Key Takeaways:

· Active enrollment levels continue to fall across the industry.

· Some universities are at risk of losing accreditation.

· The outlook for government-funded education isn’t great.

· Evidence is mounting that a for-profit education may not be worth the cost.

· Grand Canyon (LOPE) and Capella (CPLA) are proving to be worth the cost, explaining a great deal of outperformance. DeVry (DV) has some nice businesses, but its core remains challenged.

· We do not like any firm in the industry. Please refer to our Best Ideas Newsletter for our favorite investment opportunities.

List of industry constituents: American Public (APEI), Apollo Group (APOL), Bridgepoint Education (BPI), Career Education (CECO), ChinaEdu Corp (CEDU), Corinthians Colleges (COCO), Capella Education (CPLA), DeVry (DV), Education Management (EDMC), New Oriental Education (EDU), ITT Educational (ESI), Lincoln Educational (LINC), Grand Canyon Education (LOPE), K12 (LRN), Strayer Education (STRA), Universal Tech (UTI)

Enrollment

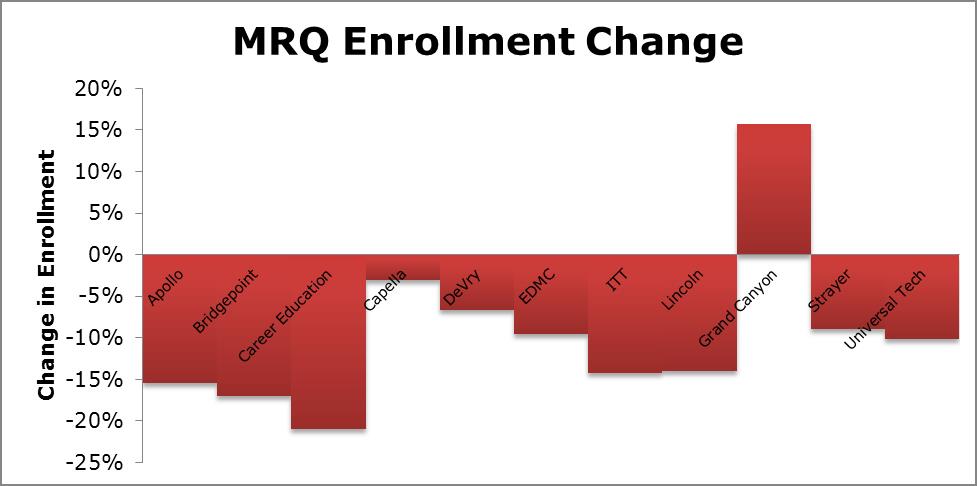

The for-profit education industry continues to face a number of problems, with perhaps the most obvious issue being enrollment. Apollo Group (click ticker for report: ), owner of the famous University of Phoenix brand, saw active enrollment decline 15% year-over-year at its flagship university during its second quarter (results released in May). As the chart below reveals, the issue is industry-wide rather than an aberration at one or two firms.

Source: Valuentum, Company Filings (as of June 2013)

Nearly every constituent faced a double-digit drop in enrollment, and only Grand Canyon (click ticker for report: ) increased enrollment. We believe there are several factors driving the enrollment declines, as we outline below.

Accreditation

Achieving accreditation as a university, or meeting the requirements (integrity, student performance, curriculum, faculty, etc) of one of six regional accrediting agencies, hasn’t always been an issue, but it has come to the forefront as a result of Bridgepoint’s (click ticker for report: ) issues with its flagship Ashford University. The accreditation body covering Ashford noted that the firm needs to move its headquarters into the Iowa/Colorado region or risk losing accreditation. However, Bridgepoint is already cutting staff, which suggests, in our view, that it may not receive accreditation even if it moves its headquarters. The Western Association of Schools Colleges already rejected Ashford, so getting accreditation from the Midwestern governing body (Higher Learning Commission of the North Central Association of Colleges and Schools) may not be easier. Without accreditation, government funding is difficult to muster. Most for-profit colleges receive upwards of 80% of revenue from Title IV funding, so keeping that revenue source is an absolute must.

