ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

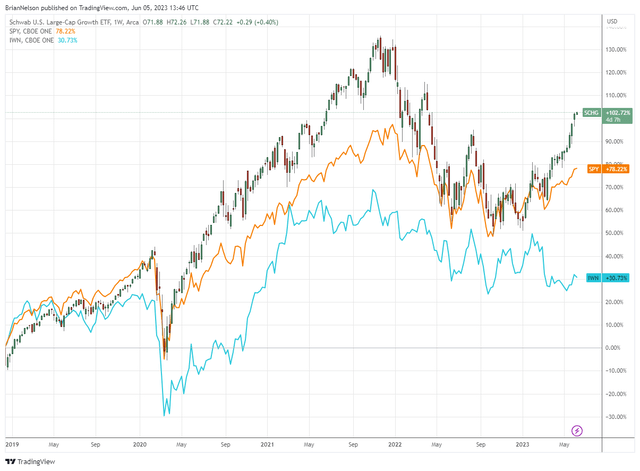

Image: Since the publishing of the first edition of the book Value Trap, the stylistic area of large cap growth (SCHG) has meaningfully outperformed both the equal-weight S&P 500 (SPY) and small cap value (IWN).

Summary of Best Ideas Newsletter portfolio changes

UnitedHealth Group (UNH): 0% --> 4%-6%

Booking Holding (BKNG): 0% --> 4%-6%

Chipotle (CMG): 1%-2% --> 6%-8%

Technology Select Sector SPDR (XLK): 0% --> 4%-6%

By Brian Nelson, CFA

With the debt-ceiling debate behind the markets, the regional banking crisis largely in the rear-view mirror, and the Fed winning the fight against inflation, a continuation of the strength in the markets as witnessed from the October 2022 lows can probably be expected. We “rode” the latest upswing with meaningful exposure to the stylistic area of large cap growth with key ideas Visa (V), Alphabet (GOOG) (GOOGL), Apple (AAPL) and Microsoft (MSFT), and we think this area will continue to lead the markets higher. According to data from Seeking Alpha, the Schwab U.S. Large Cap Growth ETF (SCHG) has advanced more than 30% so far this year, while small cap value (IWN) has been roughly flat. We’ve been pleased by the huge relative “outperformance.”

As for other possible ideas, Meta Platforms (META) has had a nice rebound in light of massive cost-cutting measures, but we won’t be adding that one back to the Best Ideas Newsletter portfolio given the low-quality earnings expansion. Nvidia (NVDA) has also done a nice job powering the markets higher, but we think that one’s shares will likely have to consolidate for some time, and its valuation remains less than attractive, in our view. That said, Nvidia may very well grow into its valuation in coming years, and the rush to implement artificial intelligence into processes across myriad industries will fill order books across the semiconductor (SMH) space for some time. This will benefit the areas of big cap tech and large cap growth, two areas uniquely positioned to take the most advantage of the advancing technology.

High ratings on the Valuentum Buying Index are few and far between at this stage in the market cycle as equities recover more generally. However, we want to go to “fully invested” in the newsletter portfolios to continue to “ride out” what we think will be continued strength in the markets through the remainder of this year. Last year was a big challenge to the newsletter portfolios but thanks to considerable energy “exposure,” both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio beat not only the market-cap weighted S&P 500 (SPY), but also the widely followed 60%/40% stock/bond portfolio. As we have narrowed our coverage down to focus more on some of the strongest names in light of the swoon witnessed across crypto and disruptive innovation equities during the latter part of 2021 and throughout 2022, we’re sticking with larger “growthy” names as our main source of idea generation.

Specifically, in the Best Ideas Newsletter portfolio, we’re initiating a new “position” in key large cap growth idea UnitedHealth Group (UNH) at a 4%-6% weighting. We already include UnitedHealth Group in the Dividend Growth Newsletter portfolio, and our rationale for why we like the name can be found here. We’re also adding a new 4%-6% weighting in Booking Holding (BKNG) and upping the weighting in Chipotle (CMG) to 6%-8%. We talked about why we have been considering both BKNG and CMG in this note here, and we’re making these moves today. On a hypothetical estimated basis, we had a “ten bagger” in our options idea generation service with respect to a consideration on the Technology Select Sector SPDR (XLK) recently, and we’ll be “initiating” a new position in that ETF at a 4%-6% weighting. These changes will bring the Best Ideas Newsletter portfolio weighting ranges roughly in-line with 95%-100% at the midpoint. The moves will be reflected in the June edition of the Best Idea Newsletter portfolio. We’ll have an update on the changes to the Dividend Growth Newsletter portfolio and High Yield Dividend Newsletter portfolio soon.

The June edition of the Best Ideas Newsletter will be released June 15.

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

2 Comments Posted Leave a comment