Don't Let "Them" Spin the Narrative

By Brian Nelson, CFA

Let’s call it how it is: 2022 was an absolute nightmare for the 60/40 stock/bond portfolio. During the year, the 60/40 stock/bond portfolio was down 16.9%, according to data from the Vanguard Balanced Index Fund Shares (VBIAX). During 2022, the S&P 500 (SPY) index was down 18.2%, meaning that the 60/40 stock/bond portfolio, despite allocating to 40% bonds, captured over 90% of the downside risk. Modern portfolio theory is dead: Stocks have done far better than bonds during upswings, and only slightly worse during downturns. The risk/reward for the 60/40 stock/bond portfolio just doesn’t add up anymore.

Bond prices did not move inversely to stock prices during the COVID-19 meltdown, and they did not move inversely to stock prices during one of the worst years for stocks in 2022. Furthermore, many were allocating to paltry yields across the 40% of the portfolio tied to bonds prior to this rate-hiking cycle, while some were taking on even more risk for yield, extending to perhaps 30-year Treasuries, (TLT), which fared even worse than the S&P 500 in 2022. Those that thought the 60/40 stock/bond portfolio would shield them from risk have simply been misled. Don’t let “them” spin the narrative!

Asset prices have been, are and hopefully always will be driven by future expectations of their respective income streams discounted by a reasonable discount rate. The higher the discount rate, the lower the present value (and therefore price) of those assets. It is an absolute abomination for commentators to say that the 60/40 stock/bond portfolio is now somehow “cheap” today (after its huge fall), when they almost certainly didn’t own or recommend the portfolio based on an intrinsic value calculation (which determines valuation). 2022 was the last nail in the coffin for modern portfolio theory, in our view, and by extension, the strongest support for long-term diversified equity investing.

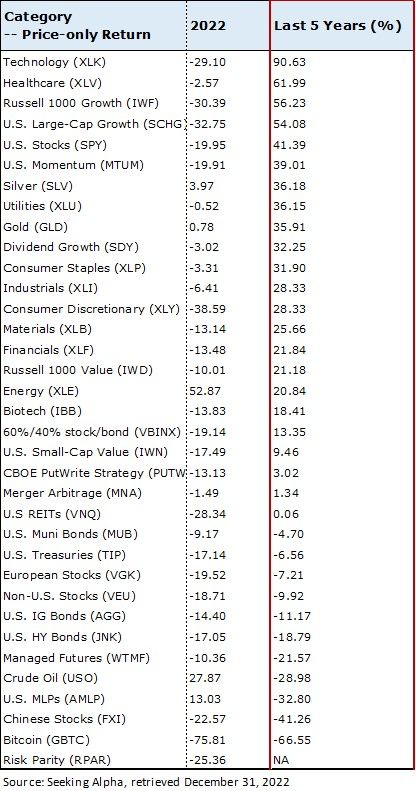

But how can we go against conventional wisdom, Nobel prize winners, and some of the most well-known allocators out there? Well, quite simply, the data. Investors just aren’t getting enough volatility protection from adding bonds to their portfolio, and they just aren’t reducing sequence-of-return risk much in retirement by adding bonds to their portfolio either. Instead, investors are giving up too much upside risk (i.e. a higher return), while practically capturing an equivalent amount of downside risk. During the past 5 years, for example, the S&P 500 was up ~9.3% per annum versus ~5.5% per annum for the 60/40 stock/bond portfolio. That’s giving up nearly 4 percentage points of return per annum just to save 1.3 percentage points (18.2% less 16.9%) during one year of a downturn!

The 60/40 stock/bond portfolio continues to fail. We’ve been a fan of big cap tech and the arbitrary area of large cap growth for a while now, and our take is not based on a historical assessment of big and small P/E ratios, but rather a view supported by the group’s net-cash-rich, secular growth characteristics that translate into tremendous free cash flow generation. Even from here, we think it will be hard to go wrong with Apple (AAPL), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT)--and even Tesla’s (TSLA) shares are starting to look cheap. The collapse of the poster child for big cap tech and large cap growth last year, Meta Platforms (META), was simply an anomaly, in our view, given Apple’s privacy changes, TikTok’s growth, and an executive team seemingly hellbent on spending billions on the metaverse.

We continue to like big cap tech and large cap growth over the long haul, as much as we have liked the group for the past five years. Whether rates fall during the next round of stimulus in the future or the economy comes roaring back in the coming years, this area is going to be ultra-leveraged to these positive catalysts. Dividend paying stocks have held up better than most during 2022, but it has mostly been because of a huge rotation into them during the year, which may not be sustainable. Certificates of deposit are now approaching ~5% at some well-known online banks. As we gear up for the other side of this recession, we expect the NASDAQ (QQQ) to pick back up again as the leader. The NASDAQ has been a huge generator of long-term wealth, and we don’t think that’s going to change.

Here’s the bottom line: The 60/40 stock/bond portfolio has failed both during the COVID-19 crisis as well as during 2022, when diversification was needed most. The strongest performers during 2022 were among the weakest performers in the years prior, and their 5-year returns still pale in comparison to those of big cap tech and large cap growth during the past five years. Small cap value, of which factor investing has been built on top of, continues to trail most other stylistic areas during the past five years. We’re staying the course. Though we expect continued tough sledding during the first quarter of 2023, we think the year will offer an incredible opportunity for investors to dollar cost average into what could be yet another strong decade of returns for stocks!

Tickerized for SPY, DIA, QQQ, SCHG, AAPL, GOOG, GOOGL, MSFT, TSLA, IWN, XLK, XLV, IWF, MTUM, SLV, XLU, GLD, SDY, XLP, XLI, XLY, XLB, XLF, IWD, XLE, IBB, VBINX, VBIAX, PUTW, MNA, VNQ, MUB, TIP, VGK, VEU, AGG, JNK, WTMF, USO, AMLP, FXI, GBTC, RPAR

---------------------------------------------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment