Although its same-store sales growth wasn’t robust, casual dining chain Red Robin (click ticker for report: ) posted decent first-quarter results Tuesday. Revenue for the quarter increased 2% year-over-year to $306 million, roughly in-line with consensus expectations. Earnings declined 7% year-over-year to $0.66 per share, which was in-line with consensus estimates. Importantly, we saw a sizeable jump in operating cash flow, which totaled $40.4 million during the quarter, compared to just $29.6 million during the same period a year ago (generating free cash flow of $26.8 million).

Even as the casual dining market remains challenged, Red Robin was able to grow company-owned same-store sales 2.2%. Traffic fell 0.6%, but higher checks helped boost fortunes. CEO Stephen Carley suggests the company is gaining market share in the space, saying:

“According to Black Box Intelligence, we outperformed our casual dining peers by 360 basis points on guest counts during the quarter. This is our fourth consecutive quarter taking market share, and follows a 390 basis point outperformance last quarter.”

A vast remodeling effort coupled with a value-oriented experience has helped drive traffic, in our view. We appreciate management’s diligence when it comes to recognizing ways of driving incremental traffic and capacity. With the summer months around the corner, we think the company will be primed to hit its 2.5%-3% same-store sales guidance figure.

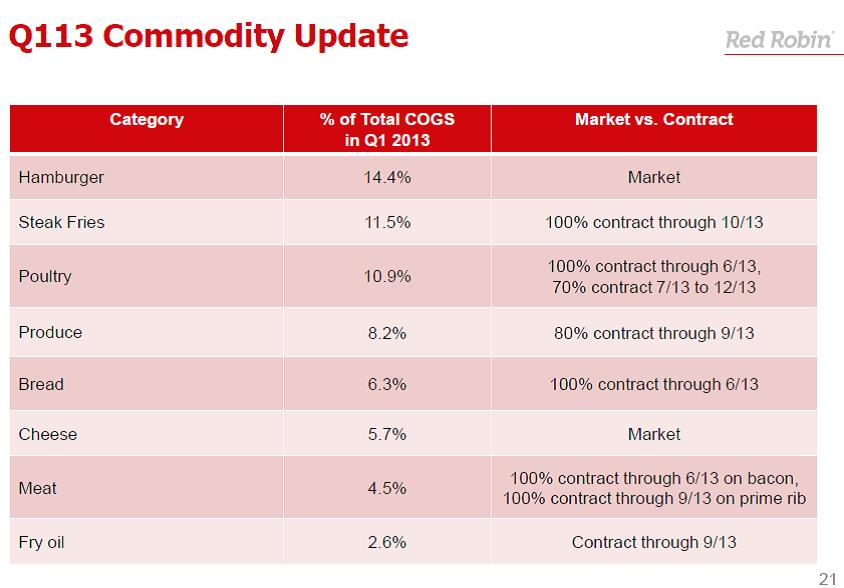

Though earnings per share were lower, we were encouraged by restaurant performance. Operating margins expanded 30 basis points to 21.5% as the company benefitted from slightly lower food costs. The majority of the firm’s inputs are hedged until the back-half of calendar 2013, but the firm’s largest input cost, hamburger meat, remains dependent on market forces. We’ve noticed that beef prices are hitting all-time highs, but Red Robin actually saw its burger costs fall during the first quarter, and CFO Stuart Brown seems optimistic about the commodity basket for the year, saying:

“So we expect commodities to be favorable for the year, but not down year-over-year. Looking at where hamburger prices are today, we expect the hamburger to be favorable to our previous guidance, really through the whole first half and then really start to pick up more in Q3 and 4 as we sort of cycle with somewhat lower numbers.”

Image Source: Red Robin

Although restaurant level operations improved, the company had higher general and administrative costs as well as higher depreciation and amortization costs that weighed on company-level operating income. Management suggests that these elevated costs will lead to improved profitability over the long run, and we think results will flow to the bottom line in the back half of fiscal year 2013.

Looking ahead, the company raised its full-year capital expenditures outlook to $70 million from $50-$55 million as the firm plans to open more of its smaller Red Robin Burger Works restaurants and spend more to remodel existing locations. General and administrative expenses are expected to be $3 million higher than previously anticipated at $87 million, while top-line guidance remained unchanged. Going forward, we like the company’s potential to increase its footprint in more urban markets via its smaller Burger Works concepts. Additionally, we believe the increase in capital spending reflects greater confidence that projects will yield results, perhaps revealing some underlying strength in the broader economy. While we like the improvements we’ve seen operationally over the past year, we aren’t interested in adding shares of Red Robin to the portfolio of our Best Ideas Newsletter at this time.