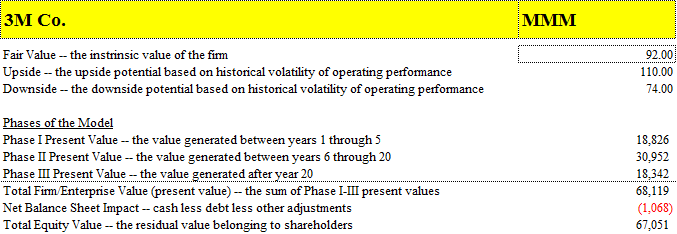

3M (MMM), best-known for making Scotch tape and Post-it Notes, reported second-quarter results Tuesday that showed weakness in LCD TV end-market demand and cost pressures related to higher input prices and the earthquake in Japan. Sales increased over 14% (about 4% organic) but the firm failed to leverage this expansion into meaningful earnings growth, which advanced less than 4% in the period. We were slightly disappointed by the performance, but we are maintaining our $92 fair value estimate.

Sales in Europe jumped over 24%, while Latin America/Canada increased over 20% in the period (revenue generated in the US improved almost 9%). The company experienced strength in its Industrial and Transportation and Safety segment thanks to growth in renewal energy, aerospace, and industrial adhesives. Its Security and Protections Services segment also revealed increased traction in occupational health and environmental safety and security systems. The firm’s Healthcare division posted decent growth as a result of expansion in skin and wound care, health information systems, and food safety. The company’s Consumer and Office and Electro and Communications segments also showed modest growth in the period, up 4% and 8.2%, respectively, in local currency.

However, in its Display and Graphics segment (sales fell over 10% in the period in local currency), the company noted significant weakness in LCD TV sales, blaming a tighter consumer electronics market and higher inventories in the channel. Given the results we’ve seen out of tech giants, Apple (AAPL) and IBM (IBM), we don’t believe we can extrapolate 3M’s results in this segment to the broader tech environment or the health of the consumer, in general. That said, we expect this segment to continue to be a drag on 3M’s results through the remainder of 2011.

3M raised the lower end of its 2011 full-year earnings guidance range to $6.10 – $6.25 from $6.05 – $6.25, but we don’t view this change as material. The company also reaffirmed its expectation for full-year organic sales growth in the range of 6% – 7.5%. In all, we don’t find 3M to be that compelling of an investment opportunity at this time, and we point to better names in the industrial space (particularly in the aerospace supply chain) as more direct plays on cyclical acceleration into 2012.