Key Takeaways:

· The generic pharmaceutical industry will benefit from a patent expiry “mountain” in 2015.

· Penetration and utilization rates of generics vary considerably by country. Japan, Italy, Spain, France, and Australia are most likely to see the greatest increases in generic penetration rates.

· We expect further M&A activity in Japan, as global players seek to gain a generics stronghold in this under-penetrated, yet burgeoning pharmaceutical market.

· Emerging market growth will offer significant opportunities for firms levered to Latin America and South Africa.

· The potential for biosimilars remains a key catalyst for the group.

· Ideas

o Teva Pharma (TEVA) is our favorite idea in the generics space thanks primarily to its upside valuation potential and global position. We’re particularly big fans of its ‘first-to-file’ position in the US generics market.

o South Africa-based Aspen Pharma (APN-ZA) is our favorite emerging-market idea, given its dominant position in the fast-growing South African generics market. The firm holds 5 out of the top 6 generics in the country, including the top-selling ARV for HIV/AIDS. Note: Aspen trades on the Johannesburg stock exchange.

Tickers mentioned: TEVA, ACT, NVS, MYL, LLY, BIIB, JNJ, AMGN, ENDP, MRK, ABT, AZN, PFE, NVO, SNY, BMY, APN-ZA

What Are Generic Pharmaceuticals?

Generic pharmaceuticals are chemical/therapeutic equivalents to the branded pharmaceuticals sold at substantially lower prices than those of the originator’s product. They contain the same active ingredients as the original branded medicines and are manufactured according to the stringent regulatory standards of various regions/countries.

The duration of a typical drug patent by branded pharmaceutical providers is roughly 20 years, though development time may eat into that patent window. Generic pharmaceuticals can be produced and marketed once relevant patents on brand-name equivalents have expired or if such patents have been invalidated. Once generics hit the market, prices for drugs can fall as much as 80% or more, as generic pharmaceutical firms aren’t saddled with the same high R&D and regulatory costs as branded pharmaceutical firms. Generic drugs can take on a variety of dosage forms: tablets, capsules, ointments, creams, liquids, injectables and inhalents.

How Big Is the Industry and How Fast Is It Growing?

The $225 billion global generics market is expected to grow at roughly a 10% annual pace to reach nearly $360 billion annually by 2016. The industry has reaped the rewards of increased acceptance on the part of healthcare insurers, consumers, and pharmacists across the globe. In countries such as France and Japan, governments are issuing regulations to increase generic penetration, which remains far below that of the US and UK. The substitution of generics as a cost-savings measure has been one of the biggest catalysts for the industry’s expansion, in our view, while the aging population and more global spending on pharmaceuticals have been other sources of growth.

In the US and other “pure generic” markets such as the UK, generic pharmaceuticals are substituted by the pharmacist for their brand name equivalent. In these markets, physicians have little control over the choice of generic maker, increasing the importance of the relationship between the generic manufacturer and pharmacy chains, distributors, and health insurers. In contrast, in Latin American countries (as well as some European markets), generics are marketed under brand names alongside the originator’s brand. In these types of markets, these “branded generics” are actively promoted. Other markets such as France and Italy are hybrid markets with elements of both approaches.

How Do Generic Pharmaceutical Firms Make Big Money?

Generic firms seek to extract value from Paragraph IV patent challenges within the Hatch-Waxman Act and early launches. In the US, the FDA requires firms to submit abbreviated new drug applications (ANDAs) in order to receive approval to make branded drugs. In most instances, FDA approval is granted upon the expiration of the branded drug’s underlying patents. However, companies may legally be rewarded with a 180-day period of marketing exclusivity for being the first generic applicant to successfully challenge these patents (first-to-file). The advantages of attaining such exclusivity are large, as the generic provider would need to only offer its drug at a modest discount to the price of the branded drug, instead of dealing with an otherwise intensely-competitive market (the firm would be the only generic on the market for that particular drug).

