In the commodified airline industry, the lowest-cost provider often dictates the price for any given route, and real pricing growth continues to elude this troubled industry. As a result, efficient and low-cost operations are paramount to success, and in many cases, essential for long-term survival.

The primary metric used to gauge the cost structure of an airline is cost per available seat mile (CASM) — or the cost to fly one seat one mile, whether it’s occupied or not. Unfortunately, comparing one airline’s consolidated CASM with that of another offers little insight into which airline is truly more cost efficient, as some carriers sport regional operations and others vastly different route structures and fleets.

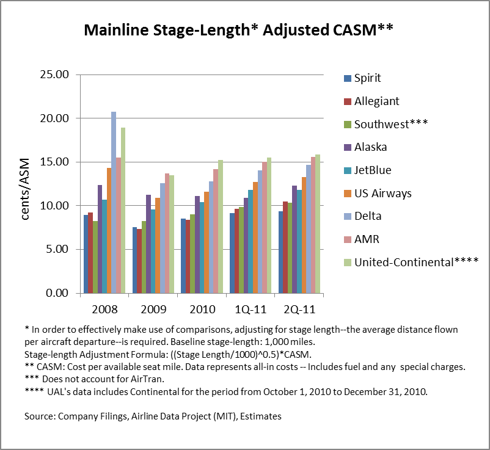

To really compare the cost structures between airlines, one has to look at mainline CASM adjusted for stage length (the average distance flown per aircraft departure). Adjusting for stage length corrects for the inherent differences in fleet sizes and route structures, while assessing an airline’s mainline operations strips out data from regional affiliates, which remain absent from the low-cost group. Traditionally, the industry has assessed this metric on a non-fuel basis, but given that fuel prices are a huge portion of an airline’s cost structure, let’s take a look at how the all-in, stage-length adjusted mainline CASM compares across a subset of carriers in the industry.

Based on second-quarter data, Spirit’s (SAVE) all-in, stage-length adjusted CASM remains significantly lower than even the most efficient of the network carriers — U.S. Airways (LCC). However, the cost gap between low-cost carriers and legacy peers is certainly narrowing. American (AMR) and United Continental (UAL) have retained their respective positions as the least-efficient airlines (based on this metric), boasting all-in, stage-length adjusted mainline CASMs that are materially higher than their low-fare counterparts. This type of cost analysis and industry evaluation, in part, led us to take a put position in AMR in our Best Ideas Newsletter, which we subsequently closed for approximately a 100% gain.

Although the overall cost gap between discount airlines and legacy, network carriers continues to shrink, low-cost carriers still have a big advantage over their larger rivals, something that will certainly come in handy during the next downturn. But even for an airline like Spirit that boasts the lowest-cost structure in the industry, we fall short of recommending the stock, as outlined in our initiation piece on the company:

There are certainly many things to like about Spirit: Its ultra low-cost structure, debt-free capital structure, and growth appeal. However, the name is still largely a play on the trajectory of jet-fuel prices and the direction of the economy (leisure travel) coupled with additional expansion risk related to the near-doubling of its fleet within five years. And with a current fleet that boasts an average age of just four years, cost pressures will intensify once Spirit’s aircraft-buying spree subsides beyond the middle of this decade. Though Spirit at some point may present a compelling trading opportunity, long-term investors can probably find a better place to put their money than the airline industry.