Legendary investor Warren Buffett was taught by his mentor Benjamin Graham about the mood swings of Mr. Market. Buffett expanded this idea, famously characterizing Mr. Market as schizophrenic. It appears the latest bout of irrationality has been extended to Apple (click ticker for report: ).

Apple is the most valuable company in the world, the most widely held, and the most watched. It has possibly more metrics to “meet” than almost any other firm. During its fiscal first quarter, Apple easily exceeded consensus bottom-line estimates with earnings of $13.81 per share, though that number was down compared to a year ago due to calendar timing (the most recently-reported quarter of 2013 was 13 weeks while last year’s quarter was 14 weeks). Revenue during the quarter advanced 18% year-over-year to $54.5 billion, slightly below consensus estimates, but still a brisk pace given the calendar shift. Perhaps the most appropriate words for putting the quarter into perspective came directly from Apple’s press release:

Average weekly revenue was $4.2 billion in the quarter compared to $3.3 billion in the year-ago quarter.

The firm sold 22.9 million iPads, 47.8 million iPhones, over 2 million Apple TVs, 12.7 million iPods, and 4.1 million Macs. Aside from the 4.1 million Mac units sold, which was 20% below expectations, no product sales deviated meaningfully from expectations.

One area of concern during the period, however, was on the gross margin side, though we don’t think the margin decline came as much of a shock. Apple’s gross margins declined 610 basis points year-over-year to 38.6% as the firm essentially refreshed its entire product line-up during the quarter. Still, we’d like to see this number settle a few basis points higher to ensure continued earnings expansion. And Apple could vertically-integrate–scoop up a key supplier–to boost gross margins should pricing pressure intensify (or it be unable to improve gross margins organically).

Other than higher cost of goods sold, Apple did a fantastic job controlling expenses. R&D increased to over $1 billion, but it remained below 2% of revenues, at 1.9%. SG&A actually declined 40 basis points as a percentage of sales, to 5.2%. Although the company continues to add stores in China, we think SG&A expenses will continue to be controlled.

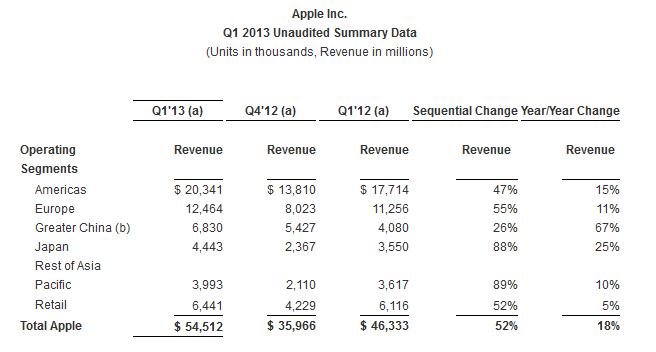

On a geographic basis, Apple experienced fantastic growth in China (shown below). Though performance was a bit underwhelming in Europe, we can’t help but focus on those numbers in China, which debunk the myth that the firm needs to make a low-end iPhone. While year-over-year sales growth in the rest of the Asian market (excluding Japan) wasn’t too strong, we think the solid results in China are far more important for the company at this time.

Retail growth was somewhat disappointing, but we think a lot of the weakness can be explained by the company’s supply-chain constraints, which also kept Mac unit sales subdued. We think Macs are a very important item for Apple stores, and we expect the number to recover as PC demand and Mac supplies improve.

The company generated an unparalleled $23 billion in cash from operations, and nearly $10 billion in free cash flow. The firm’s cash balance now sits at $137 billion! Apple could purchase nearly any company in the world. When the firm is trading at a single-digit price-to-earnings ratio and it has the capacity to buy faster-growing entities that may warrant a significantly higher multiple (for the entire business), one can easily see how Apple’s existing valuation makes little sense (without even diving into the intricacies of a discounted cash-flow model). That said, however, we’d really like to see the firm announce a substantial dividend increase or share repurchase to reward shareholders.

Going forward, the company provided fairly vague guidance. For the first time ever, CEO Tim Cook informed investors that the firm will attempt to provide more accurate future guidance, a departure from its previously conservative nature. Therefore, we were initially disappointed by management’s call for revenue of $41 billion to $43 billion—well below the Street’s consensus of $45 billion. Gross margins are predicted to be 37.5%-38.5%, with operating expenses of approximately $3.8 billion, implying just under $10 per share in earnings. That figure is well below the Street and down 20% from the same period a year ago.

However, management also noted on the conference call that guidance was intended to cover sell-through revenue, not sell-in. CFO Peter Oppenheimer addressed the issue at length:

It is that range is a 5% to 10% year-over-year increase. And there are few factors that are impacting the year-over-year results making the strong performance of the business a little bit harder to see. So, let me point a few of these out. First of all, as we have talked about last several times on the call, last year in the March quarter, we’ve built 2.6 million units of iPhone channel inventory, which allowed us to get into our 4 to 6-week range. That increased the revenue in the year ago quarter by $1.6 billion. And as Tim talked about that was sell-in that was not sell-through, we are thinking about the business on a sell-through basis. So, don’t lose sight of the 1.6 billion.

Assuming the revenue is being modeled on this “sell-through” basis, then the company’s need to build iPad Mini inventories (discussed at length) and iPhone 4 inventories are not included in the guidance. If it added $1.6 billion in revenue during the second quarter last year, perhaps it could have a similar impact on the second quarter of 2013.

At this time, there is little doubt Apple is a technically broken stock, and among the most hated stocks in our coverage universe. Respected bond manager Jeffery Gundlach thinks $425 is the stock’s fair value, and many think the innovation is over. Frankly, we feel investors are simply reaching to explain why the stock went down. Apple sold 47.8 million iPhones during the quarter, and 22.9 million iPads. And we saw fantastic iPhone activations from Verizon (click ticker for report: ) earlier this week, even though the company does everything in its power to sell customers phones with lower subsidies.

Apple is the premium technology brand in the world, and we continue to believe it has wonderful times ahead of it. Admittedly, we have no insight into Apple’s potential product pipeline, but any new, unexpected product would be icing on the cake at this point. We’d like to see better capital allocation (which has been questionable during the past few years), but we don’t think Apple should trade at a multiple below Microsoft (click ticker for report: ) and not even in the same ballpark as the profit-agnostic Amazon. However, we’re waiting for its Valuentum Buying Index (our stock-selection methodology) score to improve before we consider putting more capital to work in the name.