All data in this article is as of the published date, May 31, 2013.

Reiterating Our View

As we had outlined in our May 23 piece, “The Market Doesn’t Go Straight Up,” we identified a number of reasons why the risk-reward ratio had tilted against the investor: increased market volatility, the significant imbalance in the Valuentum Buying Index rankings (click here), and unfavorable relative/comparable market value comparisons versus historical trends. As such, we opened a put option on the broader market ETF, the SPDR S&P 500 Trust (SPY), in our Best Ideas portfolio for added downward protection ($160 strike, Dec 2013 expiration) well in advance of the sell-off Friday (we already have roughly a 30%+ cash position in our Best Ideas portfolio). The Dow closed down 209 points, while the S&P 500 fell 1.43%.

Though we (again) fall short of prognosticating on the immediate direction of the broader stock market (and seek only to protect the large gains in our Best Ideas portfolio), we would not be surprised if this retracement (sell off) continues into the coming weeks (a “June swoon”). We’ve updated our ETF report on the SPDR S&P 500 Trust, and we’re just not seeing significant valuation upside in the broad market index to drive investor interest (buying). Our price/fair value on the S&P 500 is about as close to parity as it can get without being priced to perfection: 0.99 (fairly valued). In other words, “it’s a stock-picker’s market” again!

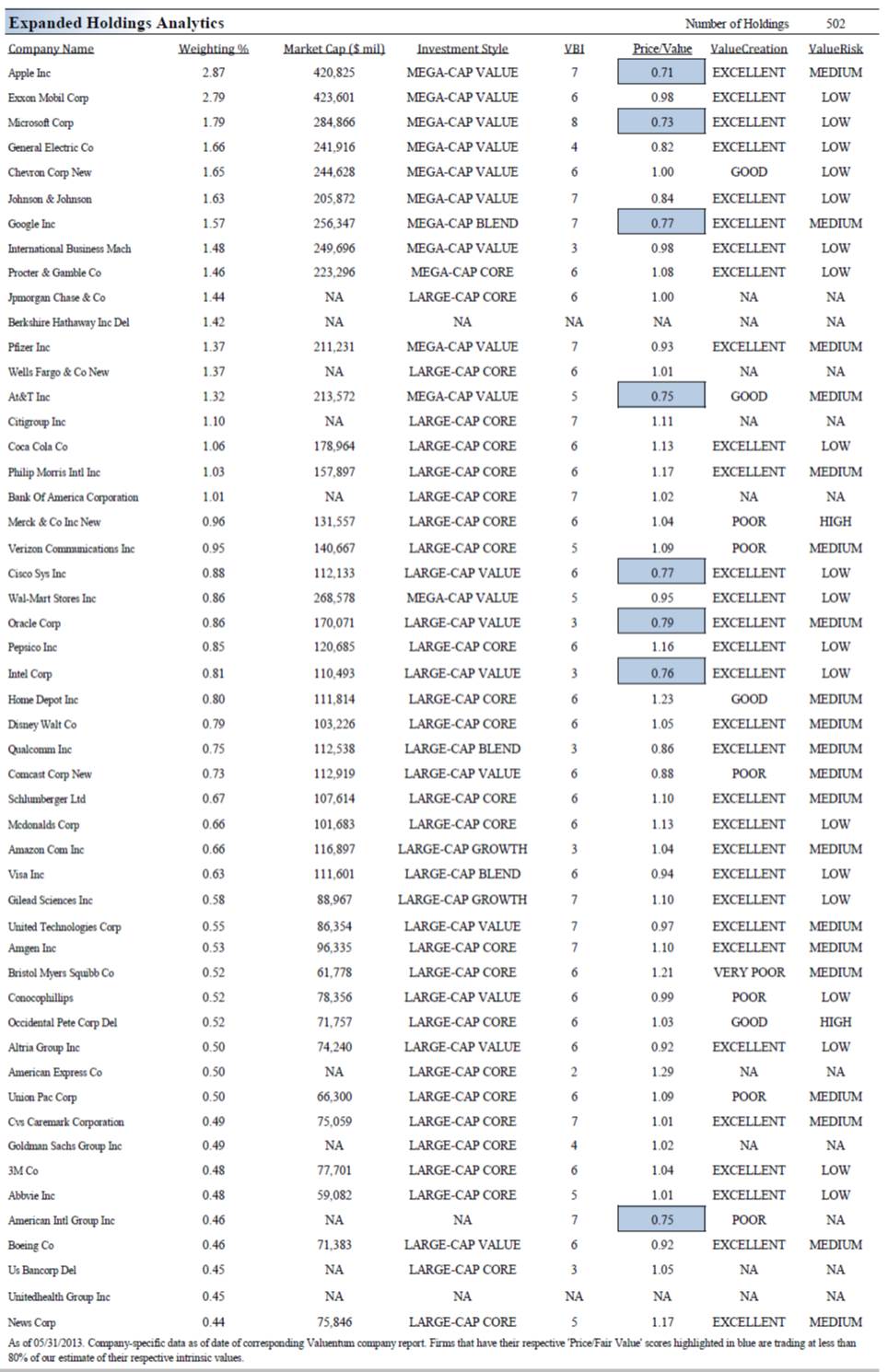

Top Constituents in the SPDR S&P 500 Trust (SPY)

Big Cap Tech Shares Offer the Best Valuation Support

We note some of the constituents in the SPDR S&P 500 ETF that offer significant valuation upside potential (i.e. those with the lowest price/fair value ratios): Apple (click ticker for report: ), Microsoft (click ticker for report: ), Google (click ticker for report: ), Oracle (click ticker for report: ), and Intel (click ticker for report: ). Interestingly (but perhaps unsurprisingly given the value bent of our methodology), all but Oracle are included in our actively-managed portfolios.

Perhaps the most obvious takeaway from this analysis is that the most undervalued opportunities in the S&P 500 fall within the the technology sector. Though we cover a number of technology ETFs–Technology Select Sector SPDR (XLK), SPDR Morgan Stanley Tech (MTK), SPDR S&P Semiconductor (XSD), SPDR S&P Software & Serv (XSW), SPDR Telecom (XTL)– we like the Technology Select Sector SPDR (XLK) the best on the basis of its best-in-class expense ratio and valuation upside potential. We showcase the top holdings of this ETF below. If we didn’t already have sufficient exposure to undervalued technology firms in our actively-managed portfolios, we’d be looking very closely at this ETF.

Top Constituents in the Technology Select Sector SPDR (XLK)