Our Thoughts on the Widespread Launch of 5G Services

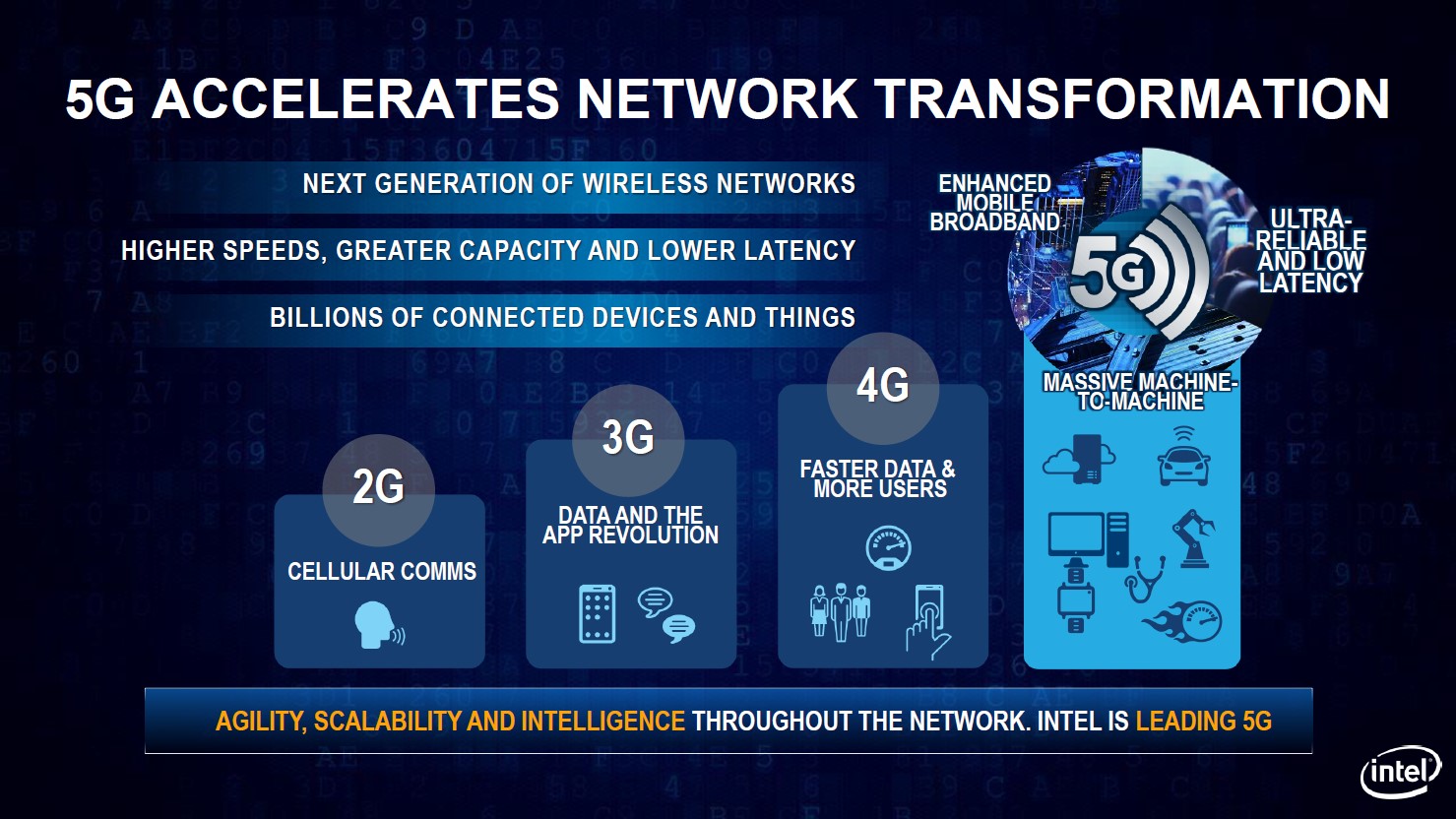

Image Shown: The evolution of wireless networks and telecommunications technology over the years. Image Source: Intel Corporation – November 2019 State of 5G Presentation

By Callum Turcan

The rollout of 5G telecommunication networks is upon us and we want to draw our members' attention to some of the key companies with meaningful exposure to this space. Many are excited about what opportunities 5G technology could enable.

Background

On July 23, AT&T Inc (T) announced its 5G network in the US was operational nationwide and that effective August 7, both consumers and businesses with certain packages would have 5G access “at no additional cost” which included customers with AT&T Unlimited Starter, Extra, Elite, AT&T Business Unlimited Web-Only and Starter wireless plans. Consumers with other packages could upgrade to 5G services as well.

