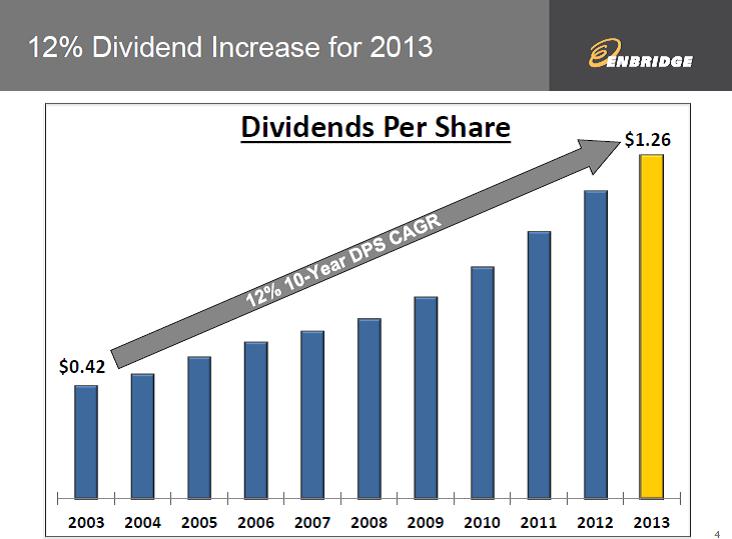

Energy transporter Enbridge (click ticker for report: ) held its annual guidance conference for 2013 this Thursday. The company raised its dividend 12% to $1.26 per share, which is in-line with its current 10-year growth trajectory. Shareholders have seen fantastic dividend growth during the past decade, and we think the company remains in a strong position to keep raising its dividend going forward.

Image Source: Enbridge

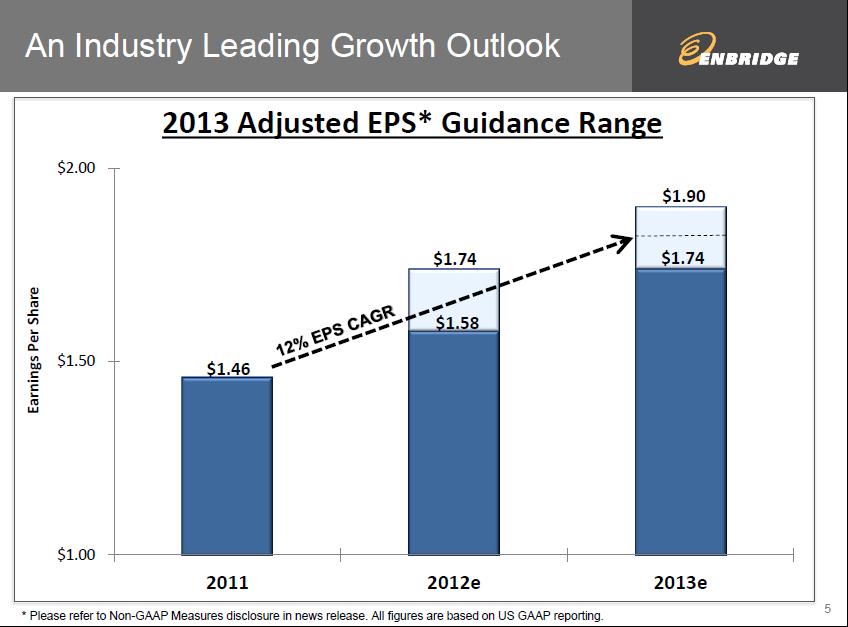

On top of a strong dividend increase, Enbridge guided to 12% earnings growth in 2013 (based on current projections).

Image Source: Enbridge

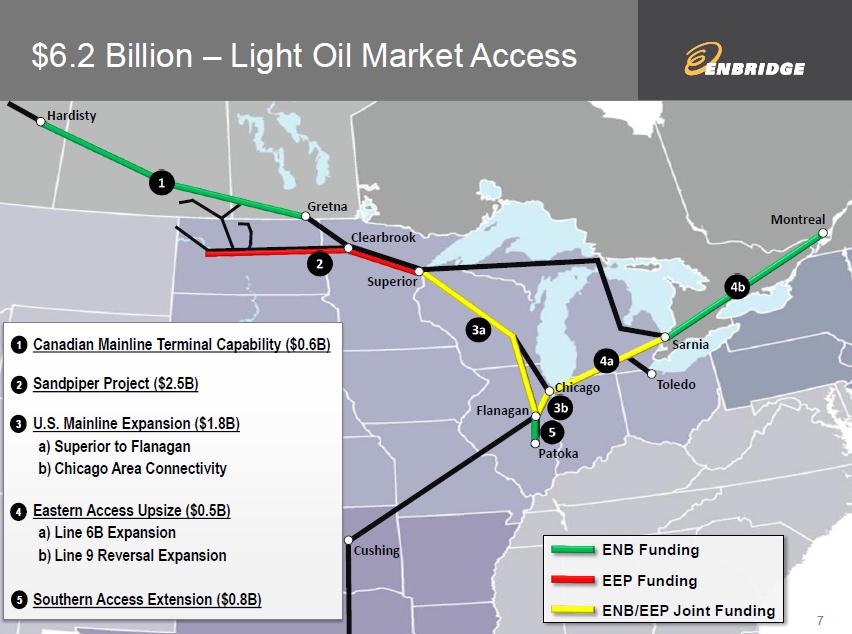

Due to the hefty demand of Canadian and North Dakota-based shale oil, the company is investing heavily in new pipelines to bring product to market and distribution centers. Enbridge announced plans to spend $6.2 billion in order to expand the pipelines from Western Canada and North Dakota.

Image Source: Enbridge

The company will also be using a joint-venture rail facility to secure 80,000 barrels per day to satiate East Coast refinery demand. Management estimates that it could potentially double capacity at the facility—and even that won’t be enough to meet potential demand. The current plan gives the firm access to several important markets, making it one of the best plays on Bakken and Canadian shale oil, in our view.

Pipeline and other oil transportation firms should continue to benefit from the US (and Canada) becoming the largest oil producer in the world (expected by 2017). Although a bevy of factors, including higher fuel economy standards and alternative energy sources, may impact demand, we believe oil will continue to be among the most chosen fuel sources on earth. We do not anticipate a material fall in oil prices, though gasoline prices (and other refined products prices) could eventually fall over the near term if refinery capacity expands at a greater-than-expected pace.

Though we don’t think shares of Enbridge are cheap, the firm’s dividend growth potential is absolutely fantastic. Still, we prefer Kinder Morgan Energy Partners (click ticker for report: ) because of its significantly higher dividend yield and its diverse businesses. Kinder Morgan continues to build new projects that should help it grow its payout in the future, and we plan to continue to hold shares of Kinder Morgan in the portfolio our Dividend Growth Newsletter.