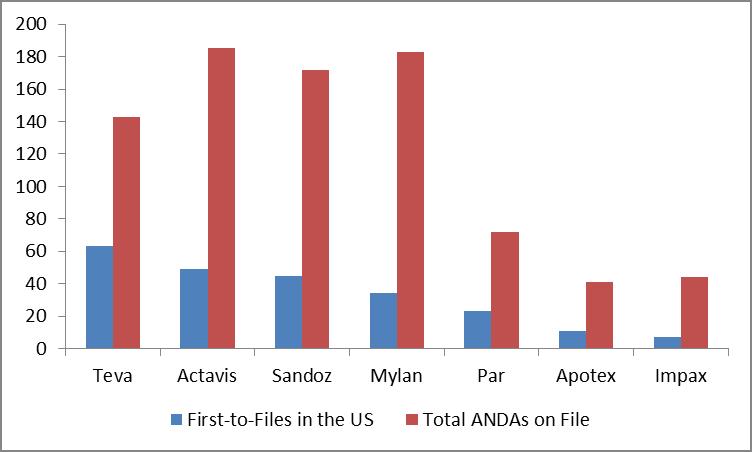

In the US, we point to Teva (click ticker for report: ) as having the greatest number of first-to-files and Actavis (click ticker for report: ), formerly Watson, as having the greatest number of total ANDAs on file.

US Gx Pipelines

Source: Actavis, Valuentum (January 2013)

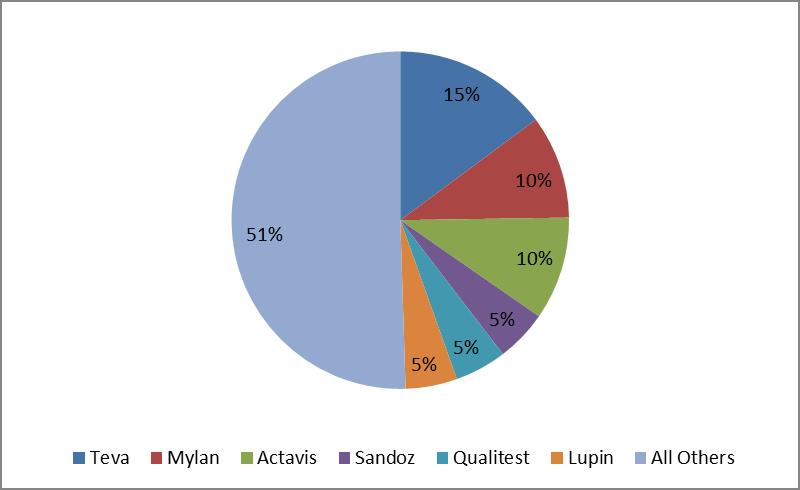

Novartis’ (NVS) Sandoz and Mylan (click ticker for report: ) also boast a compelling combination of first-to-files and total ANDAs on file. Such exposure is relatively consistent with existing US Gx market share (shown below), though Par and Apotex may make share gains in coming years. We estimate the US generics market is roughly $53-$55 billion annually.

US Gx Market Share

Source: IMS Health, Actavis, Valuentum

What Are The Risks of Generic Pharmaceutical Firms?

There are a number of risks that generic pharmaceutical firms face. For one, prices of generic drugs typically decline considerably, as additional generic pharma firms enter the market for a given product. Though we generally view pressure from government healthcare authorities to reduce expenditures on prescription drugs as a positive for lower-priced generics adoption, government mandated pricing cuts could hurt top and bottom-line performance. Further, branded pharmaceutical companies continue to defend their products vigorously and often license their own generic versions of their products—sometimes directly (these are called authorized generics). Barriers to entry are practically nil for branded firms, since no significant regulatory approvals are required for authorized generics.

A generic pharmaceutical firm’s success is largely dependent on its ability to challenge patents. To the extent that firms succeed in being the first to market a generic version of a blockbuster product, and particularly in cases where a firm is the only one authorized to sell during the 180-day exclusivity period in the US market, profits can be substantially increased. However, the number and size of new generic product opportunities for which exclusivity is available vary significantly over time and are expected to decrease during the next couple years (2013 and 2014). Patent challenges have also become more difficult in recent years, and generic firms are increasingly sharing the 180-day exclusivity period with other competitors, hurting the value of such exclusivity.

The “Mountain” in 2015

Though there are myriad risks, the generic pharmaceutical industry is still on sound footing. For one, Teva, the largest generic pharmaceutical firm in the US, has over 140 product registrations (awaiting FDA approval) that had US sales in 2012 exceeding $90 billion. Of these, more than 100 are Paragraph IV applications challenging patents of branded products. Teva is also the first-to-file on more than 60 of these products, the branded versions of which had US sales of more than $45 billion in 2012.

So, Is the Branded Patent Cliff Really Over?

Many have proclaimed that the branded Categories Member Articles