While shares languished throughout 2012, Best Ideas Newsletter and Dividend Growth Newsletter portfolio holding Intel (click ticker for report: ) has experienced a solid rebound in 2013, with shares up 21% year-to-date. We have a nice gain on the position in our actively-managed portfolios, and the firm continues to pay out a nice and safe dividend yield (about 3.7%). Our conviction in the significant valuation upside of the firm remains unchanged (the high end of our fair value range is north of $30 per share), and we continue to think fears that Intel would never become a player in the mobile space are completely unfounded.

Intel recently received the “Barron’s treatment,” as the financial publication called for shares to double. Though the publication has a large audience and readership, we believe Barron’s simply highlighted facts about the company that have been true for a few years.

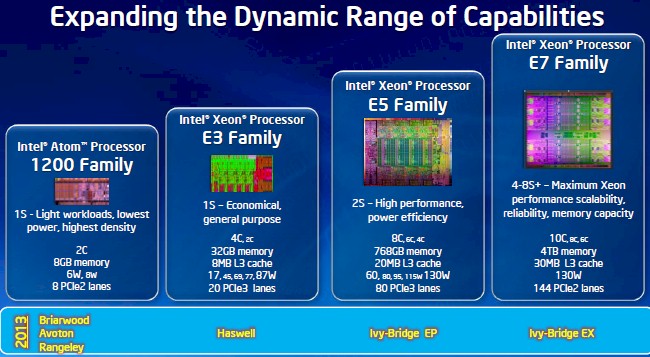

Intel Has a Great Server Business

Image Source: Intel

Intel has an enviable position in the server market, and its highly-profitable chip business has years to grow as cloud computing grasps a stranglehold on the market. CFO Stacy Smith noted on the firm’s fourth-quarter conference call:

“…we expect the data center group to return to double-digit revenue growth and diving into that, it’s the cloud data center plus our participation in portions of the market like storage and some of the networking sections of the market. It’s both unit and ASP based on the strength of our product line and follow-up.”

Intel’s future in the cloud looks fantastic and not even a shift to mobile computing will be able to interrupt cloud growth—if anything, it will boost cloud growth. Possessing multiple form factors makes cloud computing a value-add for consumers and businesses that want/need to access data and programs from anywhere. Since server chips carry higher ARPUs than PC or mobile chips, growth in this area will be a net-positive for the company.

Intel WILL Be a Player in Mobile

Let’s also not forget that Intel is aggressively investing to become a player in the mobile space. The firm just won a place in Samsung’s Galaxy tablet, and we think it’s safe to assume the firm will have a large presence on Windows and Android tablets going forward.

The dark-horse bet is that Intel’s investment in the foundry business leads to work for Apple’s (click ticker for report: ) iPhone and iPad devices. We think there is enormous potential in the deal as we remain bullish on the long-term future of Apple’s mobile devices. Our view is that Apple is desperate to ditch Samsung for chip production, and Intel’s manufacturing prowess could lure the iPhone-maker away for at least some of the job (TSMC also looks to absorb production). Recently retired CEO Paul Otellini admitted that missing the boat on the iPhone was his biggest mistake, but the foundry business could offer some chance of redemption.

Intel’s smartphone penetration isn’t good at the moment, but that could change as the company continues to gain share in the global market. The US market remains elusive as long as the firm lacks LTE technology. However, the new generation Merrfield chip demonstrates significantly better performance and battery life, making it a potential choice for chips abroad.

Intel Owns the PC Market

By now, no one doubts that Intel owns the PC market, and the latest generation of chips, Silvermont and Haswell, is going to be a huge success for Intel. Yes, the PC market is declining, and we don’t deny that. However, we continue to believe a large percentage of PCs globally won’t be usurped by mobile devices, and the new low, power consuming chips could boost PC sales.

Image Source: Intel

Apple could reveal a Haswell-powered MacBook, giving the slumping PC market a shot in the arm. It is entirely possible that savvy corporate buyers and consumers are waiting for the next generation of chips before investing in new machines.

If that doesn’t work, Intel is pushing for $599 ultrabooks by holiday 2013. Although the machines have hardly been successful thus far, we think a lower price-point could grab some lower-end PC buyers and perhaps even some of the higher-powered PC market. More importantly, affordable versions of the machine could finally pump some life back into the broader PC market. At worst, we think Intel’s PC business will stabilize over the next few years, and Intel will continue to be the global leader.

ARM A Loser?

The most obvious loser if Intel is able to successfully take share in the mobile market is ARM Holdings (click ticker for report: ). ARM got off to an early start and jumped ahead of competitors in the low-powered mobile market, but Intel is quickly catching up.

Considering that ARM claims…

“Our designs are used in more than 95% of the world’s mobile phones and are increasingly designed into a wide range of other digital electronic products.”

…it really isn’t difficult to envision a scenario where Intel takes market share. If ARM is unable to maintain its contract wins, the firm and its partners could experience a great deal of financial pain. Luckily for ARM and its licensees, the market for smartphones and tablets continues to grow at a strong pace, so it should be able to endure some modest share losses. Still, we wouldn’t add ARM to the portfolio of our Best Ideas Newsletter at this level.

Valuentum’s Take

We like the potential of the cloud to boost Intel’s fortunes by driving growth in the server business, and we think the company will take some market share in the mobile chip space—whether via its own chips or through foundry relationships. We’re expecting valuation upside in Intel to the high end of our fair value range (low-$30s), and we expect the firm to continue raising its dividend at a nice annual clip.