Verizon Communications Inc (VZ) is reportedly getting closer to launching nationwide 5G services in the US sometime soon and recently signed a deal with Samsung Electronics Co Ltd (SSNLF) worth $6.6 billion to secure 5G networking equipment. Several months ago, Samsung also secured contracts with Qualcomm Inc (QCOM) to manufacture Qualcomm’s X60 modem chips (these can be used to connect smartphones to 5G networks) using Samsung’s 5-nm process (the next generation of semiconductors).

On August 4, T-Mobile Us Inc (TMUS) announced the launch of its nationwide 5G services in the US after completing its acquisition of Sprint. Back in early-2019, Broadcom Inc (AVGO) announced its 5G switching portfolio was complete which in turn helped set the stage for the build out of 5G telecommunications infrastructure.

Various countries in Western Europe and East Asia are also in the process of launching and expanding 5G networks. Vodafone Group Plc (VOD) is building out 5G networks in the former, including various cities in Germany that now have access to 5G services after Vodafone launched such offerings in April 2020. In the latter, China Mobile Ltd (CHL), China Unicom (Hong Kong) Ltd (CHUFF), and China Telecom Corporation Ltd (CHA) are rolling out 5G services across the Middle Kingdom.

5G networks allow for significantly faster data download/upload speeds and represent a vast improvement over the performance of current-generation 4G networks. This technology could potentially allow new industries to flourish that were not previously viable.

When the world transitioned to 4G from 3G, smartphones grew from a tool to stream and listen to music or respond to emails on the go to a comprehensive entertainment and productivity device as the functionality of smartphones grew. For instance, offerings such as video streaming services and cloud-based productivity applications become accessible and useable via smartphones. Even faster download/upload speeds that 5G networks offer should further improve the functionality of smartphones. For instance, entire high-definition movies could be downloaded in mere moments or live-sports could be streamed on mobile devices in high-definition with minimal issues.

Looking beyond smartphones, 5G technology could make “smart cities” possible, which for now largely remains a theoretical concept. The idea of a smart city is that in a world where automobiles could “communicate” with each other in real-time, traffic flows could be optimized to shorten commutes (please note a key component of smart cities involves automobiles containing greater internal computing power and 5G connectivity). Smart cities could also help reduce traffic accidents as well. Additionally, 5G-enabled smart cities could help support the eventual rollout of full-autonomous vehicles through self-driving taxi services. Instead of self-driving vehicles only sensing and reacting to their nearby surroundings, these vehicles could map out the entire route and all of the vehicles along that route in real-time (in theory).

Alphabet Inc’s (GOOG) (GOOGL) Waymo unit is seeking to eventually launch a self-driving service and has already begun running trial services in Arizona. General Motors Company’s (GM) Cruise unit (which is backed by numerous parties) also envisions launching a self-driving taxi service. There are still numerous hurdles for these firms and the industry at-large to overcome, but the technology is progressing, and we think it is promising.

Qualcomm has a slate of offerings (chips, modems) geared towards the automobile industry as does Intel Corporation (INTC), keeping in mind Intel acquired automotive-focused Mobileye through a $15.3 billion deal in 2017. In 2020, Intel purchased Moovit for $0.9 billion (or $0.8 billion net of Intel equity gain) to further expand its presence in the automotive tech space. Though shares of INTC have come under fire of late due to manufacturing issues at its semiconductor fabrication operations (more on that here), we remain optimistic on Intel’s long-term growth outlook in part due to its exposure to the next-generation of automobiles. We continue to like shares of INTC as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, and members looking to read more of our thoughts on Intel should check out this article here.

Two Firms to Keep an Eye On

There are two companies with 5G exposure that we want to draw our members attention to in this article, and that is Broadcom and Qualcomm. Broadcom designs and develops a large suite of semiconductor and networking products. Earlier this year, Finland-based Nokia Corporation (NOK) tapped Broadcom as a partner to help develop its 5G ReefShark chips utilizing system-on-chips (‘SoC’) solutions, which are expected to be more efficient and in theory should help reduce operating costs while improving networking performance (thus making Nokia’s 5G chipset offerings more competitive). By teaming up with Broadcom, Nokia aims to become more competitive against its peers including China’s Huawei and Sweden’s Ericson (ERIC), both of which Nokia trails in market share in the global base station market according to research firm TrendForce.

As an aside, Broadcom has also steadily grown its IT infrastructure software business in the recent past through various acquisitions. That included its purchase of CA Tech in 2018 through a deal worth $18.4 billion by enterprise value and its $10.7 billion deal to acquire Symantec Corporation’s enterprise security business which was completed last year. The remaining portion of Symantec is now known as NortonLifeLock Inc (NLOK).

Qualcomm is a big player in the 5G mobile handset space (the firm designs modems built for smartphones that enable 5G connectivity) and in the automotive space as mentioned previously. In April 2019, Qualcomm and Apple Inc (AAPL) made waves when the duo announced they were dismissing all lawsuit against each other, and that Apple would make a payment to Qualcomm. Additionally, Apple signed a six-year licensing agreement (that included a multi-year chip supply agreement) with Qualcomm that had a two-year extension option. Effectively, Apple recognized that without Qualcomm it would be late to the 5G party so Apple decided to throw in the towel so to speak. Recently we wrote a note highlighting that Apple is reportedly getting ready to launch its first 5G-capable iPhone, which we encourage interested members to check out here.

