Since rails are heavily tied to weakening coal shipments, there was a great deal of skepticism about the industry’s strength during the back half of 2012. However, we saw evidence (AAR data) that indicated an altering freight mix (auto sales, intermodal, petroleum shipments, crushed stone, gravel and sand) could compensate for coal shipment weakness. Let’s dig into how the group is performing now that fourth-quarter results for a few of them have come in.

On Thursday, Union Pacific’s (click ticker for report: ) fourth-quarter report revealed that its performance during the period was solid. Despite the weak coal shipments, revenue grew 3% year-over-year to $5.3 billion, roughly in line with consensus expectations. Earnings were better than anticipated, growing 10% year-over-year, to $2.19 a share.

22% of Union Pacific’s revenue came from coal in 2011, and coal revenue fell 7% during the fourth quarter of 2012 (shipments declined a whopping 17%). But as the better-than-expected overall performance in Union Pacific’s quarter reveals, weakness in coal shipments will not be tragic to all rail operators.

Union Pacific’s agricultural revenues were also a bit weaker, down 8% year-over-year. Management blamed the US drought for dragging down revenues—a statement we completely agree with. From the conference call:

“A 22% decline in carloadings was driven by last summer’s drought, which unfortunately had its greatest impact in UP-served territories. The resulting tight supply of corn has reduced livestock count and lowered the domestic feed grain shipments, with increased reliance on local crops in East Texas and Arkansas also impacting our volume.”

Strength from chemicals (up 15%), automotive (up 14%), and intermodal (up 6%), however, more than offset this weakness at Union Pacific. The broader chemical market has been relatively weak all year, but since the US lacks sufficient pipeline capacity to move its newly-found oil, the railroads have stepped up to the plate. Also from the conference call:

“Mix-impacted average revenue per car was flat, and revenue grew 15%, leading the way again with petroleum products, where a 69% increase in volume was driven by over 160% growth in crude oil.”

Although firms like Kinder Morgan (click ticker report: ) are working to add pipeline capacity, we think the rails will continue to benefit in the near term, as it will take some time for increased capacity to come on line.

As long-time followers of Valuentum know, we’ve been bullish on the auto recovery in the US, and we think such strong domestic performance will continue into 2013. We fully expect the auto rebound to provide a boost to the rails in 2013. Intermodal should also remain strong in 2013 due to what management identified as a driver-supply shortage. Without a sufficient number of drivers to meet demand, rail will remain an integral part of shipping in the US.

Though its performance beat consensus expectations, Norfolk Southern’s (click ticker for report: ) fourth-quarter results, released January 22, weren’t as strong as Union Pacific’s, in our view. We think the firm’s higher exposure to coal shipments is to blame, as revenue fell 4% year-over-year to $2.7 billion and earnings per share declined 8% year-over-year to $1.30.

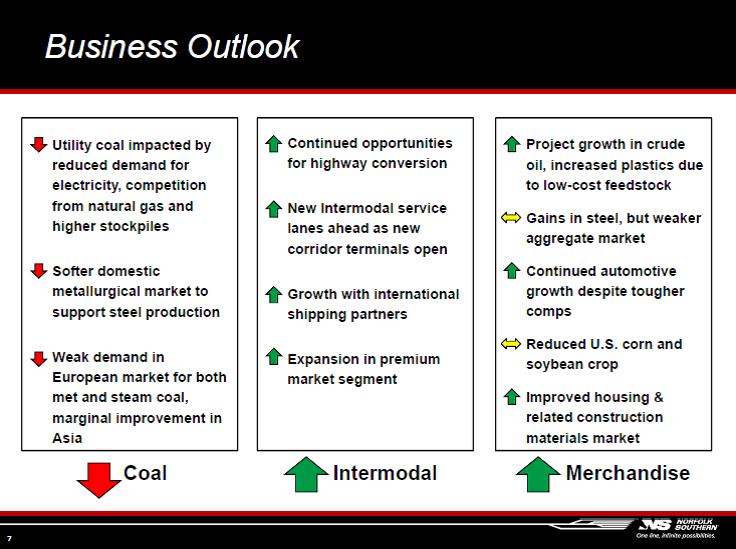

Coal revenue was down 23% compared to the same period a year ago, which weighed heavily on the company’s total revenue and earnings. Unfortunately for Norfolk, the firm isn’t very optimistic about coal heading into 2013 (shown below). However, we like the prospects for global economic growth, so we think there is some upside to the forecast (Image Source: NSC 4Q Earnings Presentation).

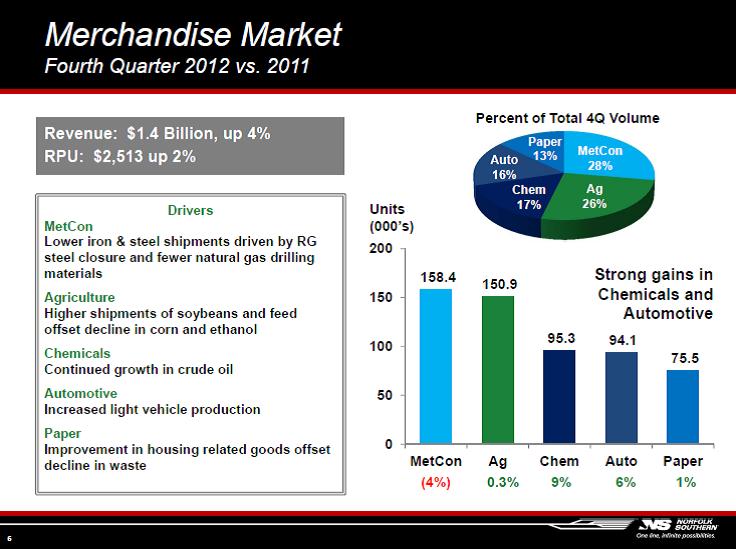

As with Union Pacific, Norfolk identified the chemicals and automotive segments as pockets of strength (shown below). Unfortunately, the firm wasn’t able to capitalize on crude oil strength as well as Union Pacific did (Image Source: NSC 4Q Earnings Presentation).

All things considered, we like the fundamentals of the rails, particularly Kansas City Southern (click ticker for report: ). Kansas City Southern has a very nice niche in Mexico, and the investment in Mexican production by auto OEMs can only provide a boost for the company (as the US auto market continues to strengthen). Though we find the cohort fairly valued at this time, we wouldn’t hesitate to add a railroad to the portfolio of our Best Ideas Newsletter at an attractive price (below the low end of our fair value range on improving technicals).