Wednesday morning, Best Ideas Newsletter portfolio holding Astronics (click ticker for report: ) helped boost its cabin electronics business and establish a relationship with Boeing (click ticker for report: ) by acquiring Oregon-based Peco for $136 million. Backing out acquisition related charges, the deal should be accretive to 2013 earnings per share.

We’ve seen consolidation before within the aerospace supply-chain, so this move isn’t very surprising. Another firm on our Best Ideas list, Precision Castparts (click ticker for report: ) made a wonderful deal for Titanium Metals in late 2012. United Tech (click ticker for report: ) also scooped up Goodrich not too long ago. We’re pleased to see Astronics move to capitalize on low interest rates, especially since the company had just $15 million in long-term debt prior to the deal.

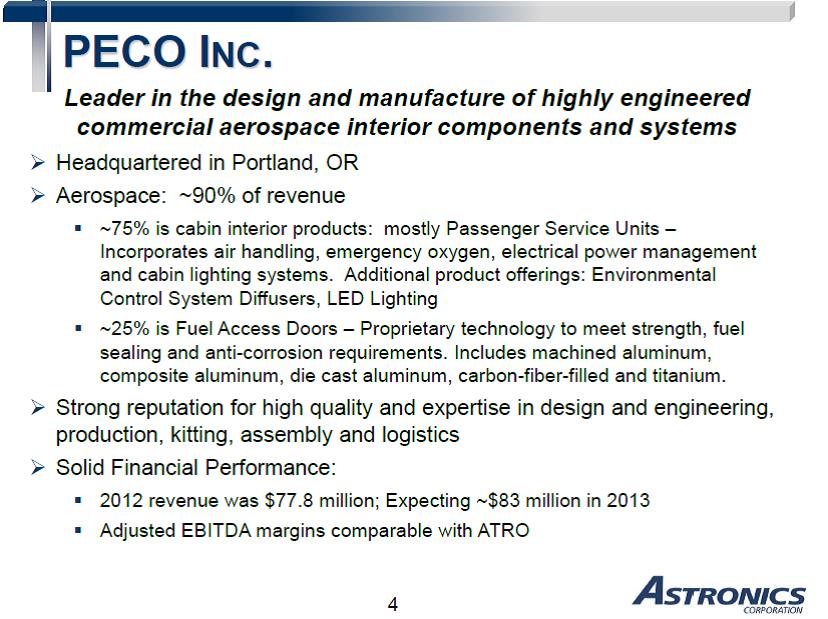

Undoubtedly, the deal could be transformative for Astronics considering Peco is expected to generate approximately $83 million in revenue during 2013. For perspective, Astronics did $266 million in sales in 2012, so the deal is quite significant. CEO Peter Gundermann noted that EBITDA margins are similar to those at Astronics (~20%), so we’re pegging EBITDA at approximately $16.6 million. Effectively, the company paid 8x EBITDA for the company, and there are natural synergies that could work to make the deal even more accretive to earnings.

The above slide accurately describes Peco, but management added some more color on the conference call. OEMs account for 85% of revenue, with Boeing by far the largest customer, accounting for 60% of sales. Although such excessive concentration is not necessary ideal, Peco’s inclusion in the 737, 747, 777, and 787 ensures that it should have stable revenues for years to come. Unfortunately, the average revenue on a 787 is well below a 737 or a 777 ($45k vs. $100k), so a shift mix towards 787 could stunt growth. Still, Gundermann (cautiously) noted:

“But for the most part, if you look back at their experience, I think you can draw the conclusion that — like you can for most aerospace companies, once you get designed in, you’re there for quite a while.”

Gundermann also suggested the acquisition could put Astronics in a position to sell products directly to Boeing, which doesn’t occur at this time (Astronics only sells products to airlines). According to Gundermann, Astronics has bid on Boeing projects before, but it has never been selected. A new “forced” relationship with the airplane giant could increase Astronics’ chances for increased dollar content on existing and new aircraft.

Overall, we like the deal for Astronics since it could potentially blossom into an expanded relationship with Boeing for a relatively low price (8x EBITDA). Though we plan to update our fair value estimate on Astronics as a result of the transaction, we don’t expect a material change to our valuation.