Agricultural equipment giant Deere (click ticker for report: ) reported mixed fourth quarter results Wednesday morning. Revenue increased strongly, growing 14% year-over-year to $9.8 billion, better than consensus estimates. Earnings grew just 8% year-over-year to $1.75 per share, which was well below consensus expectations.

Gross margins remained roughly flat, falling just 20 basis points year-over-year to 25.4%. Both research and development costs, as well as SG&A soared during the quarter, jumping 16% and 10%, respectively, and negatively impacting profitability. In fact, when adjusting for healthy share repurchases, net income per share grew only 3% year-over-year. Though it’s probable these investments could yield solid long-term results, we never like to see companies ramp SG&A expenses unless they are able to leverage the new fixed expenses almost immediately.

Agriculture & Turf revenue outpaced the broader company, with revenue jumping 16% year-over-year to $7.3 billion. The company cited better prices and higher volumes as the key drivers, but it admitted currency fluctuations negatively impacted top-line performance. We were a bit disappointed in operating margins, though we think the company is focused on delivering new, differentiated product for farmers, whose incomes remain healthy.

Source: Deere

But despite this strong customer backdrop, the company is only forecasting net sales growth of 4% next year due to “challenging economic conditions.” The firm’s guidance is a bit pessimistic, in our view, though the company may be anticipating even stronger headwinds in the European market.

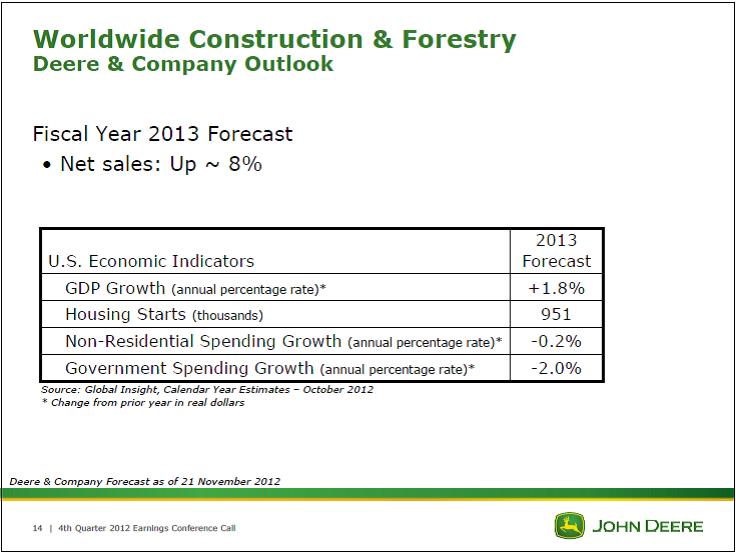

Construction & Forestry sales were less exciting, growing 7% year-over-year to $1.7 billion, though operating earnings jumped 38% to $120 million. This segment is just a fraction of the size of the agricultural segment, but the improving housing market has helped re-accelerate sales of Deere construction equipment. Given the firm’s dire forecast for government spending in 2013, we think the outlook for 8% sales expansion (see slide below) will be a bit higher if the fiscal cliff is avoided.

Source: Deere

Though Deere’s forecast for 2013 is relatively grim, with net income expected to tally $3.2 billion (up only 4%) and net sales growth of just 5%, we see some considerable upside if the economy is better than anticipated. Nevertheless, we don’t find the current risk/reward in shares of the equipment maker very compelling at this time based on its score on our Valuentum Buying Index.