Government Spending Cuts

Aside from issues related to accreditation, the outlook for government finances isn’t great, and as much as we dislike the idea, education could receive funding cuts. The 2013 sequester already slashed $3 billion in educational funding, and deeper cuts could come in 2014. Congress is looking to amend the Higher Education Act of 1956, and we could see a meaningful change in how for-profit universities are allowed to allocate funds that come from the government. Considering the for-profit education industry is literally bankrolled by the government, the industry will have few options but to accept the changes that could substantially lower advertising spending while raising curriculum and educational costs. Lower enrollment rates caused by reduced advertising and awareness coupled with higher educational costs will have a very negative impact on the industry’s profitability. For-profit institutions must prove their worth if the federal government is going to keep allocating its shrinking budget towards these institutions.

Poor Outcomes

Even if the for-profit education sector is able to satisfy the government cash cow, there is mounting evidence that the efficacy of the for-profit industry is lacking. Corinthian Colleges has an associate’s degree drop-out rate of 66.5% and a bachelor’s degree drop-out rate of 59.2%, for example. Further, Career Education (click ticker for report: ) was found to have either lied or exaggerated about its employment track record, which partially explains why the firm had a 35%+ default rate on its loans within three years. We believe the elevated default rate is a sure sign of poor financial outcomes for students. If default rates remain elevated, for-profit schools put the government cash cow at risk. Taken directly from Bridepoint’s 10-K report:

“An institution may lose its eligibility to participate in the Direct Loan and Pell programs if, for each of the three most recent federal fiscal years for which information is available, 25% or more of its students who became subject to a repayment obligation in that federal fiscal year defaulted on such obligation by the end of the following federal fiscal year.”

There are not many reasons for students to pursue a degree at an institution that will result in an unfavorable labor market outcome and a mountain of debt. Perhaps more importantly, the government won’t keep perpetuating poor outcomes.

Some For-Profit Institutions are Performing Well

The companies that are doing well seem to be doing the opposite of Corinthian. Grand Canyon University, for instance, largely strikes us as a traditional university with a for-profit bend. The school sports a Division II athletic team, has not had any issues with accreditation, and the school has admission standards (not particularly selective, but better than its peers). The three-year default rate, which totaled 36% for Corinthian, came in at just 7.39% for GCU, which is only slightly higher than its in-state public counterpart, the University of Arizona (5.58% default rate).

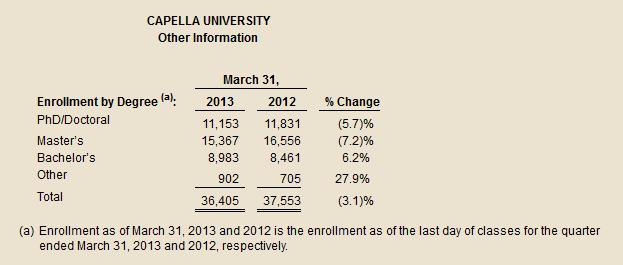

Capella Education (click ticker for report: ) is also managing better than many of its competitors, with new enrollments for bachelor’s programs actually increasing 6.2% year-over-year during the first quarter. Unlike many of its competitors that specialize in associate’s and bachelor’s programs, Capella has robust undergraduate and graduate/PhD programs. The firm is currently experiencing the lowest pace of active enrollment declines in the group.

Image Source: Capella

The default rate at Capella is only 6.5%, and the firm owns Sophia, an online learning platform that could drive future revenue growth. The segment will likely account for less than 5% of revenue during fiscal year 2013, but management sounds excited about the development, saying:

“… SOPHIA, our subsidiary that offers a social education platform that empowers students to learn in many ways. The American Council on Education’s College Credit Recommendation Service, commonly referred to as ACE CREDIT, has evaluated and recommended college credit for 5 of SOPHIA’s online courses. These self-paced courses are offered to SOPHIA Pathways for College Credit and provide significant savings over traditional college classes. After successful completion, these courses are now eligible to be considered for credit in more than 2,000 colleges and universities throughout the U.S.”

Although Capella will have to deal with competition, these new online courses, which cost less than their brick-and-mortar equivalents (and should decline in cost over the long term), offer a compelling opportunity. The space has competitors, including Coursera, and to a lesser extent, Khan Academy<