ConocoPhillips (click ticker for report: ) reported its first full quarter as an independent E&P (exploration and production) company Thursday. It spun off its refining arm Phillips 66 (click ticker for report: ) earlier this year. Though we hold ConocoPhillips in the portfolio of our Dividend Growth Newsletter, we’re taking a hard look at whether we want to keep it, as we’ve been disappointed with some of the cash-flow trends recently (particularly after considering that future performance is largely determined by volatile oil and gas prices). We’re considering swapping it for other dividend-growth opportunities available on the market today, which we provide in the following table: “Stocks With High VBI Ratings and Strong Dividend Growth Prospects.”

ConocoPhillips reported adjusted earnings of $1.8 billion during its third quarter compared to $1.9 billion in the same period a year ago. Though earnings were impacted by lower oil and gas prices, the firm had some positive commentary about recent performance. For starters, the company is still ramping up in Eagle Ford and Bakken and expects continued growth from the Canadian oil sands. Quarterly production hit 1.525 million BOE per day in the quarter (up from the year-ago quarter), and it doesn’t appear to be having trouble finding buyers for assets that it has put on the auction block. It completed the sale of NMNG (NaryanMarNefteGaz) and diluted its interest in Australia Pacific LNG during the period.

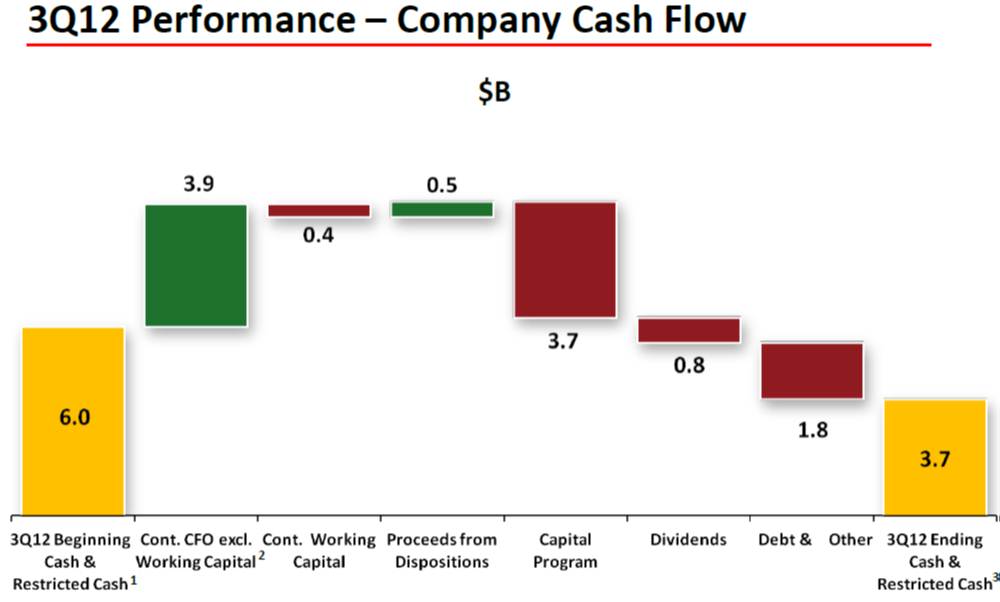

Looking ahead, ConocoPhillips expects to sell off another $8 billion in assets before the end of 2013 and achieve average annual production growth and margin expansion of 3-5% — both of which we think are achievable. During the first nine months, ConocoPhillips has generated over $2 billion in proceeds from asset distributions, which has helped its balance sheet (somewhat). Importantly, however, the firm pulled in $3.9 billion in cash from operations during the quarter, but such cash flow performance wasn’t sufficient to cover both capital spending and dividend payments. We weren’t thrilled by this recent trend as a newly-separated company at all.

Image Source: ConocoPhillips 3Q Presentation

And while we like that management remains committed to offering a sector-leading dividend, we plan to take a closer look at its future dividend coverage with cash flow and may consider removing our position from our Dividend Growth portfolio in coming weeks. If we make any moves, we’ll notify subscribers to our Dividend Growth Newsletter via email before we do so.