At Valuentum, we pride ourselves on a multi-faceted investment methodology, acknowledging that several market-movers view any given investment from different perspectives. That is precisely why we’re staying away from shares of GameStop (click ticker for report: ), which scores poorly on the Valuentum Buying Index (our stock-selection methodology). Let’s take a look at why we don’t like the company.

Changing Dynamics of Gaming Culture

One of the unique features of the video game market has been the relatively liquid buying and selling of games. Since the days of FuncoLand (which was eventually acquired by GameStop), consumers could purchase and sell games new or used, and the game shops would help facilitate this market. Have a copy of Nintendo’s Super Mario that you’d like to trade for Donkey Kong? One could sell the game to GameStop, use the credit to purchase the new (or used) game, and GameStop would then sell the purchased game to another consumer for a profit.

However, the game makers like EA (click ticker for report: ), Activision (click ticker for report: ), and Take-Two (click ticker for report: ) are struggling to compete due to a lack of new gaming consoles, as well as the new dynamics of gaming. Gaming in the pre-XBOX Live (click ticker for report: ) era was mostly played in person, making it more likely that gamers would purchase one game, complete it, and then move on to the next one. Now, online gaming is all the rage, so game purchasing is becoming much more concentrated. Gamers purchase fewer different games and spend more on games with developed online game play like Madden, NBA 2K, Call of Duty, and the likes.

Long-time gamers may remember the days of a game for literally everything in the early-mid 1990’s. Now, game creators have blockbuster film-esque budgets in order to develop blockbuster titles, making capturing the entire profit chain more important. As a result, the major console creators, Sony (SNE) and Microsoft, might disallow used games from playing on next generation systems.

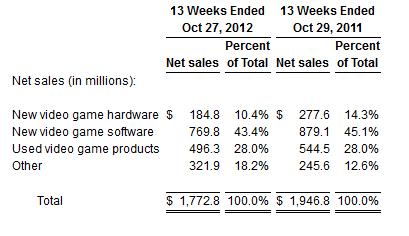

This is a big problem for GameStop. Let’s take a look at the financial results from the most recent quarter (Image Source: GameStop).

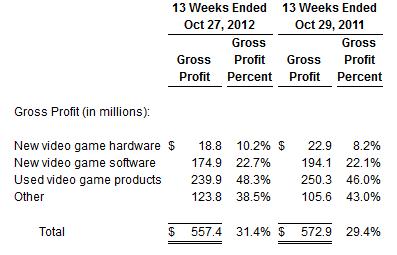

Used video games were 28% of sales, and the category declined 9% year-over-year. That certainly wasn’t good, but its impact on profitability was worse, as shown below (Image Source: GameStop).

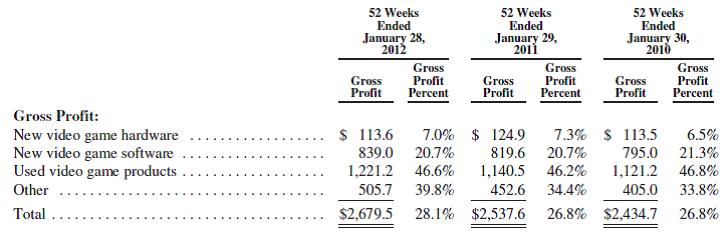

In the most recent quarter, used game sales accounted for 48.3% of gross profit! That’s a substantial category, and while gross profit in the category won’t go to zero in the near term, both Sony and Microsoft are making a decline in long-term profitability inevitable. If we look at the past several years, we can see that used games have been the primary profit engine for the company, as shown below (Image Source: GameStop).

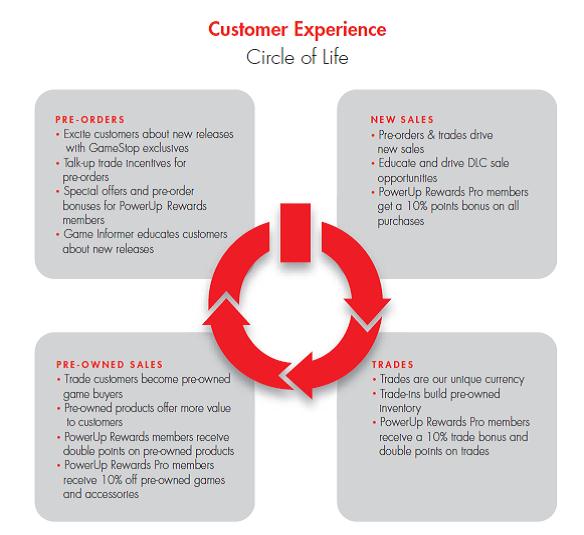

In its 2011 annual report, GameStop emphasized the importance of used games to its business model, going so far as to say its new title performance is strongly linked to its used/trade model. In other words, this represents GameStop’s competitive advantage over Amazon (click ticker for report: ) and Best Buy (click ticker for report: ).

While cutting GameStop (and Best Buy) out of the equation makes the most sense for game creators, it also makes a lot of sense for Sony and Microsoft. With the rise in cloud storage and the relatively inexpensive cost of memory hardware, digital distribution becomes even easier. It also results in cost savings for game producers, and the game producers will not have to physically distribute copies. Further, we’re sure both Microsoft and Sony would love to collect a commission on sales through their digital stores. It is readily apparent that it’s in the best interests of every entity BUT the retailers to eliminate used game sales and even physical distribution.

But GameStop Pays a Huge Dividend…

…and it certainly does. GameStop’s dividend yield is approximately 4% at current share prices. Luckily for GameStop shareholders, the firm doesn’t need much in terms of incremental capital investment, which means the firm still generates decent free cash flow. However, operating cash flow looks destined to fall substantially if used game sales are eliminated from the equation. GameStop doesn’t have any debt, which certainly helps, but neither did RadioShack (click ticker for report: ), which recently slashed its dividend.

A dividend is no reason to enter a position in a declining retailer, as we’ve seen play out several times during the past few years. Dividend yields can always get higher if the share price languishes, and there is no assurance that a high yield is a sustainable yield.

At this time, we believe shares of GameStop look fairly valued, but if fears of a used game “lockout” come to fruition, we could see our fair value estimate lowered. We think the company could easily experience a prolonged and material decline in profitability and likely go through a “right-sizing” akin to what many of the big box retailers have done recently.

Ultimately, the firm’s technicals are not great at this time, and we think the value part of the equation is highly uncertain. With earnings likely to slow, we cannot see growth investors getting behind the name. We don’t think the stock fits any investing style at this point, so we won’t be adding the name to the portfolio of our Best Ideas Newsletter at this time. Valuentum investors just aren’t interested in this potential value trap.