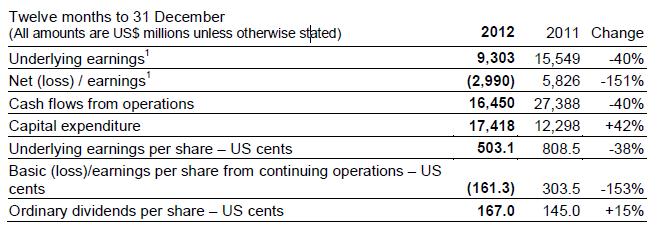

Best Ideas Newsletter holding Rio Tinto (click ticker for report: ) announced full year results for 2012 that were down substantially compared to 2011. Revenue tumbled 16% year-over-year to $50.9 billion, while earnings for the year were negative $1.61 per share, down substantially from earnings of $3.01 per share a year ago. However, most other operating metrics were much more positive, including the company’s decision to boost its dividend 15% to $1.67 per share—an annual yield of 2.9% at current levels. Valuentum subscribers know that Rio’s dividend is in good shape, even though operating results remained challenged (Image Source: RIO).

Rio Tinto only swung to a loss due to an asset impairment charge, but underlying earnings and operating cash flow still fell 40% year-over-year. Unfortunately for Rio, this came at the same time that the company increased capital spending by more than $5 billion to boost capacity. As such, the firm burned through $1 billion in cash (CFO less capex). Normally we would find an event like this very problematic, but Rio intends on generating annualized cash cost savings of $3 billion that could result in $5 billion of savings in 2013 and 2014 alone. Cash flow looks almost certain to improve, and frankly, the year could not have been worse for most commodity producers (we think the firm did a fairly solid job of generating cash). China, the world’s largest resource hog, could return to 8%+ growth this year, which in turn would lift the fortunes of all of Rio’s businesses. Commodity prices alone accounted for $5.3 billion worth of the earnings decline—even though volumes were higher.

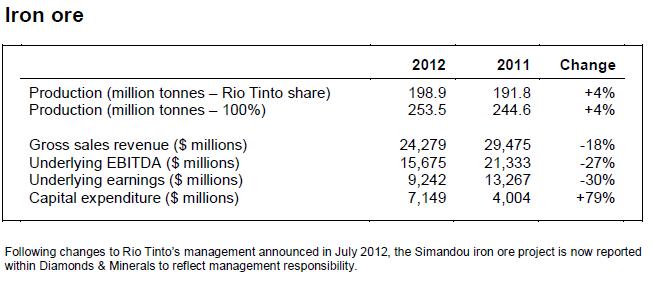

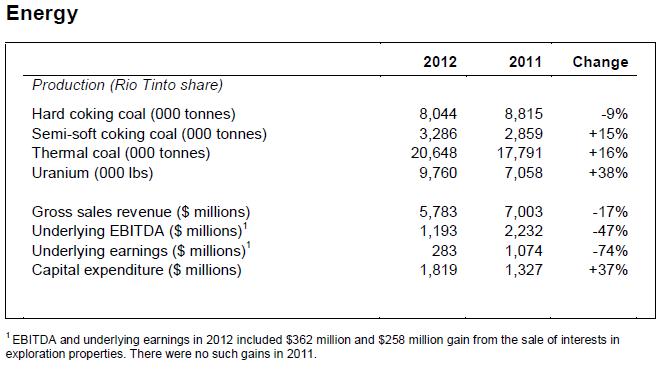

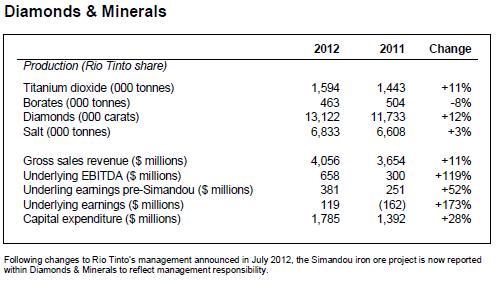

Let’s take a look at performance on a segment basis (Source of Images: RIO).

Iron ore production was strong, growing 4% year-over-year as planned capacity additions helped bring new supply on line. The firm continued to ramp production at Pilbara, with capacity on its way to 290 Mt/a by the third quarter of 2013, and 360 Mt/a by the end of the first half of 2015. Iron ore demand improved substantially during the fourth quarter of 2012 and has been strong throughout the beginning of 2013, but the firm expects at least a mild price decline.

Regardless, we like the near-term outlook for iron ore, especially since we’re feeling relatively bullish on China’s economic growth compared to 2012. Rio anticipates volumes to increase 5% in 2013 to 265 million tonnes, and we believe additional capacity will come on line throughout 2013. Iron ore remains one of the firm’s best segments.

