On January 1, medical giant Abbott (click ticker for report: ) will start trading as two firms, Abbott and AbbVie. The companies will form two distinct, publicly-traded businesses, allowing the market to value each company separately and uniquely. Pharmaceuticals will be housed in AbbVie, while medical diagnostics, baby food, and generic drugs will remain a part of Abbott. Let’s first dig into AbbVie. We’ll have a follow up article on the new Abbott in coming days.

AbbVie Led by Humira

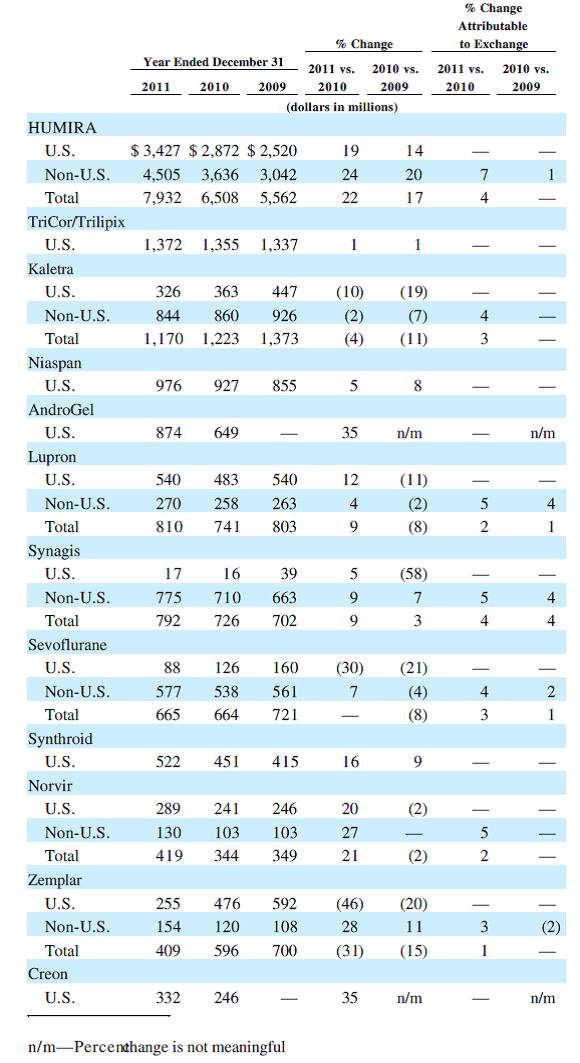

Headlining the new pharmaceuticals business is the blockbuster drug Humira, which had over $7.9 billion in sales in 2011 alone. Though originally approved for rheumatoid arthritis in 2003, the drug has been approved to treat Crohn’s disease, plaque psoriasis, ulcerative colitis, psoriatic arthritis, and ankylosing spondylitis. On top of the various uses previously approved, AbbVie hopes the drug will gain acceptance for expansion into other autoimmune conditions, thereby expanding Humira’s patent life. Assuming additional global regulatory approval, we wouldn’t be shocked to see the drug exceed $10 billion in annual sales alone.

Image Source: Abbott

Andro Gel is another of AbbVie’s fast-growing drugs, with sales growing 35% in 2011 to $874 million. Approved for the treatment of low testosterone, we think the drug will continue to gain popularity as aging males seek ways to mitigate the impact of aging. With men living longer and healthier lives, the benefits of a drug like Andro Gel have become even more pronounced. Although plenty of non-FDA approved (and some illegal) measures exist, we think consumers will opt for a process that can be professionally supervised.

AbbVie will have two other billion dollar drugs in TriCor and Kaletra. TriCor is used to treat cholesterol via LDL reduction. Cholesterol is one of the more competitive spaces in the pharmaceutical world, with drug’s such as Pfizer’s (click ticker for report: ) Lipitor and AstraZeneca’s (click ticker for report: ) Crestor prominent in the space. Kaletra is part of a therapy used to treat HIV/AIDS, though sales have steadily declined the previous two years.

Pipeline: Several Launches Coming

“Advancing the pipeline. AbbVie’s goal is to bring to market products that demonstrate strong clinical performance for patients and economic value for payors. The company’s pipeline includes both small molecules and targeted biologic therapies, and a mix of new compounds and new indications. The company has more than 20 compounds or indications in Phase II or III development individually and under collaboration or license agreements. From 2013 through 2016, AbbVie anticipates new product launches, including: AbbVie’s interferon-free regimen for the treatment of HCV; a levodopa-carbidopa intestinal gel (LCIG) in the United States for advanced Parkinson’s disease; elotuzumab, a humanized monoclonal antibody for the treatment of multiple myeloma; daclizumab, a monoclonal antibody for the treatment of multiple sclerosis; ABT-199, a next-generation bcl-2 inhibitor in development for chronic lymphocytic leukemia; and new indications for HUMIRA.”

– AbbVie S1 Filing, December 10, 2012

As with most pharmaceutical companies, AbbVie is confident about its prospects for developing its drug pipeline, though the obvious hurdles (efficacy and approval) remain omnipresent. Since the company will be incredibly well-capitalized, we believe it will be able to invest in new drugs via research and development, as well as acquisitions and partnerships if necessary.

Cash Flow Should Not Be a Problem

The beauty of a blockbuster drug like Humira is the incredibly low marginal costs associated with commercialization. On a pro forma basis, AbbVie generated $6.2 billion of operating cash flow, while spending just $533 million in capital expenditures. This gives the company plenty of money to invest in new drugs while Humira and Andro Gel remain patented.

Capitalization won’t be a problem either, with the company sitting on a cash hoard in excess of $7 billion (though it will have $14.7 billion in long-term debt and $1 billion in short-term borrowings). Given the company’s cash flow generation ability, we doubt debt servicing will be much of an obstacle at all. In fact, we like the new entity’s balance sheet.

Image Source: Abbott

High Yielder

In addition to providing investors with the potential upside of new drug commercialization, AbbVie will pay an annual dividend of $1.60 per share—an annual yield of 4.6% at AbbVie’s current “when-issued” price of $35, which is substantially higher than the combined entity’s current yield of 3.1%. This also compares favorably to the new Abbott’s paltry 1.8% dividend yield, as well as other pharmaceutical high yielders such as Pfizer and Bristol-Myers Squibb (click ticker for report: ).

The Market Doesn’t Like AbbVie

Based on the high dividend yield at the “when issued” price and the basic reason for the split (to value the businesses differently), we don’t think the market will be a big fan of AbbVie. Pharmaceuticals in general have fallen out of favor versus medical diagnostics, equipment, and more stable businesses. However, we see things a bit differently when it comes to AbbVie.

Though liking a company because everyone hates it isn’t necessarily the best investment strategy (see Radio Shack or Best Buy), hated spinoffs tend to experience initial selling pressure and (most importantly) underpricing. This has led to fantastic gains for Dividend Growth Newsletter portfolio holding Phillips 66 (click ticker for report: ), as well as solid performance from ADT (ADT), and Marathon Petroleum Company (MPC).

We’re anxiously awaiting the spinoff, and we think shares of AbbVie could make a compelling opportunity as an income or total return investment. We are strongly considering the newly-formed firm in the portfolio of our Dividend Growth Newsletter.