Recently, Qualcomm signed a licensing deal with Huawei (which also has a large smartphone business) that included Huawei paying Qualcomm royalties owed during the 2019-2020 period (through the first half of this year) under a previous agreement while securing a new licensing agreement (there is also reportedly a cross licensing component included in the new agreement). Qualcomm’s licensing business is performing well as its dominance in the 5G mobile-oriented modem space (and elsewhere) puts it ahead of the competition.

As of this writing, shares of Broadcom are trading in the upper bound of our fair value estimate range while shares of Qualcomm are trading in the lower bound of our fair value estimate range. Both firms have high quality cash flow profiles and strong positions in their respective industries which we will dig deeper into. By high quality cash flow profiles, we are referring to the ability for both Broadcom and Qualcomm to maintain their revenue generating abilities while spending relatively minimal amounts on capital expenditures (as the investments both firm’s make in their respective businesses are primarily represented by R&D expenses).

Broadcom

On September 3, Broadcom announced third quarter fiscal 2020 earnings (period ended August 2, 2020). During the first three quarters of fiscal 2020, Broadcom generated over $8.7 billion in net operating cash flow and spent less than $0.4 billion on capital expenditures, allowing for ~$8.35 billion in free cash flows. Those free cash flows fully covered $4.1 billion in dividend payments made during this period. Broadcom did not repurchase its common stock under its buyback program during the first three quarters of fiscal 2020, though the firm did repurchase roughly $0.6 billion in stock for tax withholdings on vesting of equity awards purposes.

As of August 2, Broadcom had $8.9 billion in cash and cash equivalents on hand versus $0.8 billion in short-term debt and $43.2 billion in long-term debt. While Broadcom possesses stellar free cash flow generating abilities, its large net debt load needs to be closely monitored. The company’s acquisitive streak has seen Broadcom’s total debt load grow materially in recent years.

Our fair value estimate for shares of AVGO sits at $310 per share, and the top end of our fair value estimate range sits at $388 per share. While shares of AVGO yield a nice ~3.6% as of this writing and are trading below the top end of our fair value estimate range, we are not interested in adding shares of Broadcom to either of our newsletter portfolios at this time. The company is well-positioned to capitalize on the ongoing built-out of 5G telecommunications infrastructure, but we are wary of its large net debt load and acquisitive streak. To view Broadcom’s 16-page Stock Report, click here.

Qualcomm

On July 29, Qualcomm reported third quarter fiscal 2020 earnings (period ended June 28, 2020). The firm generated $4.1 billion in net operating cash flow and spent $1.1 billion on its capital expenditures during this period, allowing for $3.0 billion in free cash flows. Qualcomm spent a little under $2.5 billion repurchasing its common stock through its buyback program and a little over $2.1 billion covering its dividend obligations during the first nine months of fiscal 2020. Some of its share repurchases were funded by its balance sheet.

As of June 28, Qualcomm had $10.6 billion in cash, cash equivalents, and current marketable securities on hand combined. Stacked up against $0.5 billion in short-term debt and $15.4 billion in long-term debt, we view Qualcomm’s net debt load as significantly more manageable than Broadcom’s. Please note that recent events, such as the new licensing agreements with Apple and Huawei (combined with the reported upcoming launch of Apple’s first 5G-capable iPhone), lends ample support to Qualcomm’s near- and medium-term growth trajectory.

In early-September, we significantly increased our fair value estimate for shares of QCOM (up to $123 per share from $86 per share previously) and please note that the top end of our fair value estimate range sits at $148 per share. To check out Qualcomm’s updated 16-page Stock Report, click here. Shares of QCOM yield a nice ~2.4% as of this writing and are trading meaningful below our fair value estimate. While we are not adding shares of QCOM to either of our newsletter portfolios at this time, we are keeping a close eye on the firm in light of its improving outlook.

Concluding Thoughts

To ride out the ongoing coronavirus (‘COVID-19’) pandemic we prefer large-cap tech companies with pristine balance sheets, quality cash flow profiles, and firms whose growth outlooks are underpinned by secular growth tailwinds. Between Broadcom and Qualcomm, we are keeping a closer eye on Qualcomm given its more manageable net debt load and the company’s aforementioned near-term catalysts.

-----

Auto Making Industry – F GM HMC HOG TM TSLA

Auto Parts Supplier Industry – ALSN APTV JCI LEA MGA

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communication Equipment Industry – CIEN SATS LHX PLT QCOM VSAT

Communications Equipment Space – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Telecom Services – BCE CTL EQIX FTR S T TMUS VZ VOD

Related: TSM, SNNLF, SCWX, SPY, VOD, CHA, CHL, CHUFF, ERIC, NLOK

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment