Over the past week, both JP Morgan (click ticker for report: ) and Wells Fargo (click ticker for report: ), two of the nation’s most important banks, reported fourth quarter results.

JP Morgan reported better than anticipated earnings of $1.39 per share, but the firm’s net interest margin (NIM)—return on deposits less the cost of deposits—continues to decline. As the graph below shows, the bank’s NIM has fallen to 2.4% in the most recently-reported quarter from 3.42% in fiscal year 2009 (Image Source: JPM Q4 2012 Earnings Presentation). Such a trend remains an ongoing problem with the banking sector as a whole, but the weakness is not tragic and does not alter our long-term thesis on the group, which is tied to improving real estate markets and stronger consumer credit quality (and better loan performance).

J P Morgan CEO Jamie Dimon thinks the trend in NIM will eventually reverse itself, but continued compression will likely impact 2013 profitability in the Consumer & Business banking unit for some time to come. As the comments above show, reduced loan yields and lower return expectations on investment securities (particularly in the fixed-income market) are the main drivers.

P Morgan CEO Jamie Dimon thinks the trend in NIM will eventually reverse itself, but continued compression will likely impact 2013 profitability in the Consumer & Business banking unit for some time to come. As the comments above show, reduced loan yields and lower return expectations on investment securities (particularly in the fixed-income market) are the main drivers.

However, other metrics at JP Morgan look more promising. Credit card sales volumes advanced 9% year-over-year at the bank, and deposits surged 10% year-over-year, to $404 billion (up 3% on a sequential basis).

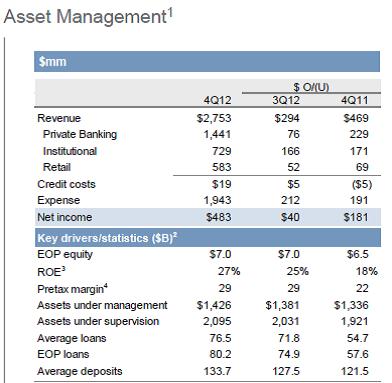

The firm’s high-return asset management business continues to perform well, too. As the image to the right reveals, net income surged, as assets under management and supervision advanced (Image Source: JPM Q4 2012 Earnings Presentation). Compared to many of its peers, JP Morgan remains light in wealth management, and we think the segment can become a meaningful profit driver going forward.

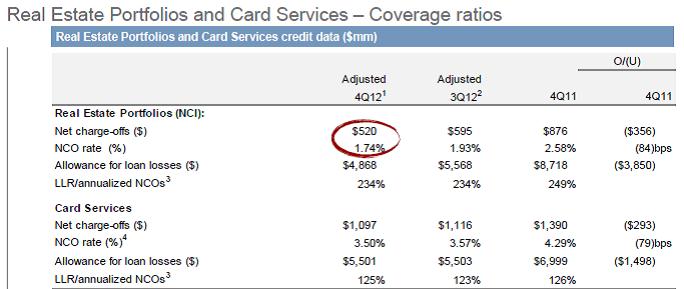

Most importantly, in our view, credit quality continues to improve. Both the firm’s net charge-offs and allowance for loan losses declined as the real estate market heals. On a year-over-year basis (as the graph below shows), the bank’s net charge-off rate fell to 1.74% from 2.58%, while the allowance for loan losses dropped to $4.87 billion from $8.72 billion (Image Source: JPM Q4 2012 Earnings Presentation). We like what we see and think these ratios are most informative of the ongoing improvement and health of the banking sector.

JP Morgan remains excited about the prospects of repurchasing stock, though recent strong share performance has made the idea a slightly less-attractive proposition. Buying stock below intrinsic value is value-creative, while buying stock above intrinsic value is value-destructive.

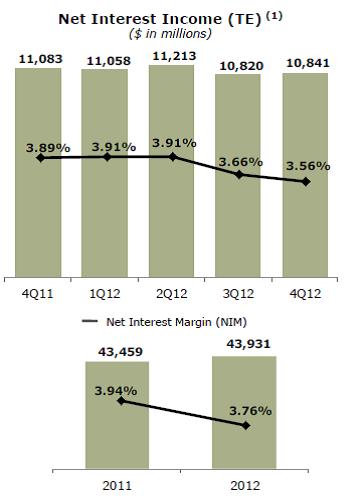

Similar to JP Morgan, Wells Fargo, the nation’s largest mortgage originator, exceeded estimates by a few pennies, earning $0.91 per share during the fourth quarter. As the chart to the right shows, net interest margins were also weak at the bank, falling 10 basis points sequentially and 33 basis points from the mark achieved in the fourth quarter of 2011 (Image Source: WFC Q4 Earnings Presentation).

Similar to JP Morgan, Wells Fargo, the nation’s largest mortgage originator, exceeded estimates by a few pennies, earning $0.91 per share during the fourth quarter. As the chart to the right shows, net interest margins were also weak at the bank, falling 10 basis points sequentially and 33 basis points from the mark achieved in the fourth quarter of 2011 (Image Source: WFC Q4 Earnings Presentation).

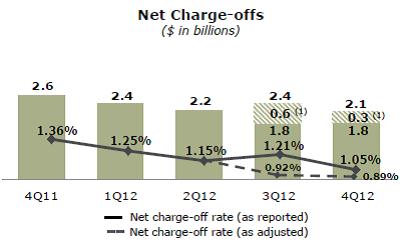

Credit quality continues to improve at Wells Fargo as well. On a reported basis, net charge-offs are now almost 1% of loans. The bank is notorious for being a bit stricter in its lending practices than other firms, so its below-market charge-off rate is not surprising. As the graph below shows, the downward trend is fantastic (Image Source: WFC Q4 Earnings Presentation).

In addition to a well-performing loan portfolio, Wells Fargo continues to build its wealth management, brokerage, and retirement operations. Segment earnings surged 13% year-over-year to $351 million, and managed account assets in the retail brokerage business grew 20% year-over-year to $304 billion. Adding additional assets tends to be both a profitable and sticky business, making it a wonderful segment for Wells Fargo to continue to expand.

Though we’re huge fans of the improving credit quality of both banks, we continue to prefer diversified exposure to the banking sector via the Financial Select Sector SPDR (click ticker to download report: ).