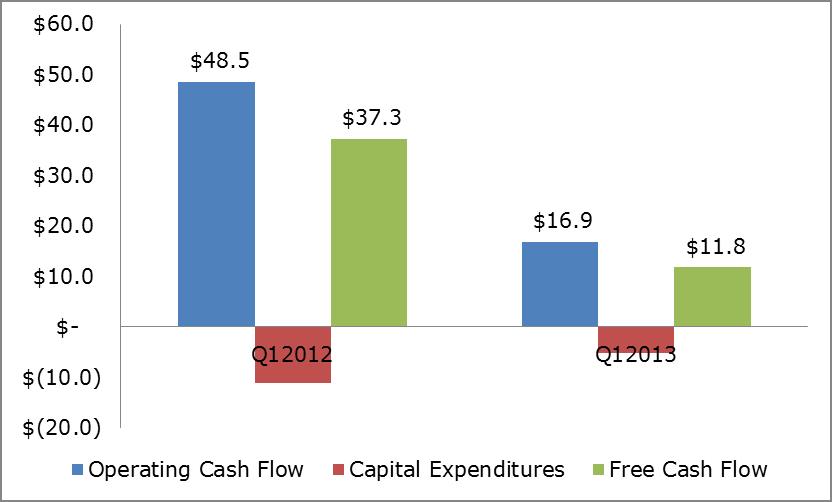

RadioShack’s Cash Flow Story — $ mil

Source: Company Filings, Valuentum

In the case of RadioShack, it also has a large debt load that was manageable when the company’s earnings were strong. However, debt becomes a huge hurdle when cash flow generation deteriorates.

What About a Turnaround?

Some may be convinced that recently-hired CEO Joe Magnacca is the right man to lead the turnaround. The former Walgreens (click ticker for report: ) executive seems to grasp the importance of a great store design. The company opened one of its newly-remodeled stores in Manhattan with the goal of drawing a younger crowd, but we likely won’t get much commentary on the performance until the firm’s next earnings call. It may be a step in the right direction, but we doubt that it will matter much.

For one, RadioShack’s business remains highly dependent on smartphone sales, which are going in the wrong direction at the company. From CFO Dorvin Lively on the first quarter conference call:

“…the majority of the assortments in our stores and others are now on a smartphone basis, much higher dollar amounts and typically, at a lower gross margin rate…”

In other words, RadioShack’s smartphone revenue is growing while its gross margins shrink. Net-net, we think that’s likely a negative for the company. More importantly, everyone sells smartphones. Amazon (click ticker for report: ), Wal-Mart (click ticker for report: ), Best Buy (click ticker for report: ), and the mobile carriers themselves are in the business of selling smartphones. What makes RadioShack better than the competition? We really cannot identify anything. Further, almost every competitor is in a stronger financial position than RadioShack, so if price wars were to escalate, RadioShack would be in the worst position to absorb lower gross margins.

The next obvious concern we have with RadioShack is finding a reason why the business needs to exist. Virtually all of the hobbyist items found at RadioShack can be found on Amazon or eBay (click ticker for report: ), often at lower prices. The rest of RadioShack’s product assortment is really no different than any other consumer-electronics seller, and we simply do not see how it can compete with online retailers. We already mentioned that everyone sells smartphones, but everyone also sells commodity computers and TVs. Though the company has survived a long time in the US, we simply do not see a compelling reason for it to exist going forward. This is not unlike other US companies whose time has simply past.

But What If Consumers Really Like the New Stores?

Though we doubt the remodeling efforts will be enough to drive consumers into stores, there is always a chance the turnaround could work (albeit this is a very slim chance). At this time, RadioShack doesn’t have enough cash in its coffers to renovate its 4,000+ stores, but that aspect could change if free cash flow suddenly improves. This is an upside risk, but we doubt it happens. The company has tried repositioning itself throughout the years (remember “The Shack”) and failed.

The Black Swan: Amazon

The odds of Amazon taking over RadioShack are not high, but it remains yet another upside risk. The thesis goes that Amazon CEO Jeff Bezos could look to acquire a large store footprint to allow users to interact with Kindles and create mini-distribution areas to help boost the firm’s same-day delivery service. RadioShack’s 4,000+ locations plus the inventory overlap could make it a compelling acquisition target.

But we’re not getting too excited about this idea either. Barnes and Noble (BKS) could easily shutter many of its stores in the coming years, and Sears (click ticker for report: ) will likely divest favorable operating leases in the near term. JC Penney (click ticker for report: ) could also look to shrink its store base if results flounder. In short, there will be plenty of real estate (if Amazon wants it), and we do not see why RadioShack’s footprint is more attractive—especially since stores wouldn’t have excess room for storage like a big box purchase would allow.

What Is RadioShack Worth?

As an operating business, we do not believe RadioShack is worth much. Our fair value estimate range is $1-$3 per share with 2.28% chance the equity is worthless. Rarely do we see prominent businesses simply close the doors and give up, but we use such as a means of valuing RadioShack.

We note, however, its net (book) value remains above the current share price, even when we take a large haircut to the value of its net plant, property, and equipment (net PP&E) and inventory balances. Though we think PP&E is likely worth less than its value on the balance sheet given the relative unattractiveness of much of the firm’s store footprint, the firm’s net asset value is still positive at this time.

Source: Company Filings, Valuentum — net value (as stated) excludes goodwill

Still, we don’t think valuing RadioShack on a NAV basis is the accurate way of evaluating the business. For one, we have a relatively high degree of confidence that the business will not simply close shop and give the remaining proceeds to shareholders (and/or get bought out as an operating entity). Rather, we think the company will continue to operate and experience further deterioration in its fundamentals. If this occurs, the firm’s cash balance could fall meaningfully.

Valuentum’s Take

Ultimately, RadioShack’s core business is crumbling, and rumors of the firm needing additional liquidity lead us to believe that second-quarter results will be weak (with potentially negative free cash flow). We’re steering far away from shares in the portfolio of our Best Ideas Newsletter.