With an estimated SAAR of 15.7 million units during June, the US auto market continues to surge back to relevancy. Let’s take a look at the major players and their respective results.

Ford

Best Ideas Newsletter holding Ford (click ticker for report: ) continues to execute at an exceptionally high level. Unit sales jumped 13% year-over-year to 235,643 units. With the housing recovery in full gear, pickup sales have really accelerated, as F-Series sales surged 24% year-over-year to 68,009 units. Heavy truck sales increased 31% year-over-year, but only accounted for 726 units.

Car sales were also fantastic, with sales increasing 13% year-over-year. Sales of the Fiesta more than doubled, while Focus sales jumped 9% and Taurus sales surged 15%. Fusion sales were roughly flat, but Ford still sold 24,313 cars.

SUV sales were “only” 8% higher than a year ago, driven by a 32% increase in Ford Edge sales and an 11% increase in Explorer sales.

Image Source: Ford June Sales Presentation

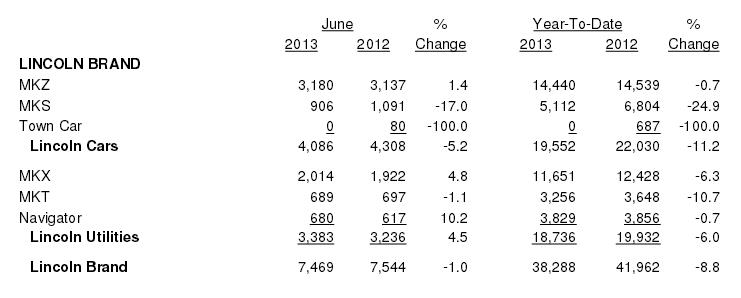

Lincoln continues to lag the greater Ford business, but sales losses moderated in June, declining just 1% year-over-year (though sales remain down 9% year-to-date). Net of the impact of the discontinued Town Car, sales in June were virtually flat. Again, we’re not anticipating much from Lincoln, but any incremental improvement has a positive impact, in our view.

Overall, we were very pleased with Ford’s June performance and across-the-board strength. F-Series sales are highly-profitable for the company, so we wouldn’t be surprised to see a modest increase in operating margins if the sales mix tilts in favor of the pickup.

GM

Though it’s not experiencing the same robust growth as Ford, GM (click ticker for report: ) posted solid sales gains in June, with unit sales increasing 7% year-over-year to 264,843 units. As electric vehicles become accepted by the mainstream, GM continues to benefit, with sales of the Chevrolet Volt surging 53% year-over-year to 2,698 units. The recently-released Spark (shown below) performed well during its first month, with sales totaling 3,104 units. The Spark is reminiscent of the other small cars we’ve seen hit the market over the years such as the Fiat 500 and SmartCar. With its small stature, the vehicle expects to attract young, urban buyers.

Image Source: Wikimedia Commons

Sales of other small cars were solid, led by the Cruze (up 73% year-over-year) and the Sonic (up 7% year-over-year). Chevrolet pickup sales were also strong, jumping 29% year-over-year to 43,259 units—a solid improvement, but still greatly lagging the F-Series.

Other vehicles at Chevrolet were mixed, with the Corvette and Camaro experiencing double digit decline and the Suburban and Tahoe posting relative weak sales. Due to its similar product mix, GMC sales weren’t great, increasing just 4.5% as strong Sierra (pickup) sales weren’t enough to offset weakness from the Yukon, Yukon XL, and Acadia.

Image Source: GM June Sales Presentation

The strength at GM can be found in the resurgence of Cadillac and Buick (both shown above). Though June was a fairly weak month for Buick (sales declined 4.1%), unit sales are up 12% year-to-date. The Enclave and Verano continue to experience strong sales gains, which we believe are the result of increased marketing and great design.

As for Cadillac, sales of the Escalade weren’t great, falling 11% year-over-year during June. However, sales of the XTS jumped 197%. Needless to say, the vehicle faced weak comparisons from June a year ago, but we are blown away at how successful the car has been in replacing the DTS and STS. We like the positioning as a mid-sized vehicle, particularly as large cars appear to be losing ground.

Generally, we were pleased with GM’s results, but we do not like the company nearly as much as we like Ford.

Toyota

Japanese manufacturer Toyota (click ticker for report: ) also experienced strong sales gains in June, with raw sales increasing 10% year-over-year to 195,235 units, which is 14% higher on a daily sales rate-basis (Toyota’s preferred metric).

Toyota car sales were relatively strong across the board (minus Scion), increasing 8% during the month. The Camry managed to increase its unit sales 12% year-over-year to 35,870 units—without a question the industry leader in the mid-sized car. Corolla sales were roughly flat, but the hybrid market’s darling, the Prius, experienced a 10% sales bump. We are optimistic that Toyota can remain a top competitor in the small and mid-sized space, though competition from Nissan, Honda (click ticker for report: ), GM, and Ford remains fierce.

Pickup sales were solid, but the company likely lost share to GM and Ford, as pickup unit sales increased just 16% during June, compared to the 20%+ gains from the North American competitors. However, unlike its American OEM competitors, Toyota saw some strong SUV sales gain, particularly from the recently redesigned RAV4, as its sales jumped 36% year-over-year during the month to 20,540 units.

On the luxury front, LS and ES strength drove Lexus car sales 13% higher on a year-over-year basis during June. We think the ES’s 6th generation is gaining increased acceptance in the marketplace, and the LS is experiencing similar success. SUV sales haven’t been stellar in 2013, with the trend continuing in June, as unit sales increased just 0.5%. Other than Toyota-branded and Honda SUVs, the SUV space was pretty weak during the quarter, likely the result of high gas prices and the poor fuel economy of larger vehicles. We aren’t too worried about Lexus, even if SUV sales remain subdued.

Ultimately, Toyota remains among our favorite auto OEMs from a fundamental perspective, but its valuation isn’t compelling enough to warrant a position in the portfolio of our Best Ideas Newsletter at this time.

Honda

Honda’s June sales were, at risk of sounding like a broken record, very solid, with unit sales increasing 10% year-over-year to 136,915 units. Honda may not have the same variety of units as some of its competitors, but it doesn’t seem to matter as the tried-and-true Accord (up 10%) and the Civic (up 8%) both sold around 30,000 units (and continue to be popular with a sticky customer base).

Regarding SUVs, the company saw its CR-V post a 14% year-over-year increase in sales to 26,572 units, Pilot sales surged 21% year-over-year to 12,085. The Pilot had some nice features added in the 2013 model year version, which we think helps explain the strong performance year-to-date (up 14%).

As for Acura, its performance was relatively weak during June, with sales declining 10% year-over-year to 13,765 units. For a long while, Acura had a nice niche as a low-end luxury player, but we’ve seen everyone from Audi and BMW to Mercedes crowd the space in recent years, making it highly competitive. Honda will need to invest heavily in its luxury division if it wants to remain competitive, in our view.

Best of the Rest

Chrysler’s June sales rose 8% year-over-year during June to 156,686 units, driven largely by the Ram and Jeep Cherokee. After its run as the US growth story of 2012, Volkswagen’s sales dipped 3.2% year-over-year. On the other hand, BMW’s June sales rose 24.6% year-over-year, with the 3-Series leading the charge. Mercedes’ growth wasn’t as robust, but it also set sales records with a 7% jump during June.

Valuentum’s Take

The US auto recovery continues its upward trajectory. Ford remains our best auto-OEM idea, and we’re sticking with our position in the company in the portfolio of our Best Ideas Newsletter.