German conglomerate Siemens (click ticker for report: ) put its 50% stake in Nokia-Siemens Networks on the chopping block just a few weeks ago, and the firm already has found a buyer: Nokia (click ticker for report: ). Nokia will pay Siemens $2.2 billion (€1.7 billion) for the half of the joint-venture it doesn’t already own—not a bad price for a business that reported €13.8 billion in revenue and €822 million in operating profit during 2012. With adjusted EBITDA of €1.09 billion, Siemens let go of the stake for less than 3x EBITDA.

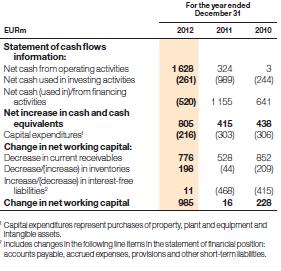

Image Source: Nokia-Siemens Networks Annual Report

With its mobile phone business sputtering, we certainly like the deal for Nokia. The joint-venture has been free cash flow positive for the past two years, and we think operations will remain strong going forward. LTE network growth remains all but certain across the globe, and we expect to see carriers invest in network upgrades to win customers.

With a cash-generating business in the fold, Nokia will have more time to figure out how to improve its smartphone business, if it doesn’t decide to focus elsewhere. Further, Nokia’s initial cash outlay will be only €1.2 billion as Siemens will finance the rest with a bridge loan. The deal should immediately be accretive to earnings.

The obvious question for Siemens is why did it let go of its stake for such a low valuation? Even troubled competitor Alcatel-Lucent (click ticker for report: ) trades at nearly 6x EV/EBITDA. Some even thought the total business was worth more than €5 billion? We think the answer is twofold. The most apparent reason is to help focus the company’s efforts on its core electronics, healthcare, and energy businesses, while eliminating disparate segments. We’ve seen several global conglomerates, including GE (click ticker for report: ) opt to downsize and cut costs in recent years. Siemens is already in several businesses, and its networking operations do not necessarily fit nicely within its overall portfolio.

The second reason, in our view, is that Nokia already owns 50% of the business and makes a strong fit as owner. We doubt Nokia will attempt any drastic operational or strategic changes that could put employees at risk (an issue that could become more pertinent if the stake was sold to a private equity firm looking recoup its investment). Perhaps Siemens could have waited longer and sold its stake at a higher valuation, but it might not have been worth the time, effort, and potential backlash.

Valuentum’s Take

We like the deal for Nokia—it paid a relatively low valuation, acquired a business in a growing industry, and it diversified away from being a smartphone OEM. As for Siemens, the deal will be relatively quick and painless, and we wouldn’t be too worried about the company leaving €500 million on the table, especially if it helps Siemens focus on its core businesses. Though we plan to make a few tweaks to our valuation models for both companies, we think shares of both European firms are fairly valued at this time. Neither is receiving consideration for inclusion into the portfolio of our Best Ideas Newsletter at the moment.