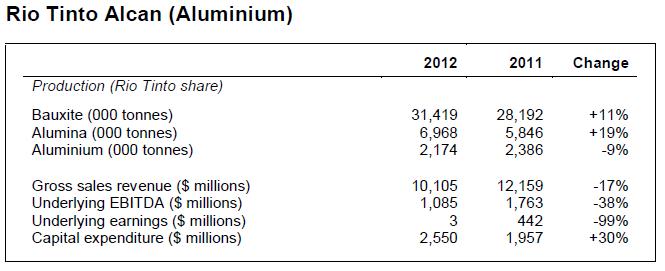

The broader aluminum market was absolutely terrible in 2012 thanks to a substantial decline in prices. In fact, Rio took a pre-tax impairment charge of $12.4 billion to reflect the negative changes in the broader aluminum market. Production is expected to rise for bauxite, alumina, and aluminum in 2013, though pricing remains uncertain going forward. Lowering cash costs will be most important, and we think such is certainly attainable given Rio’s track record of strong operational performance. Like so many deals that consummated during the past five years, the company ended up purchasing assets near a market peak, making the deal highly destructive to shareholder value. While the previous CEO takes the blame, we hope current CEO Sam Walsh takes a more disciplined approach to asset acquisition.

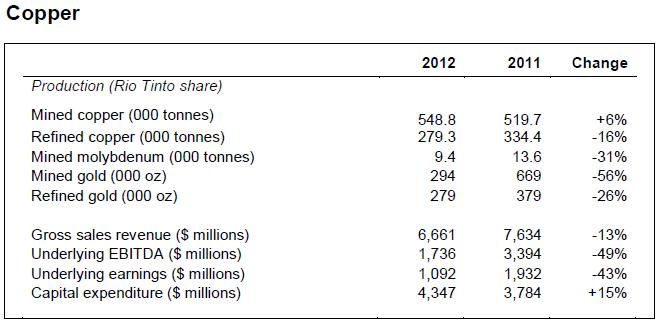

Copper results were highly challenged, as the segment dealt with the combination of declining EBITDA and rising capital expenditures. Production fell for every resource, except for mined copper, where volumes increased 6% year-over-year. The production increase was easily offset by a 10% decline in copper prices (as well as lower grades of gold), which hurt profitability.

Unfortunately for the firm, capital expenditures over the next several years will need to remain high in order to increase capacity and extend the lives of existing mines. Mined copper production is expected to jump 21%, while refined copper production is expected to increase 10% in 2013. The outlook for copper prices in 2013 is fairly neutral, but a return to economic growth in China could help propel demand and improve the pricing picture.

Revenue in the energy segment slipped 17% compared to the prior year, with EBITDA sinking nearly 50%. Production gains were terrific across the board (some segments did face easy comparisons), but global coal pricing slumped in the wake of modest global economic growth. Hard coking coal prices dropped as much as 62%, thermal coal prices fell as much as 39%, and uranium prices were down as much as 20%. Given the high fixed cost nature of mining operations, weak pricing can wreak havoc on earnings, which was the case during 2012 in the energy segment (and all other segments for that matter).

Rio took a write down to account for the diminished value of its Mozambique operations, but the company is more interested in boosting capacity and investing in productivity. The Mozambique mine in particular remains constrained due to a lack of supporting infrastructure—always an important risk for miners who invest in underdeveloped economies. Looking ahead, production of hard coking and semi soft coking is anticipated to increase to 8.5 million tonnnes and 4 million tonnes, respectively, but production of thermal coal and uranium is anticipated to fall to 20.5 million tonnes and 9.5 million pounds. Both thermal coal and uranium experienced dramatic volume increases in 2012, so we aren’t too worried about a slight pullback.

As for segment earnings, we could see a strong price recovery for coking coal thanks to higher steel production in China and other emerging economies. Unfortunately, growing global supplies could impair industry profitability dynamics, and coal, particularly of the thermal variety, faces potential long-term regulatory risk and obsolescence. We’re cautious on the amount of earnings Rio’s energy segment will produce in 2013, but we doubt it will be significantly worse than 2012.

The firm’s Diamonds & Minerals segment was a bright spot for Rio during 2013, with revenue jumping 11% and underlying EBITDA up 119%. Titanium dioxide production jumped 11%, allowing the firm to capitalize on higher prices during the first half of 2012. Unfortunately, the industry has been struck by oversupply as of late, so it appears 2013 could be a challenged year.

Diamond production rose to fill some of the void left by lower production at competitor Anglo American’s DeBeers, though prices were not too strong throughout 2012. Although we don’t see a dramatic demand increase in the cards for 2013, continued jewelry strength in China and India could improve prices.

Rio is forecasting pretty strong production increases, with titanium dioxide, diamonds, and borates increasing to 1.7 million tonnes, 13.9 million carats, and 0.5 million tones, respectively. With DeBeers seeing production flat for diamonds and other producers worried about global titanium oxide supply imbalance, we think Rio could see some upside in this segment.

Overall, we thought 2012 was a challenging year for Rio, but such volatile down years are to be expected from commodity producers (which is why we focus on mid-cycle earnings for our valuation). In 2011, Rio generated over $15 billion in free cash flow, so a swing to negative $1 billion for one year isn’t the end of the world. The firm’s balance sheet isn’t nearly as leveraged as some competitors, with its debt-to-capital ratio at 25% (after issuing $7.9 billion in low-cost debt during 2012). The company has a net debt position of $19.3 billion, but it has $7.1 billion worth of cash on its balance sheet (and no individual year of huge debt expirations).

In spite of posting an accounting loss in 2012, the firm’s strong balance sheet allowed for the aforementioned dividend increase. We continue to believe shares of Rio have upside, and we like holding the low-cost miner in the portfolio of our Best Ideas Newsletter. As we stated earlier, we aren’t predicting a tremendous year for 2013, but fortunes could change quickly, and we’re comfortable holding shares in anticipation of stronger global economic growth.